Expanding from domestic freight brokering into international shipments unlocks enormous growth potential, but it also introduces a new layer of complexity. Brokers must master customs clearance rules, navigate diverse documentation, apply Incoterms strategically, manage hidden charges like demurrage or detention, and build a global network of reliable partners. In this comprehensive guide, we’ll break down every major area you need to know, plus expert insight and prompts to spark deeper thinking for your own operations.

Key Differences When Brokering International vs Domestic Freight

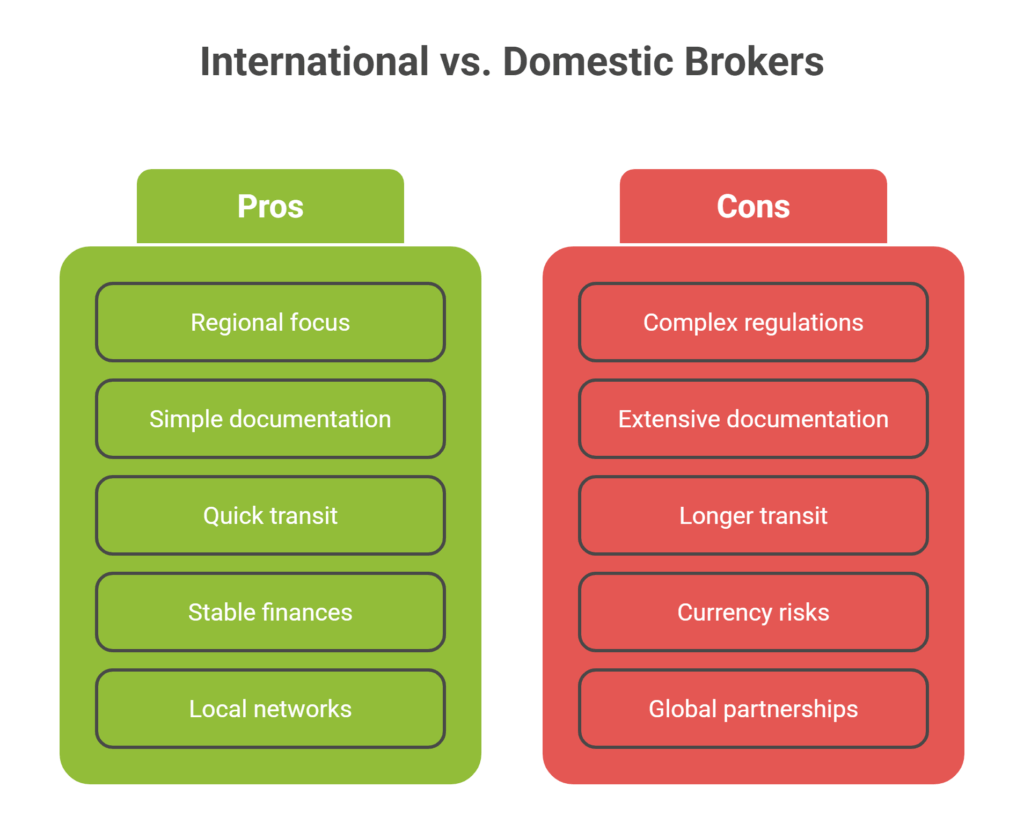

Freight brokering within domestic borders and across international lines both involve connecting shippers and carriers, but the scope, risks, and requirements differ dramatically. Domestic brokering focuses on efficient, compliant, and cost-effective transport inside one regulatory system, while international brokering expands that complexity across multiple jurisdictions, languages, and trade policies.

Key distinctions to understand:

- Regulations and compliance: Domestic brokers handle one set of transport and safety rules, while international brokers must manage import/export laws, customs filings, and tariffs across countries (International Chamber of Commerce [ICC], n.d.).

- Documentation and process: International shipments require additional documents like commercial invoices, certificates of origin, and export declarations, beyond what’s needed for domestic loads (ICC, n.d.).

- Transit time and risk: Cross-border movements involve longer timelines, port handling, customs clearance, and more points of potential delay or damage (World Trade Organization [WTO], n.d.).

- Financial management: International trade exposes brokers to fluctuating currencies, payment delays, and additional banking processes such as letters of credit (U.S. Customs and Border Protection [CBP], n.d.).

- Network and relationships: Domestic networks focus on regional carriers, while international brokers build partnerships with freight forwarders, NVOCCs, and overseas agents.

Actionable steps to transition from domestic to international:

- Start with one region or trade lane: Focus on learning regulations and partner networks for one market before expanding globally.

- Build a compliance playbook: Track import/export documentation requirements and trade restrictions per country.

- Partner with licensed customs brokers: They can navigate clearance rules and prevent costly compliance mistakes.

- Use tech tools built for global trade: A TMS with international modules can help manage documents, currency conversions, and regulatory workflows.

- Educate your clients: Offer clarity on how international rules, costs, and timelines differ from domestic shipping.

“In many cases, the margin in international brokering isn’t won just in movement cost, but in avoiding compliance penalties and demurrage. Small mistakes at customs often wipe out your gains.”

Which international trade lanes (countries or regions) currently intimidate you the most, and what’s your biggest obstacle (regulation, local contacts, language, tariffs)?

How Customs Clearance Works & Your Role as Broker

Understanding import vs export procedures

- Export clearance (from origin country): involves submitting filings to that country’s export authority, possibly obtaining export licenses, and securing export customs approval (CBP, n.d.).

- Import clearance (at destination): requires filing import declarations, paying duties & taxes, handling inspections, and satisfying regulatory requirements (e.g., product standards, sanitary checks) (WTO, n.d.).

Broker’s responsibilities in customs clearance:

Before diving into the specifics, it’s important to understand that customs clearance is not a single event, it’s a coordinated sequence of steps that requires precision and communication between multiple parties. The broker plays a pivotal role in orchestrating each phase, ensuring that all paperwork, filings, and compliance checks are flawlessly executed (CBP, n.d.).

- Gather and validate required documents.

- Choose correct HS codes and tariff classifications.

- Submit filings and liaise with customs authorities or local brokers.

- Track and expedite inspections or queries.

- Pay or arrange payment of duties, taxes, or other fees.

- Communicate with clients (shippers/consignees) about hold-ups, compliance issues, or additional costs.

Step-by-step clearance flow:

- Prepare documentation (invoice, packing list, certificates).

- Transmit export filing / declaration (if required).

- Freight moves to the port / terminal.

- Vessel/airline transport.

- Arrival at destination port.

- Importer or agent submits import declaration.

- Customs review or inspection (if flagged).

- Duties, taxes, fees must be settled.

- Cargo released and turned over to inland carrier or consignee.

“Customs authorities tend to target repetitive errors (wrong HS codes, missing certificates, mismatched weights). Brokers who build “pre-check” templates drastically reduce delays.”

Struggling with complex customs clearance? Discover how SPI’s freight broker solutions can simplify international shipments and keep your cargo moving smoothly.

Essential Papers You Must Always Have in International Shipments

Core documents you must master

- Commercial Invoice: The primary invoice showing seller, buyer, goods description, value, currency, terms, etc (ICC, n.d.).

- Packing List: Details the contents of each package/container (weights, dimensions, marks).

- Bill of Lading / Air Waybill / Sea Waybill: The transportation contract and title document for moving goods.

- Certificate of Origin: Certifies which country the goods originate from; often needed to qualify for preferential trade deals or to satisfy customs (WTO, n.d.).

- Export license or permits: Needed when goods are regulated (e.g. dual use, defense, chemicals).

- Customs declarations (export/import): Electronic or paper declarations filed with authorities (CBP, n.d.).

- Insurance certificate: Proves coverage during transit (U.S. Department of Commerce, n.d.).

- Other official certificates: e.g. phytosanitary, fumigation, quality, health, etc., depending on product type.

Tips for document accuracy:

- Double-check consistency: names, addresses, weight, dimensions, commodity codes must match across documents.

- Use templates but tailor per destination country rules.

- Provide translations if required.

- Attach supporting documents (e.g. purchase order, contract) when requested.

“Some customs agencies randomly request a full audit trail (invoice → contract → packing → shipment). If your documents don’t stand together, they may reject the shipment.”

What document has given you the most trouble in past international shipments, and what went wrong?

Why Incoterms matter

Incoterms (International Commercial Terms) are globally recognized trade rules published by the International Chamber of Commerce (ICC) that clearly define the responsibilities of buyers and sellers in international transactions. They determine who handles shipping, insurance, documentation, customs clearance, and financial risk at each stage of the journey. Essentially, they serve as the universal language of global trade, ensuring both parties understand their obligations. Misunderstanding or misapplying them can lead to disputes, unexpected logistics costs, and even legal complications.

Key Incoterms and their implications:

- EXW (Ex Works): Seller makes goods available at their premises; buyer bears almost all costs and transport risk.

- FOB (Free on Board): Seller is responsible until goods are loaded on vessel; buyer takes risk thereafter.

- CIF (Cost, Insurance & Freight): Seller pays costs, freight, and insurance to destination port, but buyer bears risk once goods pass ship’s rail.

- DAP / DDP / FCA / CPT etc.: There are many others; each allocates responsibility differently.

How brokers should leverage Incoterms:

- Clarify with shipper & consignee which Incoterm they’re using.

- Price your services accordingly (what you must deliver vs what client handles).

- Factor insurance, customs costs, and inland transport into your margin.

- When contracting carriers or forwarders, ensure their liability aligns with the Incoterm.

- For risk management, prefer terms that limit your exposure unless compensated appropriately.

“High-performing brokers often insist that clients provide a “Trade Term Sheet” with the chosen Incoterm, value thresholds, and risk sharing clearly documented before quoting.”

If you had to choose only two Incoterms to specialize in (for clarity and simplicity), which would you pick, and why?

How Shipping Costs Are Calculated in International Freight

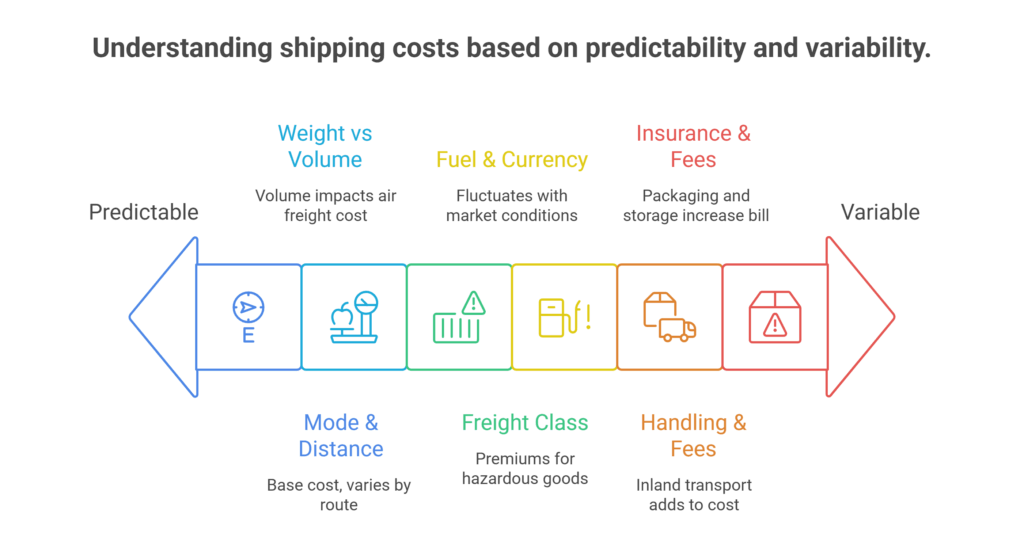

Before we dive into the specific cost components, it’s worth noting that international shipping rates are shaped by a wide range of factors beyond just distance or weight. Understanding these variables helps brokers provide accurate, competitive quotes and prevents unexpected expenses that can erode profit margins.

Core cost drivers:

1. Mode & distance: Ocean, air, rail, or multimodal routes differ drastically in cost per unit distance.

For example, shipping a 40-foot container from Los Angeles to Shanghai by sea may cost a fraction of what airfreighting the same cargo would, but with a longer transit time.

2. Weight vs volume (dimensional weight): For air shipments especially, volume often drives cost more than weight.

For instance, a large but lightweight shipment of foam packaging could cost more than a small crate of metal parts due to space occupied in the aircraft.

3. Freight class / commodity type: Hazardous, perishable, or oversized goods have premiums.

A shipment of lithium batteries or pharmaceuticals will incur higher costs because of regulatory handling requirements.

4. Fuel surcharges & currency adjustments: These fluctuate with market conditions.

If oil prices surge or the destination currency weakens, carriers may apply variable surcharges to offset losses.

5. Handling, pickup & delivery, documentation, customs fees: Inland legs, drayage, terminal handling, etc.

For example, trucking a container from the inland factory to port may add several hundred dollars to the total cost.

6. Insurance, packaging, storage, port & terminal fees: Premium packaging for fragile goods, warehouse storage before departure, or port storage while awaiting customs clearance all add to the final bill.

How to build your pricing formula:

- Start with base rate per kg or TEU (ocean) or per CBM / weight (air).

- Add surcharges (fuel, security, war risk).

- Include handling, pickup/delivery, terminal & drayage fees.

- Factor in customs clearance, inspection, and documentation overhead.

- Add margin or buffer for currency or regulatory variation.

- Adjust for volume discounts or consolidation where applicable.

“Many brokers lose money because they omit “hidden legs” like pickup to port, empty container repositioning, or terminal handling, costs clients assume you’ve included.”

Which cost component gives you uncertainty when quoting international freight, and what would make that more predictable?

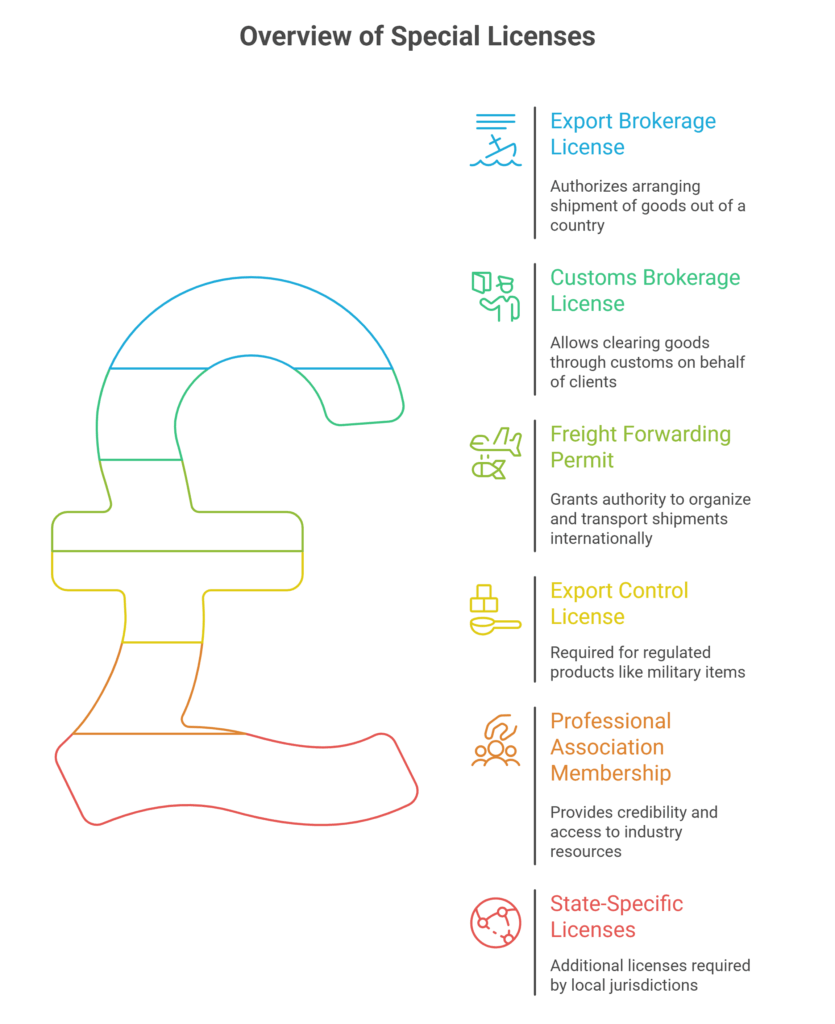

Types of Special Licenses

Many countries regulate who can legally arrange shipments across their borders, requiring proper accreditation or partnerships with certified entities. Failing to comply can result in shipment holds, fines, or even legal action. Whether you’re managing exports, imports, or cross-border freight forwarding, understanding the licensing landscape is crucial for staying compliant and credible in global trade. These special licenses might be required:

- Export Brokerage License: Authorizes a broker to arrange the shipment of goods out of a country. Ensures compliance with the origin country’s export laws, including documentation, reporting, and legal restrictions.

- Customs Brokerage License: Allows a broker to act on behalf of importers or exporters to clear goods through customs. In the U.S., this is issued by Customs and Border Protection (CBP) after passing the broker exam (CBP, n.d.).

- Freight Forwarding Permit / License: Grants the authority to consolidate, organize, and transport shipments internationally on behalf of clients, often including arranging air, ocean, or multimodal transport.

- Export Control / Defense Trade License: Required for regulated products such as military items, dual-use goods, or controlled chemicals. Ensures legal compliance with international arms and trade control laws (Export-Import Bank, n.d.).

- Professional Association Membership / Accreditation: While not always mandatory, membership in recognized customs or logistics associations can provide credibility, access to industry resources, and proof of professional compliance standards.

- State-Specific or Local Licenses (varies by country): Some jurisdictions require additional licenses or registration to operate as a logistics or customs broker locally, especially for restricted goods or specialized services.

What you should do:

- Research licensing rules in both your home country and your target trade countries.

- If needed, partner with licensed local customs brokers so you don’t have to duplicate certifications everywhere.

-

Stay compliant on training, bond, insurance, and audit requirements.

“Many small brokers underestimate this barrier. In one case, a broker lost multiple shipments because customs in a destination country refused to work with him, he lacked a local certification or license.”

In your target markets, which countries do you suspect have the toughest licensing or certification barriers, and why?

How to Find Reliable International Carriers & Forwarders

Choosing reliable carriers and forwarders reduces delays, prevents compliance issues, and protects your reputation with clients. Solid relationships ensure that shipments move efficiently from origin to destination, even when unexpected challenges arise.

Criteria for selecting overseas partners:

- Valid licenses, insurance, and good safety/compliance records.

- Experience in your trade lane & commodity.

- Transparent pricing, audits, and references.

- Good communication, technology integration (EDI, tracking).

- Strong financial stability and responsiveness.

Steps to build your network:

- Start with small, low-risk loads to test partners.

- Use referrals from trusted peers or industry associations.

- Visit partner facilities if possible or conduct audits.

- Build redundancy. Never rely on a single partner exclusively.

- Use performance metrics (on-time delivery, claims, response time).

- Incorporate partners into your TMS/visibility system.

“Top brokers often audit their partner forwarders annually. They also tie performance incentives (bonuses) to metrics like claim rates, document accuracy, and delivery consistency.”

Looking for trustworthy international carriers and forwarders? Learn how SPI streamlines carrier payments and builds strong global partnerships to keep your operations running efficiently.

Cross-Border Shipping Challenges & Workarounds

Typical pain points in cross-border trade:

- Different regulatory regimes, customs & inspection standards.

- Language or documentation translation issues.

- Infrastructure gaps (roads, rail, port congestion).

- Border delays or political friction (e.g. between US/Mexico or Canada/US).

- Currency control, local taxes, or foreign exchange barriers.

Tactics & strategies:

- Use transit zones or bonded corridors to minimize re-clearing.

- Familiarize yourself with NAFTA/USMCA or other regional trade treaties.

- Pre-clear shipments when possible.

- Maintain local contingency partners (trucking, warehousing) at border zones.

- Monitor political or regulatory developments closely.

- Educate clients proactively about border risks and expected delays.

“The worst border delays come from unexpected local road closures, political protests, or sudden regulation changes.”

Which cross-border corridor do you expect to work in (e.g. between your country and neighbor)? What’s your biggest concern there?

What Are Emergency Bunker Fees & Peak Season Surcharges?

Definitions & causes:

Emergency bunker fees (EBF): An emergency bunker fee is a surcharge applied by carriers to cover unexpected spikes in fuel prices, also called “bunkering” costs. Unlike regular fuel surcharges, EBF is usually applied on short notice when global oil prices fluctuate dramatically or when fuel shortages occur at a port or region.

Example: If crude oil prices surge suddenly, a shipping line might add $100–$300 per container as an EBF to offset unanticipated fuel costs. Brokers must communicate these potential fees to clients upfront to avoid disputes.

Peak season surcharges (PSS): Peak season surcharges are temporary fees imposed during periods of high demand, such as before holidays, retail season ramps, or major export cycles. They reflect the increased cost of securing space on vessels, aircraft, or trucks when capacity is tight.

Example: In the months leading up to Chinese New Year or Black Friday, a carrier may add $200 per container for shipments from Asia to North America due to limited container availability. Effective brokers factor PSS into quotes and plan bookings early to minimize costs.

When & how they apply:

- Carriers may impose them at short notice depending on fuel costs or congestion.

- They are typically passed through to the customer, but the broker must build them into quotes or disclaimers.

Management strategies:

- Monitor fuel cost indices and include dynamic fuel clauses.

- For peak season, negotiate capacity or lock in slots early.

- Use flexible contract clauses to allow surcharges.

- Educate clients so they expect surcharges rather than seeing them as hidden fees.

“Emergency bunker fees and peak season surcharges are standard mechanisms that help brokers manage fuel volatility and seasonal capacity constraints.”

How frequently have you seen sudden surcharges in your trade lanes, and did your quoting model absorb them successfully?

Special Packing, Labeling & Palletizing Rules for International Shipments

Key requirements to watch:

- ISPM 15 wood packaging standard: Most countries require treated and stamped wood pallets/crates.

- Hazardous goods labeling & marking rules under IMDG, IATA, etc.

- Proper weight & dimension labels as per origin/destination demands.

- Country-specific labeling (language, units, warnings).

- Securing cargo for sea/air transport: bracing, dunnage, shrink wrap, airbags.

- Stacking strength & pallet load limits based on mode (air vs sea).

Best practices:

- Always verify packaging regulations for both origin and destination.

- Pre-check crates or pallets with local standards.

- Use labels durable to moisture, abrasion, and handling.

- Take pictures of packaging before shipment for reference in claims.

- Train your packing providers or partners on international compliance.

“Following ISPM 15 and other international packaging standards is critical to avoid customs rejection and ensure cargo safety.”

Which item you ship is the hardest to pack compliantly under international rules, and how might you redesign packaging to simplify?

How to Handle Urgent International Bookings & Quote Requests

When dealing with international shipping, urgent bookings and quote requests are inevitable. Being prepared to respond quickly can prevent missed business opportunities and help maintain client trust.

Steps to speed up urgent shipments:

- Maintain a fast-quote team or template with pre-priced trade lanes.

- Leverage trusted partners and spot capacity channels.

- Use escalation protocols for priority customs clearance.

- Pre-check documentation while awaiting confirmation.

- Lock in transport and routing before filling every detail.

- Communicate expectations and risk transparently with the client.

Tips for internal readiness:

- Maintain ready templates for common lanes (rates, surcharges, docs).

- Use software that can auto-populate quotes and flag missing documentation.

- Keep a list of priority contacts at forwarders, carriers, and customs brokers.

- Pre-approve credit or payment terms for frequent clients to avoid delays.

“Top brokers often simulate urgent shipment scenarios to test their systems, ensuring that the team can respond within hours rather than days.”

What internal processes or tools would help you respond faster to urgent international booking requests, and where do you see potential bottlenecks?

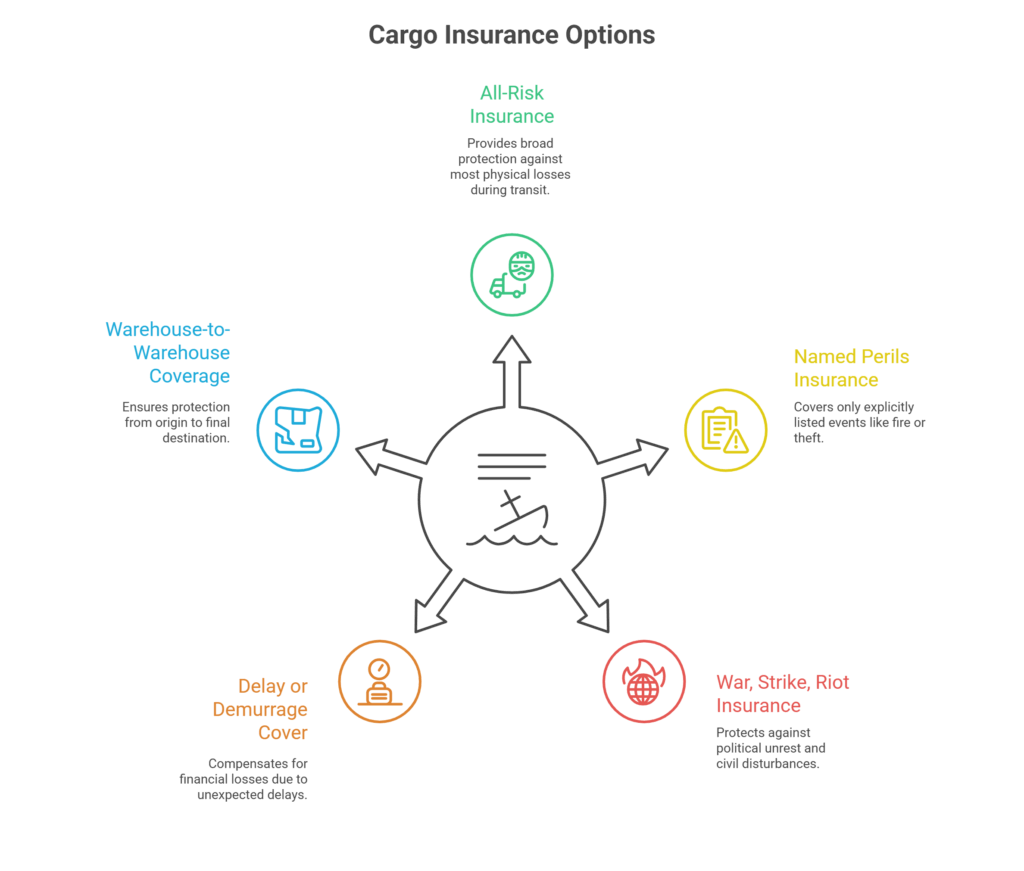

Insurance Considerations for International Cargo

Why insurance is essential internationally:

- In cross-border shipments, risks (piracy, theft, damage, delays) are elevated.

- Liability limits under carriage contracts (e.g. Hague-Visby, CMR) may not cover full value.

- Insurance gives recourse beyond carrier liability.

Types & coverage to look for:

- All-risk cargo insurance: This type of coverage provides broad protection against most types of physical loss or damage to your shipment during transit, including theft, damage, or accidents, except for specific exclusions listed in the policy. It’s ideal for high-value or sensitive cargo where maximum coverage is desired.

- Named perils insurance: Unlike all-risk coverage, this policy only protects against explicitly listed events such as fire, collision, or theft. It’s generally less expensive than all-risk insurance but requires careful review to ensure the perils listed match your shipment’s exposure.

- War, strike, riot insurance: This optional add-on protects cargo moving through high-risk zones prone to political unrest, civil disturbance, or labor strikes. It’s particularly important for shipments to regions with known instability or during periods of heightened geopolitical tension.

- Delay or demurrage cover: Certain policies can compensate for financial losses caused by unexpected delays, such as demurrage fees or other costs incurred when cargo cannot be unloaded or cleared on time. This is useful for perishable goods or time-sensitive shipments.

- Warehouse-to-warehouse coverage: This coverage extends protection beyond the port or terminal, ensuring the cargo is insured from the moment it leaves the origin warehouse until it arrives at the final destination. It accounts for all transit points, including loading, unloading, and storage along the route.

Best practices:

- Always disclose correct value, packaging, routing, incoterm, and coverage needs.

- Check whether the client or broker is named as the insured party.

- Review deductibles and exclusions (e.g. delay, shortage).

- Use a global insurer familiar with your trade lanes.

- Keep claims documentation (photos, packing, inspection reports, bills) ready.

“Using pre-priced templates and rapid response workflows significantly improves efficiency in urgent international bookings.”

Worried about compliance and risk in international freight? Explore SPI’s comprehensive compliance and risk management solutions to protect your business and shipments.

Frequently Asked Questions (FAQs)

1. How long does it typically take for international shipments to clear customs?

The time can range from a few hours to several days, depending on the country, documentation accuracy, inspections, and customs backlog. Pre-filing and accurate documents reduce delays.

2. Can I quote “door-to-door” rates that include all costs (freight, duties, delivery)?

Yes you can, but you must account for every leg: origin pickup, export clearance, transport, duties/taxes, import clearance, delivery. Use buffer margins for unknowns and surcharges.

3. What happens if my paperwork is wrong or incomplete?

Customs may hold your cargo, reject clearance, impose fines, demand corrections, or even seize goods. In worst cases, you may need to re-export or abandon the cargo at great loss.

Master International Freight Brokering

Expanding into international shipping offers enormous growth potential, but it comes with added layers of complexity, from customs clearance and documentation to Incoterms, surcharges, and global partner management. By understanding the key differences between domestic and international brokering, staying compliant with licensing and regulatory requirements, and building a trusted network of carriers and forwarders, brokers can confidently navigate cross-border logistics while minimizing risk and maximizing efficiency.

Ready to grow your business globally? Contact us to connect with experts and streamline your international shipping operations.

References

- CBP. (n.d.). U.S. Customs and Border Protection. Retrieved from https://www.cbp.gov

- ICC. (n.d.). International Chamber of Commerce: Incoterms. Retrieved from https://iccwbo.org

- WTO. (n.d.). World Trade Organization: Trade Procedures. Retrieved from https://www.wto.org

- Export-Import Bank. (n.d.). International Trade Finance. Retrieved from https://www.exim.gov

- U.S. Department of Commerce. (n.d.). Export Administration Regulations. Retrieved from https://www.bis.doc.gov