Competing against large, established brokerages can feel overwhelming for independent operators. National firms benefit from scale, brand recognition, and volume pricing. However, success in today’s freight market is not determined by size alone. Independent brokers who focus on specialization, service quality, and strategic execution can compete effectively and sustainably (Transportation Intermediaries Association [TIA], n.d.).

This guide explores proven strategies independent brokers can use to thrive, supported by practical independent freight broker tips and real-world insights.

Understand the Playing Field Before You Compete

Large brokerages dominate through scale: national coverage, massive carrier networks, and marketing budgets. But scale also brings rigidity (DAT Freight & Analytics, n.d.). Understanding this contrast is the first step to learning how to compete with big freight brokers effectively.

What Big Brokerages Do Well

- National account coverage

- Volume-based carrier pricing

- Advanced internal systems

- Strong brand recognition

Where They Struggle

- Slow decision-making

- Generic service models

- Limited flexibility for small or specialized shippers

This gap is exactly where small freight broker advantages come into play—speed, personalization, and niche expertise (TIA, n.d.).

“Many seasoned brokers note that large firms often lose customers due to slow responses, not pricing. Speed and accountability frequently win contracts.”

Where do you see large brokerages consistently dropping the ball in your market?

Specialize to Stand Out, Not Blend In

Generalists struggle in competitive markets. Specialists thrive. One of the most powerful ways to differentiate is by focusing on freight broker niche markets that larger firms overlook or underserve (FreightWaves, n.d.).

Why Generalists Struggle

Generalist brokers often face:

- Intense rate pressure

- Low shipper loyalty

- Constant carrier churn

- Difficulty standing out in sales conversations

When a shipper sees no meaningful difference between you and ten other brokers, price becomes the only deciding factor.

Why Specialists Thrive

Specialists:

- Understand specific operational pain points

- Speak the shipper’s language

- Anticipate issues before they happen

- Command higher margins due to expertise

This is where independent brokers can consistently outperform larger firms.

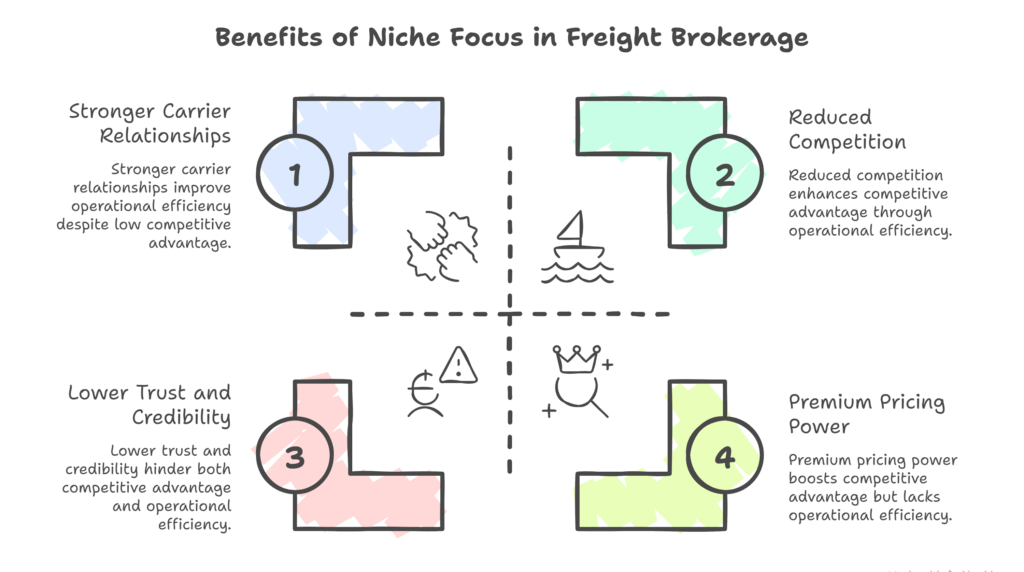

How Freight Broker Niche Markets Create Competitive Advantage

Specialization creates a defensible position that’s difficult for large brokerages to replicate quickly.

Key Benefits of Niche Focus

-

Reduced Competition

Fewer brokers actively pursue niche freight, which means fewer price wars. -

Higher Trust and Credibility

Shippers prefer brokers who understand their industry’s constraints, regulations, and timelines. -

Operational Efficiency

Repeating similar shipments allows you to streamline processes, carrier selection, and pricing. -

Stronger Carrier Relationships

Carriers appreciate predictable freight and consistent lanes, which improves capacity access. -

Premium Pricing Power

Expertise allows you to justify rates based on value, not just cost.

High-Opportunity Niche Examples

1. Reefer Freight for Regional Food Producers

Regional food producers often struggle with:

- Strict delivery windows

- Temperature compliance

- Limited carrier pools

- High spoilage risk

Large brokerages may deprioritize smaller-volume food shippers. A specialized broker who understands cold-chain requirements, FSMA compliance, and seasonal demand fluctuations becomes indispensable (FreightWaves, n.d.).

Why this niche works:

- High switching costs once trust is built

- Long-term contracts

- Strong referral potential within the industry

2. Construction Materials for Local Contractors

Construction freight has unique challenges:

- Job-site delivery constraints

- Tight project timelines

- Specialized equipment needs (flatbeds, step decks)

- Frequent last-minute changes

Independent brokers who understand construction workflows can coordinate deliveries around project schedules and avoid costly delays.

Why this niche works:

- Repeat business across projects

- Strong local relationships

- Less sensitivity to minor rate differences

3. Port Drayage or Short-Haul Intermodal

Drayage is operationally complex and time-sensitive:

- Port congestion

- Appointment systems

- Demurrage and detention risks

- Chassis availability

Many large brokers avoid drayage due to complexity. A broker who specializes here can offer immense value by managing details others overlook.

Why this niche works:

- High barrier to entry

- Strong demand near ports

- Sticky shipper relationships

4. Seasonal Agricultural Freight

Agricultural freight requires:

- Seasonal scaling

- Fast carrier onboarding

- Weather-aware routing

- Flexible scheduling

Shippers in this space prioritize reliability over rock-bottom pricing, especially during harvest peaks.

Why this niche works:

- Predictable seasonal cycles

- High urgency freight

- Opportunity for repeat annual contracts

How to Choose the Right Niche

-

Assess Your Existing Network

Look at the carriers, regions, and industries you already understand. -

Analyze Market Gaps

Identify industries underserved by large brokerages. -

Evaluate Complexity vs. Reward

Complex niches scare competitors, but reward specialists. -

Test Before Committing

Start with a few customers or lanes before fully positioning yourself as a specialist. -

Build Messaging Around the Niche

Your pitch, website, and outreach should clearly reflect your specialization.

“Brokers who dominate a niche often face less price pressure and higher shipper loyalty than generalist brokers.”

Which industries in your region are underserved by national brokerages?

Build Trust Faster Than Big Brands Ever Can

Large companies rely on brand trust. Independent brokers must build trust as a freight broker through direct relationships, transparency, and consistency (Harvard Business Review, n.d.).

Trust-Building Tactics

- Honest rate explanations

- Proactive shipment updates

- Fast problem resolution

- Direct access; no call centers

Trust compounds over time and directly impacts referrals and repeat business.

“Trust often outweighs price after the first successful shipment, especially for SMB shippers”

What specific actions have helped you earn repeat loads from a new shipper?

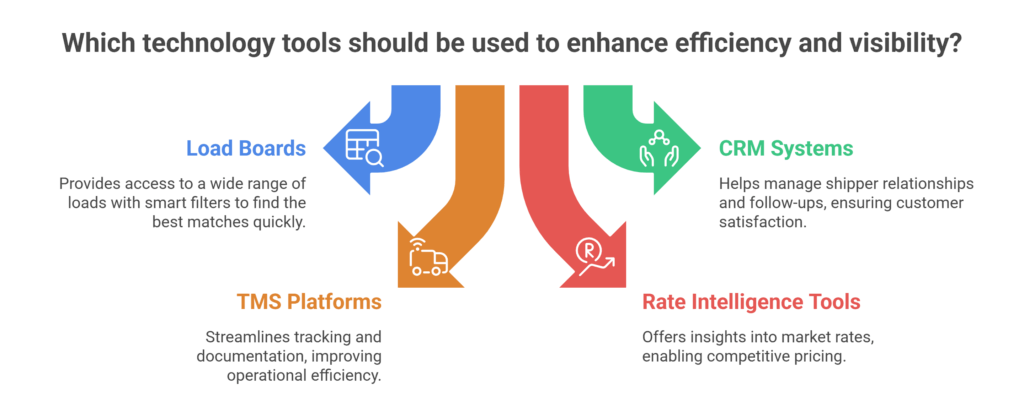

Use Technology Strategically, Not Excessively

You don’t need enterprise software to win. You need the right technology tools for freight brokers that enhance efficiency and visibility without slowing you down (Gartner, n.d.).

High-Impact Tools

- Load boards with smart filters

- CRM systems for shipper follow-ups

- TMS platforms for tracking and documentation

- Rate intelligence tools

Used correctly, these tools help level the playing field with larger firms.

“Technology should support relationships, not replace them. Brokers who over-automate often lose their personal edge.

Are you using technology to strengthen relationships or replace them? Discover freight broker technology that helps you work faster, stay visible, and scale without losing the personal touch that sets you apart.

Clarify Your Operating Model Early

Many newcomers confuse independent freight dispatch vs brokerage, but the distinction matters for compliance, revenue, and scalability [FMCSA], n.d.).

Key Differences

- Dispatchers work for carriers; brokers represent shippers

- Brokers manage contracts, liability, and pricing

- Dispatching limits growth potential compared to brokerage

Understanding this difference ensures you build a scalable, legally sound business model from day one.

“Brokers who start with clear operational boundaries avoid costly compliance issues later.”

Do you see dispatching as a stepping stone or a long-term path?

Learn from Real Freight Brokerage Success Stories

Growth leaves clues. Studying freight brokerage success stories reveals repeatable patterns independent brokers can adopt.

Common Success Factors

- Clear niche focus

- Relationship-first sales approach

- Consistent follow-up systems

- Gradual, controlled scaling

These stories prove that small operators can build profitable, respected brokerages without massive funding [FMCSA], n.d.).

“Most successful independents grew slowly and deliberately. Rapid scaling often broke service quality.”

Which growth pattern feels most realistic for your current stage?

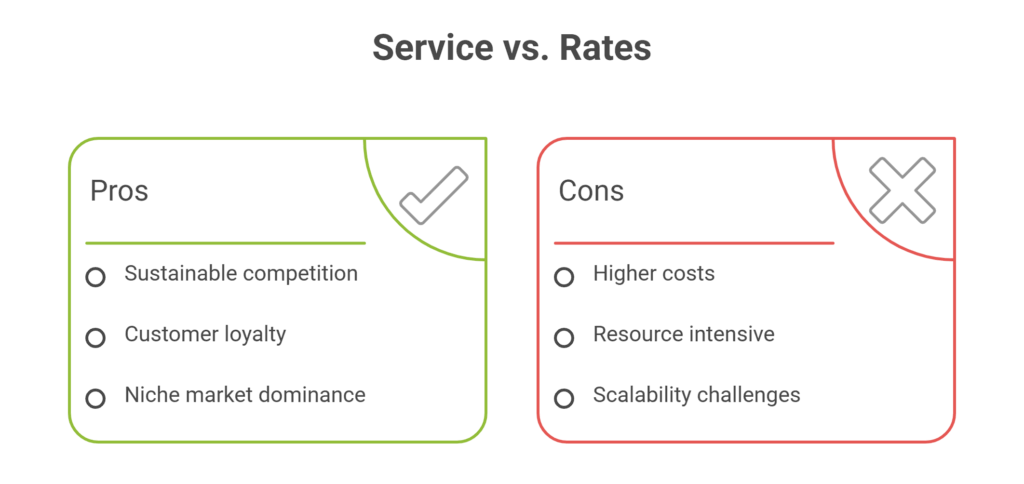

Compete on Service, Not Just Rates

Price wars favor the biggest players. Service wars favor independents. This mindset shift is critical if you want to compete with big freight brokers sustainably [FMCSA], n.d.).

Service Differentiators That Matter

- Same-day quotes

- Dedicated lane expertise

- Direct broker access

- Post-delivery follow-ups

This approach reinforces small freight broker advantages and keeps customers loyal even during tight markets.

“Shippers remember how problems were handled more than how cheap the rate was.”

What service promise can you confidently deliver better than a national firm?

Scale Intentionally for Long-Term Stability

Sustainable growth comes from systems, not just sales. Long-term freight broker business growth depends on disciplined expansion (TIA, n.d.).

Smart Growth Practices

- Document repeatable processes

- Expand one lane or customer type at a time

- Protect service quality during scaling

Growth without structure often leads to burnout or customer churn.

Before competing aggressively, every broker must fully understand how to start a freight brokerage the right way;licensing, bonding, insurance, and compliance.

Skipping these fundamentals creates risk that large competitors can easily exploit.

Build Relationships That Multiply Opportunity

Strategic freight broker partnerships with carriers, agents, or complementary service providers can unlock capacity and new customers without heavy overhead.

Partnerships accelerate growth while preserving independence.

“Strong carrier relationships often outperform large carrier databases.”

Are you building trust or just moving freight? See how the independent freight agent model helps brokers build stronger relationships and compete through service, not size.

Keep Customers Longer Than Your Competitors

Retention beats acquisition. Strong freight broker customer retention comes from consistency, communication, and accountability.

Retention Drivers

- Regular check-ins

- Performance reviews

- Flexible solutions during disruptions

Loyal customers insulate you from market volatility.

Even relationship-driven brokers benefit from structured freight broker marketing strategies and reliable freight broker lead generation.

Used correctly, digital marketing for freight brokers supports credibility rather than replacing sales conversations.

“Marketing works best when it reinforces trust already built through service.”

Which channel brings you the highest-quality leads today?

Competing Smart Beats Competing Big

Independent brokers don’t need to outspend or outscale national firms, they need to outthink and outserve them. By applying focused independent freight broker tips, leveraging specialization, relationships, and discipline, smaller operators can thrive in competitive markets.

When executed well, these strategies turn independence into an advantage and position you for long-term success, proof that size isn’t the deciding factor in modern freight brokerage.

Ready to turn your independence into a competitive edge? Contact us to build smarter systems and stronger shipper relationships.

Frequently Asked Questions (FAQs)

1. Can an independent broker really compete with national brokerages?

Yes. Specialization, speed, and service quality often outperform scale in niche markets.

2. What’s the fastest way to differentiate as a small broker?

Niche focus combined with proactive communication and transparency.

3. Is technology mandatory for competing today?

Technology helps, but relationships and execution still matter more than tools alone.

References

DAT Freight & Analytics. (n.d.). Freight market insights. Retrieved from https://www.dat.com

Federal Motor Carrier Safety Administration. (n.d.). Broker authority and compliance. Retrieved from https://www.fmcsa.dot.gov

FreightWaves. (n.d.). Freight brokerage trends. Retrieved from https://www.freightwaves.com

Gartner. (n.d.). Transportation technology insights. Retrieved from https://www.gartner.com

Harvard Business Review. (n.d.). Trust in business relationships. Retrieved from https://hbr.org

Transportation Intermediaries Association. (n.d.). Freight brokerage best practices. Retrieved from https://www.tianet.org