Not every shipper is worth chasing, and the fastest way to waste time as a broker is onboarding the wrong one. Knowing how to qualify a shipper starts with asking the right questions, at the right time, in the right order.

This guide breaks down a complete shipper qualification checklist using proven shipper discovery questions that help you assess fit, uncover risks, and position yourself as a strategic partner, not just another broker sending rate emails.

Assess Their Business Structure and the Prospect’s Role

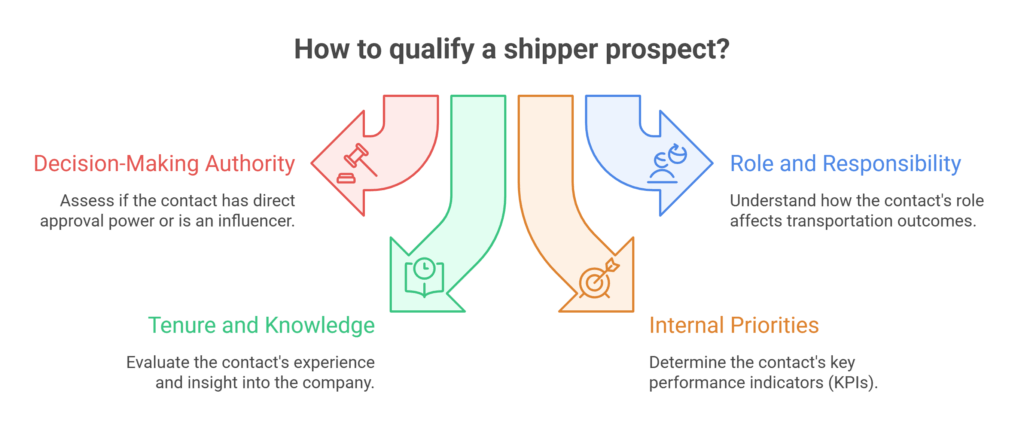

Understanding a shipper’s internal structure is the first step in determining whether a deal is real, actionable, and worth pursuing. This evaluation anchors your entire shipper qualification checklist and shapes how you navigate the shipper decision-making process.

What should be checked:

-

Decision-making authority and influence

You should assess whether the person you are speaking with has direct authority to approve new brokers or is acting as an influencer who gathers information for someone else. Selling to the wrong stakeholder often leads to stalled deals, delayed approvals, or last-minute reversals (Inbound Logistics, n.d.). -

Clarity of role and responsibility

Evaluate how closely their role is tied to transportation outcomes. A logistics manager or supply chain director typically has different priorities than a procurement or operations contact. Understanding this helps you frame your value in terms that matter to them personally (American Trucking Associations, n.d.). -

Tenure and operational knowledge

Longer tenure often means deeper insight into historical challenges, carrier performance trends, and internal politics. Newer contacts may be more open to change but lack the authority or context to move quickly. -

Internal priorities and success metrics

Determine how transportation performance impacts their role evaluation. If cost reduction, service reliability, or customer satisfaction are core KPIs, you can tailor your positioning accordingly.

“Deals move faster when brokers align their pitch with both organizational goals and individual incentives.”

How do you adjust your approach when the contact is an influencer rather than a final decision-maker?

Identify Core Shipping Challenges and Operational Pain Points

This step transforms surface-level interest into meaningful opportunity. Accurately identifying shipping pain points allows you to diagnose problems rather than pitch generic solutions.

What should be checked:

-

Frequency and severity of disruptions

You should assess how often issues occur and how damaging they are to operations or customer relationships. Occasional delays differ significantly from systemic service failures. -

Root causes of shipping issues

Determine whether problems stem from capacity shortages, poor carrier performance, internal planning gaps, or communication breakdowns. Treating symptoms without understanding causes leads to repeat failures (American Trucking Associations, n.d.). -

Cost and operational impact

Evaluate whether shipping challenges result in financial penalties, lost customers, overtime labor, or inventory disruptions. Pain tied to revenue or customer satisfaction usually signals stronger urgency. -

Tolerance for change

Some shippers complain about problems but are unwilling to change processes. You should assess whether they are truly open to improvement or simply shopping for lower rates (Transport Topics, n.d.).

“The more clearly a shipper understands their own pain, the easier it is to position meaningful solutions.”

Do you ever walk away from prospects who acknowledge problems but resist operational change?

Evaluate Freight Volume, Lanes, and Freight Characteristics

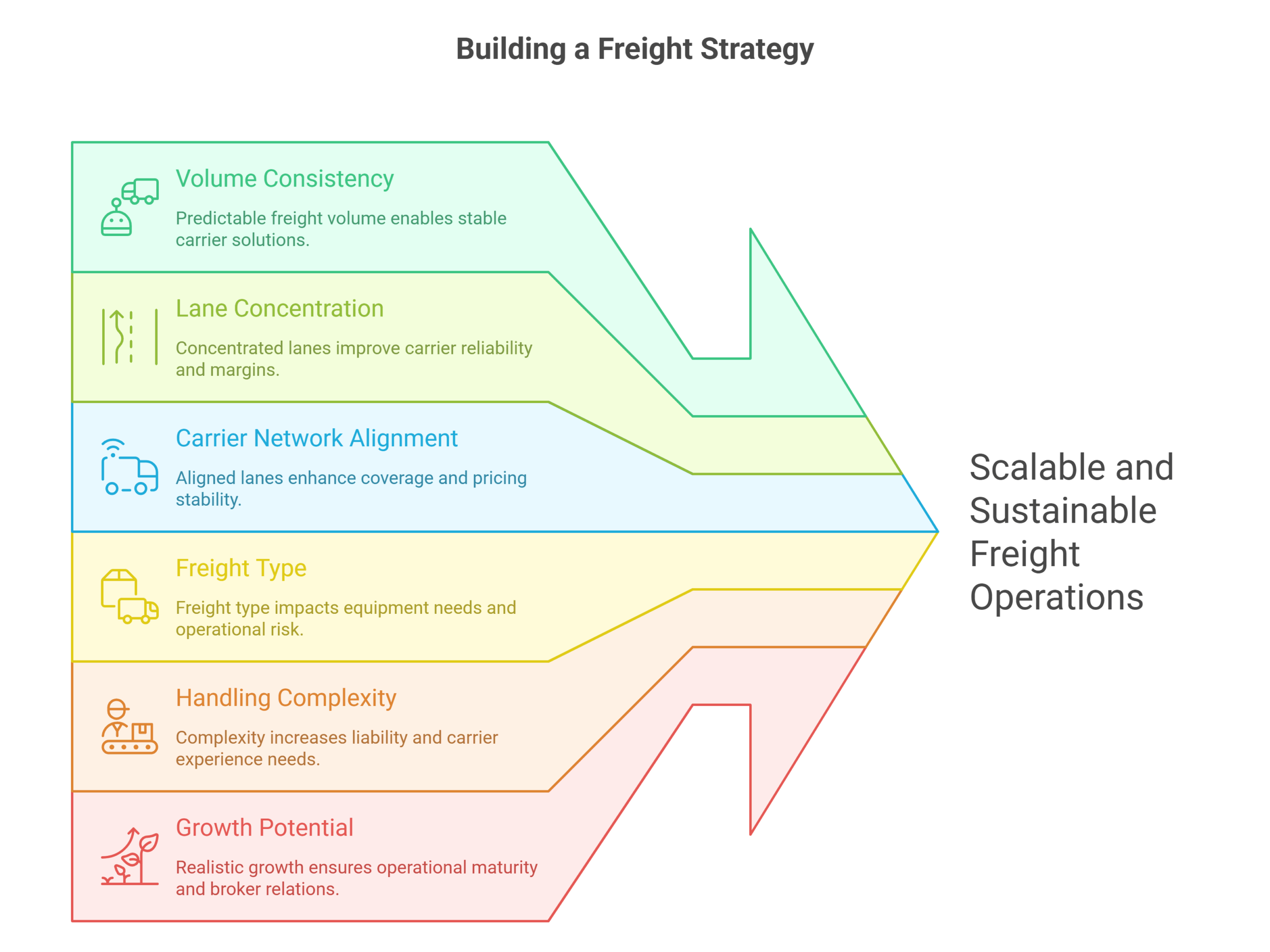

A proper freight volume assessment goes far beyond asking “how many loads do you ship?” This step determines whether an opportunity is scalable, operationally compatible, and financially sustainable. It is one of the most critical components of how to qualify a shipper, because volume and lane structure directly affect pricing leverage, carrier availability, and service consistency.

What should be checked:

-

Volume consistency and shipment cadence

You should evaluate whether the shipper’s freight moves on a predictable weekly or monthly cadence or if volume fluctuates heavily based on short-term demand. Consistent volume allows you to build repeatable carrier solutions, negotiate better rates, and reduce last-minute capacity scrambling. One-off or highly sporadic shipments may be profitable short-term but often lack long-term scalability (FreightWaves, n.d.). -

Lane concentration versus fragmentation

Assess whether the shipper has defined core lanes that repeat regularly or a fragmented network with constantly changing origins and destinations. Concentrated lanes are easier to support with reliable carriers and produce better margins. Fragmented lane structures increase operational complexity, reduce carrier loyalty, and often lead to higher costs and service risk. -

Lane compatibility with your carrier network

It is essential to determine whether the shipper’s lanes align with where your carrier base already operates. Even strong volume can be a poor fit if lanes consistently move into dead zones, low-demand markets, or regions with chronic capacity shortages. Lane alignment directly impacts coverage reliability and pricing stability. -

Freight type and equipment requirements

You should closely examine the types of freight being shipped and the equipment required, such as dry van, reefer, flatbed, or specialized equipment. Freight that requires temperature control, securement, oversized permits, or special handling introduces higher risk and operational oversight. Understanding this upfront helps you assess whether the freight fits your operational strengths and compliance capabilities (Inbound Logistics, n.d.). -

Handling complexity and regulatory exposure

Beyond equipment, consider whether the freight involves hazmat classifications, food-grade requirements, high-value cargo, or strict delivery appointments. These factors increase liability and require more experienced carriers, stronger tracking processes, and tighter communication standards. -

Seasonality and demand volatility

Evaluate whether volumes spike during certain seasons, promotional cycles, or industry-specific demand periods. Seasonal freight can be profitable, but it also creates pricing volatility and capacity pressure. You should determine whether the shipper understands these fluctuations and whether expectations around pricing and service adjust accordingly. -

Growth potential versus operational strain

Finally, assess whether the shipper’s projected growth is realistic and manageable. Rapid volume growth without operational maturity often leads to service failures, rushed onboarding, and strained broker-carrier relationships. Sustainable growth aligned with planning and forecasting is a much stronger signal of long-term fit.

Freight that looks attractive on paper can become unprofitable if volume, lanes, and freight characteristics are misaligned with your network. Smart brokers qualify freight as carefully as they qualify the shipper.

“Accurate freight volume assessment prevents overpromising and ensures operational efficiency.”

When evaluating a new shipper, which matters more to you: higher volume or better lane predictability, and why?

Review Current Transportation Providers and Satisfaction Levels

A detailed transportation provider evaluation helps you understand competitive positioning and risk during freight broker prospecting.

What should be checked:

-

Number and type of providers used

Assess whether the shipper relies on a few strategic partners or rotates through many brokers. High provider turnover can signal pricing pressure or unrealistic expectations (Transport Topics, n.d.). -

Reasons for dissatisfaction

You should look for specific, repeatable service gaps rather than vague complaints. Clear dissatisfaction points reveal where you can realistically outperform competitors. -

Length of existing relationships

Long-term relationships suggest stability, while short-term churn may indicate unresolved issues on either side (Inbound Logistics, n.d.). -

Motivation for considering new brokers

Determine whether the shipper is proactively improving operations or reactively responding to a recent failure.

“Shippers who consistently switch providers often recreate the same problems unless expectations change.”

How do you differentiate between a shipper seeking improvement and one chasing the lowest price?

Understand the Decision-Making and Onboarding Process

Understanding the shipper decision-making process protects your time and helps you forecast realistic close timelines.

What should be checked:

-

Stakeholder involvement

Identify how many people must approve a new broker and what each stakeholder cares about (American Trucking Associations, n.d.). -

Evaluation criteria

Assess whether decisions are based on price, service history, technology, compliance, or a combination. -

Onboarding requirements

Understand documentation, compliance checks, and setup steps that may slow activation. -

Typical approval timelines

Knowing whether decisions take days or months helps you prioritize effort during freight broker prospecting.

“Clear timelines prevent wasted follow-ups and improve pipeline accuracy.”

Struggling to navigate complex shipper approval processes and slow onboarding cycles? Discover how our freight brokerage back-office support helps brokers streamline approvals, manage documentation, and move deals forward faster.

Clarify KPI Expectations and Service Standards

Misaligned logistics KPI expectations are a leading cause of broker-shipper conflict.

What should be checked:

-

Defined performance metrics

Determine which KPIs matter most and how they are measured. -

Reporting and visibility expectations

Assess how often updates are required and in what format (FreightWaves, n.d.). -

Escalation processes

Understand how issues are flagged and resolved internally. -

Flexibility during disruptions

Evaluate tolerance for delays caused by weather, capacity shortages, or unforeseen events.

“Documented KPIs turn subjective complaints into objective conversations.”

Do you proactively define KPIs or wait until issues arise?

Evaluate Payment Terms and Financial Reliability

Assessing freight broker creditworthiness is essential to protecting cash flow and long-term stability.

What should be checked:

-

Standard payment terms

Confirm whether terms align with your operating and carrier pay cycles. -

Payment consistency

Evaluate whether payments are historically reliable or frequently delayed. -

Financial transparency

Willingness to provide references or verification signals professionalism (FreightWaves, n.d.). -

Claims and dispute history

Frequent disputes may indicate operational or financial risk.

“A profitable account on paper can be damaging if payment behavior is unreliable.”

Curious about how technology can simplify credit and payment management? See our freight broker tech solutions

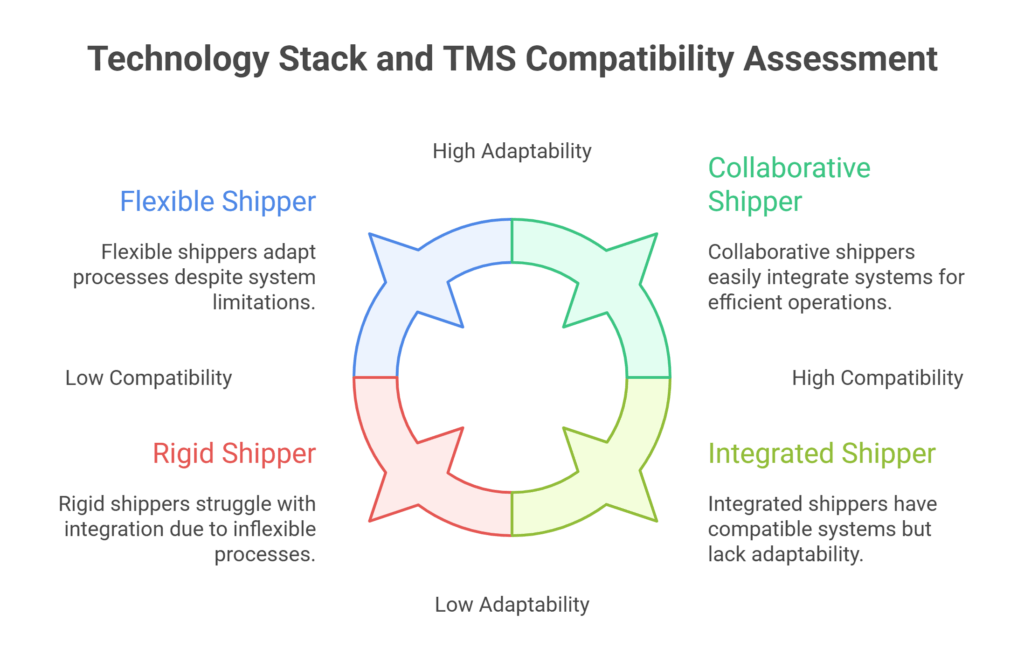

Review Technology Stack and TMS Compatibility

Technology alignment is no longer nice to have in shipper relationships. It directly affects speed, visibility, data accuracy, and scalability. Asking the right TMS integration questions early helps you determine whether an account will run efficiently or slowly drain time through manual work, errors, and constant exceptions.

This step is especially critical when qualifying larger or fast-growing shippers, where system misalignment can quietly erode margins.

What should be checked:

-

TMS capabilities, maturity, and limitations

You should evaluate whether the shipper’s transportation management system supports automation, API or EDI integrations, and real-time visibility. A modern, well-configured TMS can streamline load tenders, tracking updates, and reporting. In contrast, outdated or heavily customized systems may limit integration, require manual data entry, and create dependency on emails and spreadsheets. Understanding system limitations upfront helps you assess long-term scalability and labor requirements (Cerasis, n.d.). -

Load tendering, acceptance, and execution workflows

Assess how loads are tendered to brokers and carriers and how acceptance is confirmed. Some shippers rely on automated tenders through their TMS, while others use email, portals, or shared documents. You should also evaluate how tracking is handled, whether through system integrations, manual check calls, or third-party visibility tools. The more manual the workflow, the higher the risk of missed updates, service failures, and administrative overhead. -

Data accuracy, reporting requirements, and visibility expectations

Determine what level of reporting the shipper expects and how frequently it is required. This includes lane performance, cost analysis, on-time metrics, and exception reporting. You should assess whether reports need to be customized or delivered in specific formats and whether the shipper expects real-time dashboards or periodic summaries. Misaligned reporting expectations often create friction even when service performance is strong (American Trucking Associations, n.d.). -

System interoperability and integration effort

Evaluate how easily the shipper’s systems can integrate with your internal tools, carrier tracking platforms, or visibility providers. Some integrations are straightforward, while others require extensive setup, IT involvement, or ongoing maintenance. You should weigh the upfront and ongoing effort required against the account’s revenue potential. -

Process flexibility and adaptability

Not all systems will integrate perfectly. You should assess the shipper’s willingness to adapt workflows when technical limitations exist. Shippers who insist on rigid processes without flexibility often create operational bottlenecks. In contrast, collaborative shippers are more likely to adjust tendering, reporting, or communication methods to achieve smoother execution. -

Technology roadmap and future readiness

Finally, evaluate whether the shipper plans to upgrade or modernize their technology stack in the near future. A shipper actively investing in technology signals long-term partnership potential, while a stagnant system may limit growth and efficiency over time (Transport Topics, n.d.).

“Early discussion of TMS integration questions reduces operational friction and improves service delivery.”

What are the most common TMS integration challenges for new shippers?

Frequently Asked Questions (FAQs)

1. What is a shipper qualification checklist?

A shipper qualification checklist is a structured list of questions and evaluation criteria that helps brokers determine if a shipper is a good fit for partnership (Inbound Logistics, n.d.).

2. How often should brokers reassess shippers?

It’s best to review shipper performance and needs periodically, at least every 6–12 months, to maintain alignment and discover new opportunities (FreightWaves, n.d.).

3. Can TMS integration improve broker efficiency?

Yes, integrating with a shipper’s TMS enables real-time tracking, automated reporting, and smoother communication, saving time and reducing errors (DAT Solutions, n.d.).

Secure Reliable Partnerships

Using a shipper qualification checklist and shipper discovery questions helps freight brokers uncover shipping pain points, evaluate volumes, and understand the shipper decision-making process. By asking the right questions, assessing KPIs, verifying creditworthiness, and exploring technology integration, brokers can secure high-value, reliable shipping partnerships.

Ready for smarter, more profitable shipping relationships? Contact us to start qualifying shippers the right way.

References

American Trucking Associations. (n.d.). Freight broker best practices. Retrieved from Discover more

Inbound Logistics. (n.d.). Shipper qualification checklist and strategies. Retrieved from Discover more

Transport Topics. (n.d.). Freight broker prospecting and carrier evaluation. Retrieved from Discover more

FreightWaves. (n.d.). Understanding freight volume assessment and shipper discovery questions. Retrieved from Discover more

Cerasis. (n.d.). How to qualify a shipper and evaluate transportation providers. Retrieved from Discover more