Starting a freight brokerage is a bold move, one that demands clear planning, smart decisions, and strong execution. Whether you’re aiming to broker freight across borders or focus locally, getting your fundamentals right from the beginning sets the tone for growth, profitability, and credibility. This guide walks you through initial steps and business planning, diving into everything from licensing and capital to operations and structure, so you can launch with confidence.

First Steps to Becoming an Independent Freight Broker

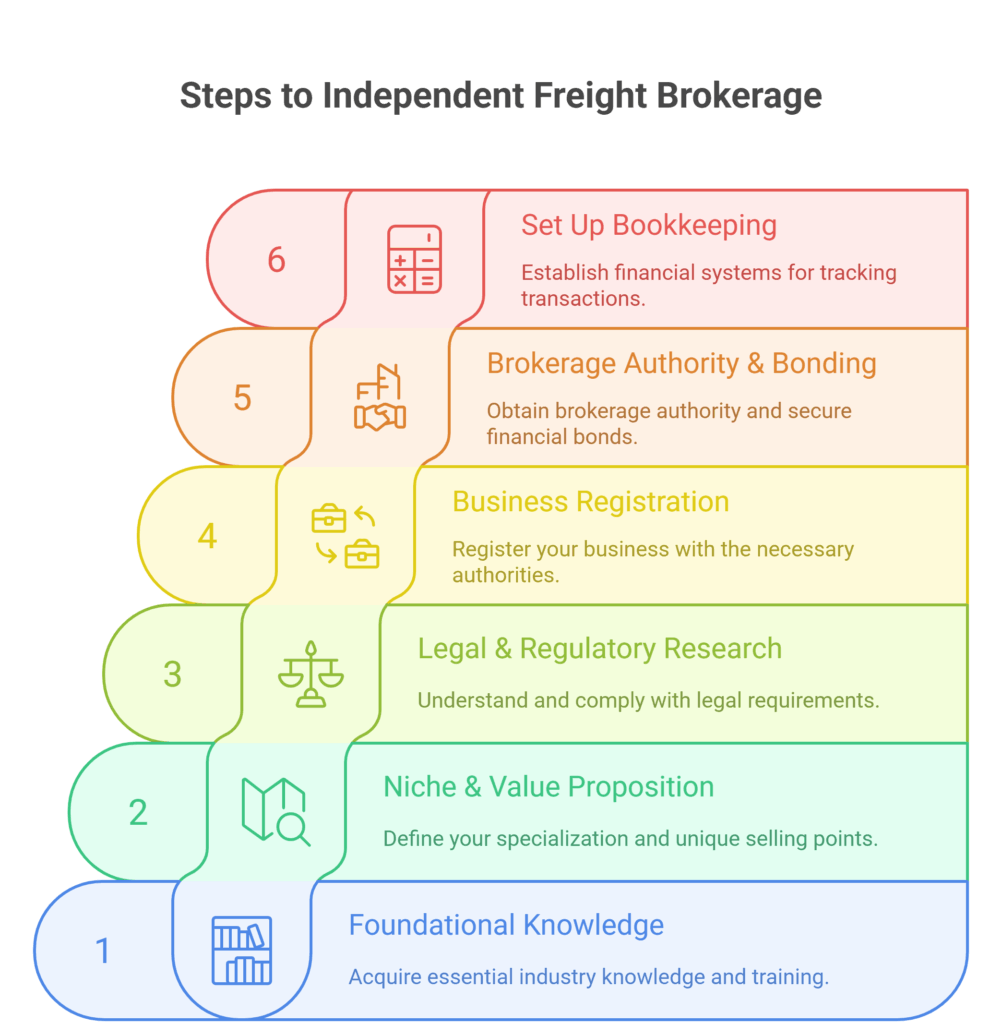

Here are the essential first moves you should make:

-

Gain foundational knowledge & training

- Learn about freight law, logistics processes, and transportation regulations that govern the industry.

- Explore online courses, webinars, or in-person programs tailored for freight brokers.

- Consider working for a brokerage or logistics company first, it provides valuable real-world experience you can apply when running your own operation (FMCSA, n.d.).

-

Decide your niche and value proposition

- Choose the freight you want to specialize in, such as refrigerated goods, dry van, or oversized freight.

- Define your geographic focus: local, regional, or nationwide.

- Identify your differentiator, whether it’s superior customer service, cutting-edge technology, or competitive pricing. This will become your selling point when approaching clients (Logistics Management, n.d.).

-

Research legal and regulatory requirements

- Understand licensing and registration requirements for your country or state.

- Review bond and trust fund obligations that protect shippers and carriers.

- Confirm insurance requirements for liability, cargo protection, and errors & omissions (FMCSA, n.d.).

-

Register your business

- Pick a professional, relevant, and legally available business name.

- Decide your legal entity type, LLC, sole proprietorship, or corporation, and file the paperwork.

- Obtain tax IDs and required permits from state or federal authorities (SBA, n.d.).

-

Apply for brokerage authority and bonding

- File with the Federal Motor Carrier Safety Administration (FMCSA) or equivalent authority.

- Secure the mandated surety bond or trust fund to demonstrate financial responsibility (FMCSA, n.d.).

-

Set up journals & bookkeeping

- Open a separate business bank account to keep finances organized.

- Invest in accounting software to track invoices, expenses, and payments.

- Create a plan for cash flow, since brokers often must pay carriers before shippers release funds (Accounting Today, n.d.).

“Picking a specific freight type + geographic focus lets you tailor your pricing, operations, and marketing, making it easier to stand out and forecast costs.”

What niche freight types or geographic areas are underserved currently, and how might a new broker position fill that gap?

Building a Business Plan

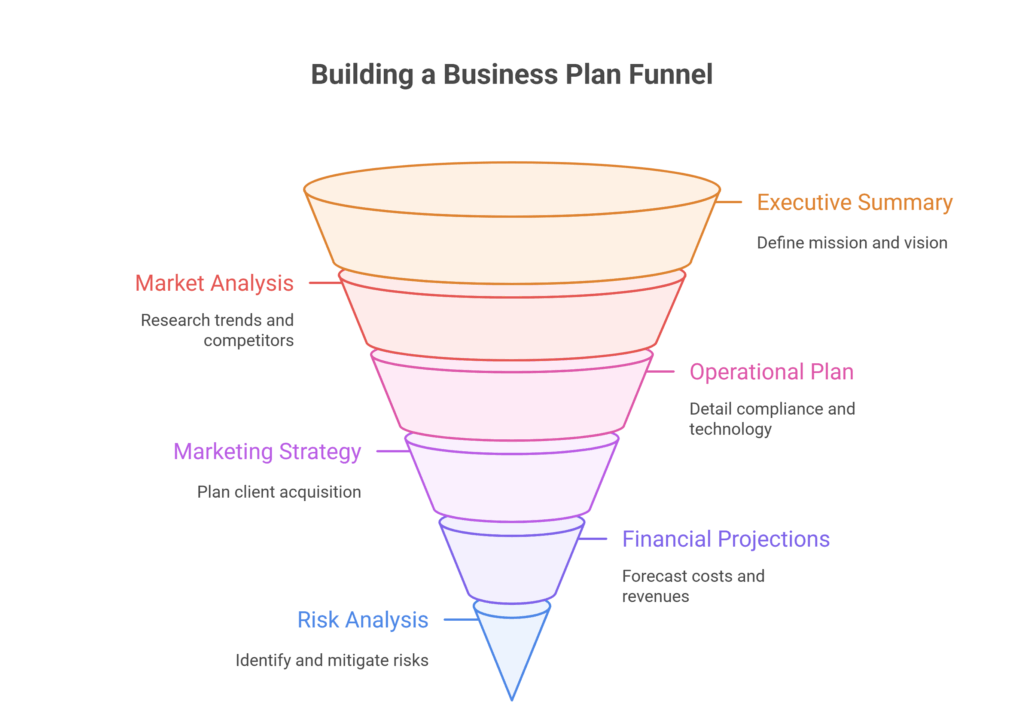

A strong business plan is more than paperwork, it’s your roadmap. Here’s how to build one:

1. Executive Summary

- Clearly state your mission, vision, and why your brokerage will succeed.

For example, you might explain that your mission is to simplify cross-border logistics for small exporters, while your vision is to become a top 10 regional broker in five years.

- Include a quick overview of finances, niche, and growth strategy.

For instance, highlight projected startup capital, the segment you’ll serve (like refrigerated produce), and your expansion plan (adding 50 clients per year). This section should capture attention and sell your business concept.

2. Market Analysis

- Research freight industry trends, market growth rates, and shifts in shipping demand (FMCSA, n.d.).

For example, e-commerce growth continues to increase demand for last-mile delivery brokers.

- Evaluate competitors: what they do well and where they fall short. You might note a competitor has strong technology but lacks customer service, leaving room for you to differentiate.

- Identify your target shippers and carriers, including their specific needs and challenges. For instance, refrigerated shippers often struggle with timely capacity, which your brokerage could solve.

3. Operational Plan

- Detail how you’ll handle compliance, licensing, and insurance, such as assigning a compliance officer or outsourcing filings to specialists (FMCSA, n.d.).

- Decide whether you’ll operate remotely or lease office space. A home office can cut early costs, while a leased office builds credibility with larger shippers.

- Outline the technology stack you’ll use (TMS, load boards, accounting systems). For example, Truckstop or DAT load boards combined with QuickBooks for accounting.

- Define staffing requirements, whether hiring employees or outsourcing tasks. A solo broker may outsource dispatch and bookkeeping until volume justifies full-time staff.

4. Marketing & Sales Strategy

- Plan how to acquire clients: email outreach, cold calls, social media, or networking events (SBA, n.d.).

For example, LinkedIn outreach can connect you with manufacturers in need of freight solutions.

- Explain how you’ll build relationships with carriers and ensure quality service, perhaps by offering quick pay or loyalty incentives.

- Develop a branding and pricing strategy that matches your target market.

For instance, a value brand may focus on competitive rates, while a premium brand emphasizes reliability and white-glove service.

5. Financial Projections & Pro Forma

- List startup and recurring costs in detail, from $300 licensing fees to $5,000+ for annual insurance.

- Build revenue forecasts based on realistic shipment volumes and rates. For example, project 50 loads per month at an average $150 commission per load.

- Create a cash flow analysis and identify the break-even point, such as reaching 200 loads in year one to cover fixed costs.

6. Risk Analysis & Contingencies

- Address risks like late payments, freight fraud, or sudden rate changes, and describe how you’ll monitor and mitigate them.

- Prepare contingency plans such as using multiple carriers or securing lines of credit. For example, you might diversify across five carriers per lane so you’re not dependent on a single partner.

“Lenders often look for a detailed 3‑ to 5‑year financial plan, including worst‑case, mid, and best‑case scenarios. Showing you’ve thought through fluctuations in freight demand or rate compression can make the difference in securing funding.”

Looking for actionable insights and tips for independent freight broker agents? Explore our full guide here.

How Much Capital & What Startup Costs You’ll Face

How Much Capital Do You Need?

- For a lean brokerage, expect to invest $5,000 ‑ $15,000 to cover licensing, bonding, software, and office basics.

- For a growth-focused brokerage, prepare $30,000‑50,000+, which allows for stronger marketing, better technology, and additional staff.

Common Startup Costs

- Broker License / Operating Authority: ~$300 application fee, depending on location.

- Surety Bond / Trust Fund: A $75,000 bond is required in the U.S., with premiums ranging from $900‑$2,500+ per year based on credit.

- Insurance (Liability, Cargo, E&O): Expect $1,500‑$5,000+ annually for essential policies.

- Software & Technology: A transportation management system, load boards, and CRM may cost $1,000‑$5,000+ in the first year.

- Office Setup: Budget at least $2,000 for home office essentials or more if you lease commercial space.

- Marketing & Branding: From logo and website design to advertising campaigns, costs vary but often range $1,000‑$5,000+.

“Many new brokers underestimate cash flow requirements. You often need to pay carriers within 30 days, but shippers may take 45‑60 days to pay. Having capital reserves or factoring arrangements is essential.”

What financing options (loans, factoring, investors) best balance startup risk for a new brokerage?

Picking the Best Legal Form & Name for Your Brokerage

Business Structure Options

- Sole proprietorship: Easiest to set up, but the owner has full personal liability.

- Partnership: Allows multiple owners, but profits and risks are shared.

- LLC: Offers liability protection with flexible tax benefits, making it a popular choice for startups.

- Corporation (C‑Corp / S‑Corp): Good for scaling but requires strict compliance and can involve double taxation depending on the structure.

Choosing a Business Name

- Select a name that’s professional, memorable, and reflects your industry.

- Check trademark databases, web domains, and social media handles for availability.

- Register the name with your local jurisdiction for legal protection.

Physical Office vs. Remote

- Remote setup: Saves money and is practical for startups, especially with cloud-based systems.

- Physical office: Enhances credibility with clients and provides room for team expansion but comes with higher costs.

Office Equipment & Tech

- Invest in reliable computers, internet, and business phone systems.

- Use a Transportation Management System (TMS) to streamline operations.

- Subscribe to load boards and CRM tools to manage shippers and carriers.

- Add accounting software for invoicing and expense management.

“An LLC is often the sweet spot for new freight brokers: limited liability, tax flexibility, and manageable compliance.”

Would you prioritize reducing costs with a remote office, or invest in a physical space to build credibility?

Compliance: Process Agents, DUNS, and Essential Registration Tools

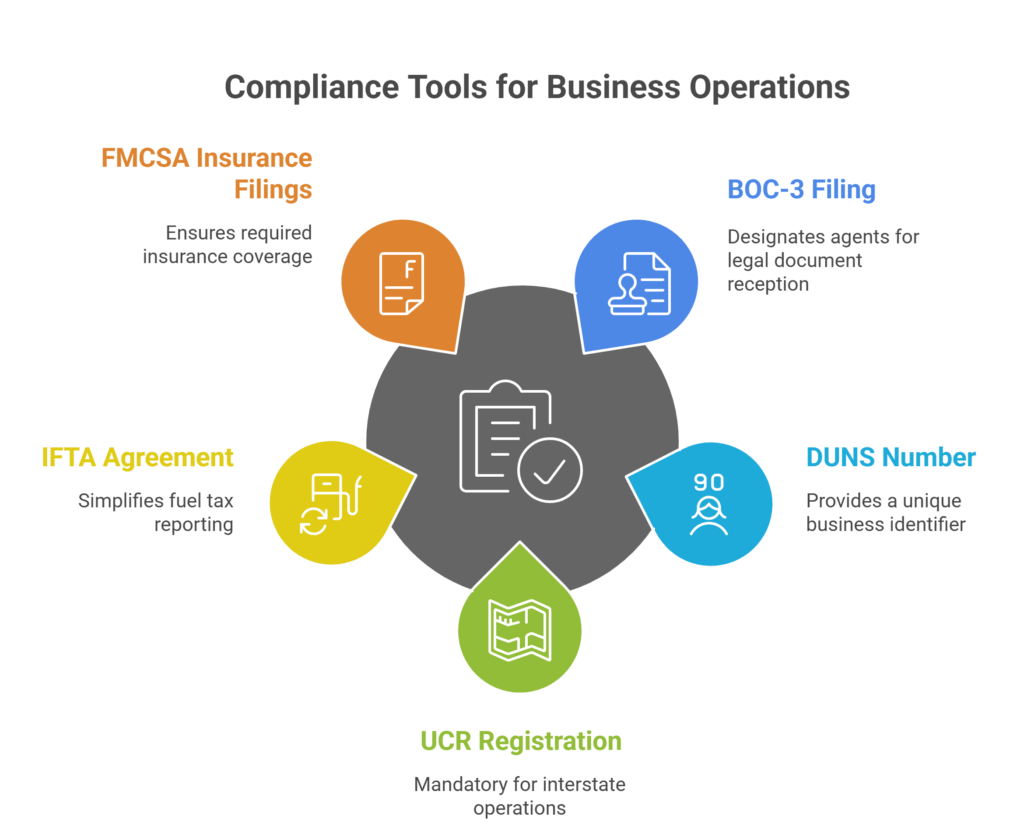

Process of Agents/ BOC-3 Filing (Blanket of Coverage)

- The BOC-3 is a form required by the Federal Motor Carrier Safety Administration (FMCSA) in the U.S. for brokers and carriers (FMCSA, n.d.).

- It designates a process agent in each state where you do business. That person or company is authorized to receive legal documents on your behalf if your business is sued or served.

- Example: If your brokerage is registered in Texas but a legal issue arises in Ohio, your appointed Ohio agent would accept the paperwork. Without a BOC-3, your operating authority cannot be activated.

DUNS Number (Data Universal Numbering System)

- A DUNS number is a unique 9-digit identifier assigned by Dun & Bradstreet (D&B).

- It creates a business credit profile, which lenders, shippers, and government agencies use to check your financial credibility (FMCSA, n.d.).

- Example: Many large corporations and government contracts require a valid DUNS number before they will do business with you.

Other Registrations

- Unified Carrier Registration (UCR): Mandatory for all brokers and carriers who operate across state lines in the U.S. It helps fund state highway safety programs.

- International Fuel Tax Agreement (IFTA): Applies only if you operate trucks. It simplifies fuel tax reporting across states/provinces.

- FMCSA Insurance Filings (e.g., BMC-91): Proof that you have the required levels of liability and cargo insurance.

- Example: A freight broker without a UCR cannot legally operate interstate, and failing to maintain proper insurance filings can result in revoked authority.

“A DUNS number is not legally required everywhere, but it boosts credibility with lenders, shippers, and government contracts.”

What tools or registrations beyond the basics could give your brokerage a competitive advantage?

Actionable Steps to Start Your Freight Brokerage

- Get training / industry experience: Build a knowledge base through work or courses.

- Research niche, market, competitors: Understand your target customers and rivals before launching.

- Draft a business plan: Use it as a roadmap for growth, funding, and operations.

- Choose name & structure; register business & tax IDs: Establish your legal foundation.

- Secure financing/capital: Ensure you have adequate reserves for licensing, insurance, and cash flow.

- Apply for operating authority/licensing: File with FMCSA or local equivalent.

- Obtain surety bond / trust fund: Required for legal compliance and to build trust.

- Appoint process agents; file paperwork: Complete BOC‑3 and other necessary filings.

- Set up office/remote systems; get tech; launch marketing & operations: Prepare your tools, systems, and brand presence before going live.

“Following a structured roadmap prevents common pitfalls like underfunding or regulatory delays.”

Looking for a deeper guide to walk you step‑by‑step through launching your brokerage? Watch our YouTube video here: Start Watching.

Frequently Asked Questions (FAQs)

1. Do I need a physical office to start a brokerage?

No. You can start from home with reliable internet and phone systems. Many successful brokers operate remotely.

2. How long does it take to complete licensing and bonding?

Timelines vary. For example, in the U.S. obtaining broker authority may take 4‑6 weeks once paperwork is correct.

3. How is a freight broker surety bond cost calculated?

The bond itself is fixed (e.g. $75,000 in the U.S.), but your annual premium depends on credit score, financials, and risk profile.

Launch Your Freight Brokerage the Right Way

Launching a freight brokerage isn’t just about checking boxes on a to-do list, it’s about building a business model that lasts. By focusing on training, selecting a strong niche, securing the right registrations, and setting up financial systems early, you give your brokerage the foundation it needs to thrive in a competitive industry. Success comes from strategy, persistence, and adaptability. The brokers who last are the ones who consistently refine their processes, deliver value to both shippers and carriers, and stay ahead of compliance and market shifts.

Ready to start your freight brokerage with confidence? Contact us to get expert support and proven solutions.

References

- FMCSA. (n.d.). Becoming a freight broker. Retrieved from https://www.fmcsa.dot.gov

- Logistics Management. (n.d.). Cold chain logistics trends. Retrieved from https://www.logisticsmgmt.com

- SBA. (n.d.). Choose your business structure. Retrieved from https://www.sba.gov

- Accounting Today. (n.d.). Best accounting software for small businesses. Retrieved from https://www.accountingtoday.com