Freight rate negotiation is one of the most critical skills for brokers. It’s not just about pushing numbers, it’s about balancing profitability, fairness, and trust between shippers and carriers. In the current freight market, successful brokers rely on value-driven selling, data insights, and long-term relationship strategies to secure win-win agreements.

Below, we’ll break down practical negotiation strategies and actionable steps for brokers looking to maximize margins without burning bridges.

Winning Shipper Business Profitably

To win profitable business from shippers, freight brokers need more than just competitive pricing. They must demonstrate value, reliability, and market expertise.

Key Strategies:

1. Sell on Value, Not Just Price: Emphasize reliability, specialized services, and customer support (Truckstop.com, n.d.).

Example: Instead of offering the lowest price, emphasize your ability to secure a temperature-controlled carrier during peak produce season, when capacity is tight.

2. Know the Market: Benchmark against current spot and contract rates to stay competitive (DAT, n.d.).

Example: Highlight a track record of on-time deliveries and proactive status updates using real-time tracking.

3. Highlight Problem-Solving: Position yourself as the broker who prevents delays and reduces risk (FMCSA, n.d.).

Example: Offer additional compliance support (like ELD monitoring) or customized reporting for supply chain visibility.

“Shippers pay a premium for reliability when late deliveries mean penalties with their customers.”

How do you show shippers that your brokerage is more than just a cost option?

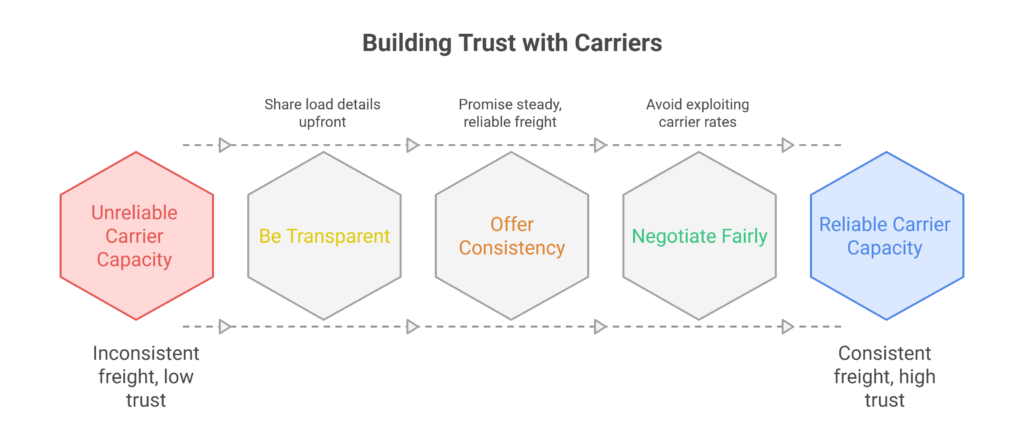

Negotiating with Carriers

Carriers are your partners, not just cost centers. Building trust ensures capacity when you need it most.

Steps for Success:

1. Be Transparent: Share load details upfront (deadhead, lanes, weight, equipment needs).

Example: Share the shipper’s delivery expectations upfront (like strict delivery windows) so the carrier knows what to expect.

2. Offer Consistency: Carriers value steady freight more than one-off cheap loads (FMCSA, n.d.).

Example: Promise lanes that run weekly instead of one-off loads, which helps carriers plan better.

3. Negotiate Fairly: Avoid driving rates so low that carriers feel exploited (FreightWaves, n.d.).

Example: Offer quick pay terms (like 23-day average pay) to stand out from brokers who pay in 45 days or longer.

“Carriers are more likely to prioritize brokers who treat them fairly, even if rates aren’t always the highest.”

What do you do to strengthen long-term carrier loyalty while negotiating tough rates?

How to Leverage Rate Data in Negotiations

Tools like DAT RateView and Truckstop Rate Insights can transform your negotiation approach.

How to Apply Data:

1. Counter Low Shipper Targets: Use live data to show realistic market averages.

Example: Use DAT RateView to show that the average spot rate for Chicago–Dallas is $2.25/mile this week (DAT, n.d.)

2. Educate Carriers: Explain why market dips or spikes affect rates FreightWaves, n.d.).

Example: Share how holiday surges or weather disruptions increase demand and rates in certain regions.

3. Improve Credibility: Fact-based conversations build trust and authority (Truckstop.com, n.d.).

Example: When a shipper requests $1.50/mile for a lane that’s trending at $2.00/mile, show them verified rate indexes.

“Brokers using data-backed negotiations often close faster and face fewer objections.”

Which data tools have helped you gain leverage in your negotiations?

Responding to Common Negotiation Tactics from Shippers and Carriers

Both sides play their cards during negotiations. Being prepared avoids traps.

Common Shipper Tactics:

- Multiple Quote Comparisons: Shippers may collect several broker quotes and use the cheapest as leverage.

Example: A shipper says another broker quoted $100 less per load, pressuring you to match or beat it.

- Claiming “Other Brokers Offer Cheaper”: They often reference unnamed competitors to push your rate down.

Example: A shipper insists they can get the lane for $1.50/mile elsewhere, even if the market average is $1.80.

- Last-Minute Rate Squeezes: After verbally agreeing, shippers may demand a discount right before tendering.

Example: On the morning of pickup, they ask you to shave $50 off or risk losing the load.

Common Carrier Tactics:

- Requesting “Badhee Rate” (Higher Than Market): Carriers may ask for above-market rates to test your flexibility.

Example: Market shows $2.00/mile, but the carrier demands $2.40 claiming lane difficulty.

- Claiming Hidden Costs: They might inflate costs like tolls, fuel, or parking (FreightWaves, n.d.).

Example: A carrier asks for an extra $75 citing tolls that only total $20.

- Threatening to Walk Away Last Minute: Some carriers attempt to force higher pay by threatening cancellation.

Example: At pickup, a driver says they won’t load unless you increase pay by $200.

“Staying calm, factual, and professional disarms negotiation games and shifts focus to long-term partnership.”

Want to explore comprehensive shipping solutions to strengthen your negotiation power? Check out our shipping services.

How to Handle Objections

Objections are opportunities to reinforce value.

Steps to Handle Rate Objections:

1. Listen First: Take time to fully understand the concern before reacting.

Example: If a shipper says your quote is too high, ask clarifying questions about their budget and expectations before defending your rate.

2. Explain Value: Tie rates to reliability, on-time delivery, and problem prevention.

Example: Emphasize that your carrier network has a 98% on-time rate, which reduces costly delays compared to cheaper brokers.

3. Offer Flexibility: Adjust on accessorials, not just base rate.

Example: If a shipper pushes back, offer to waive a $50 detention fee instead of cutting $200 from the base rate.

4. Be Ready to Walk Away: Protect your margins when expectations are unrealistic.

Example: If a carrier demands $2.80/mile while the market is $2.00, politely decline and seek another option to avoid losing money.

“Brokers who learn to reframe objections into problem-solving conversations close more deals without cutting into margins.”

How do you turn a “your rate is too high” objection into a value conversation?

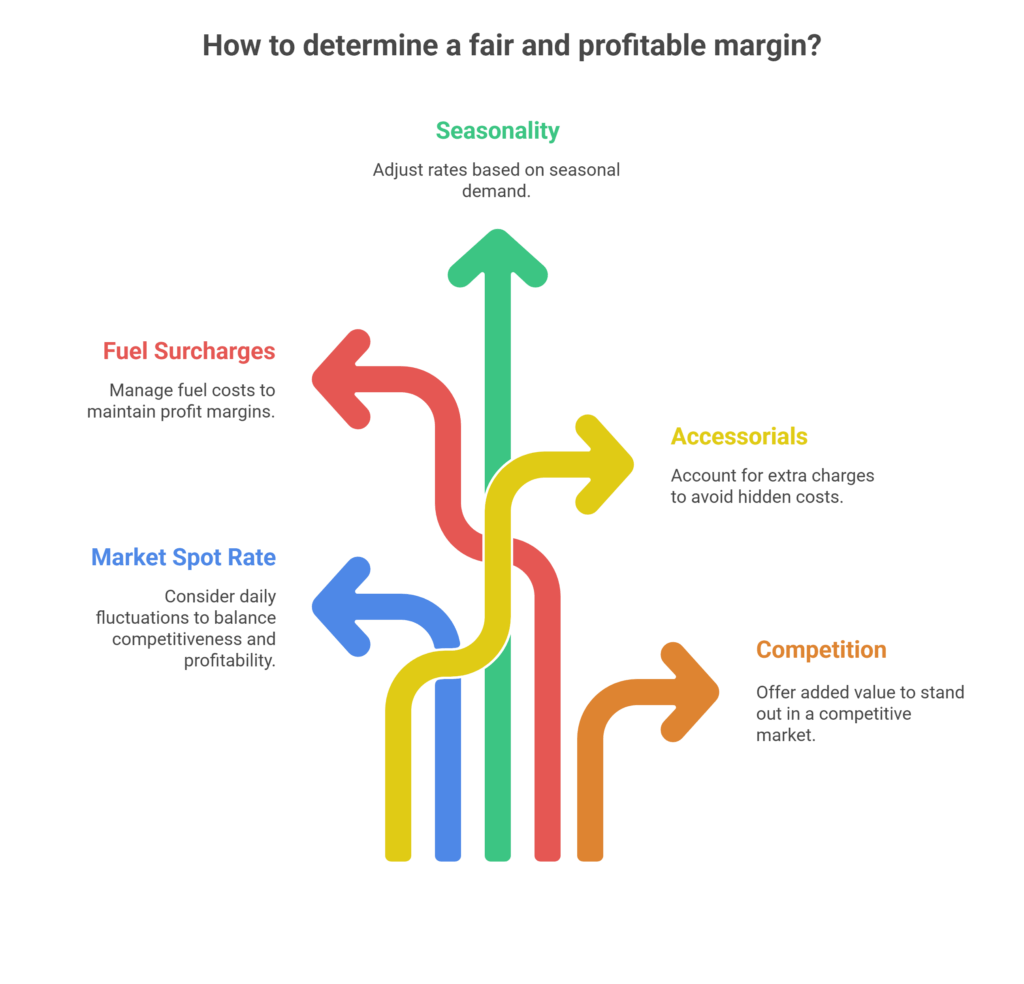

Key Factors in Determining a Fair and Profitable Margin

Margins are the lifeblood of brokerage. Too high, and you lose business; too low, and you lose profit.

Consider These Factors:

1. Market Spot Rate vs. Contract Rates: Spot rates can fluctuate daily, while contract rates are fixed over a period (FMCSA, n.d.).

Example: A spot rate for a Chicago–Dallas lane might jump to $2.50/mile during a heat wave, while your contract rate is $2.10.

2. Fuel Surcharges and Fluctuating Costs: Fuel costs directly impact all-in rates (DAT, n.d.).

Example: Fuel price spikes $0.20/gallon, increasing total load cost by $50; you can explain the fuel surcharge to the shipper.

3. Seasonality (Holiday Peaks, Slow Months): Rates vary by time of year due to capacity and demand shifts.

Example: During Christmas, demand surges for retail shipments, so rates rise 15–20%.

4. Accessorials and Hidden Costs: Extra charges for detention, layovers, or special handling affect profitability.

Example: A detention charge of $50/hr applies if loading exceeds 2 hours.

5. Competition in the Lane: High broker or carrier competition can drive rates down (FMCSA, n.d.).

Example: Five brokers bidding on the same lane may force you to offer added value instead of just lowering rates.

“The most profitable brokers set consistent margin goals and adjust flexibly based on capacity conditions.”

What margin range do you aim for when quoting lanes, and why?

Negotiating Accessorial Charges

Detention, layovers, and fuel surcharges add up. If ignored, they eat into profits.

Best Practices:

- Discuss Accessorials Upfront: Avoid surprises later by clearly communicating all potential fees and conditions.

- Put Agreements in Writing: Document all accessorial agreements in contracts or emails.

Example: Confirm in writing that detention charges apply after 2 hours of wait time.

- Educate Both Parties: Explain the purpose and calculation of each accessorial so shippers and carriers understand the costs.

Example: Show how a fuel surcharge fluctuates with the DOE index and impacts the total load cost.

“Clear agreements on accessorials protect broker margins while keeping relationships transparent.”

How do you negotiate accessorials without straining the deal?

Knowing When to Walk Away

Sometimes, the best negotiation is no negotiation.

Signs It’s Time to Walk Away:

- Rates fall below cost-to-serve.

- The carrier refuses to comply with insurance/safety standards.

- Shipper consistently underbids and undervalues service.

“Walking away from unprofitable or risky loads builds long-term credibility and financial health.”

Have you ever walked away from a deal that looked tempting but wasn’t sustainable?

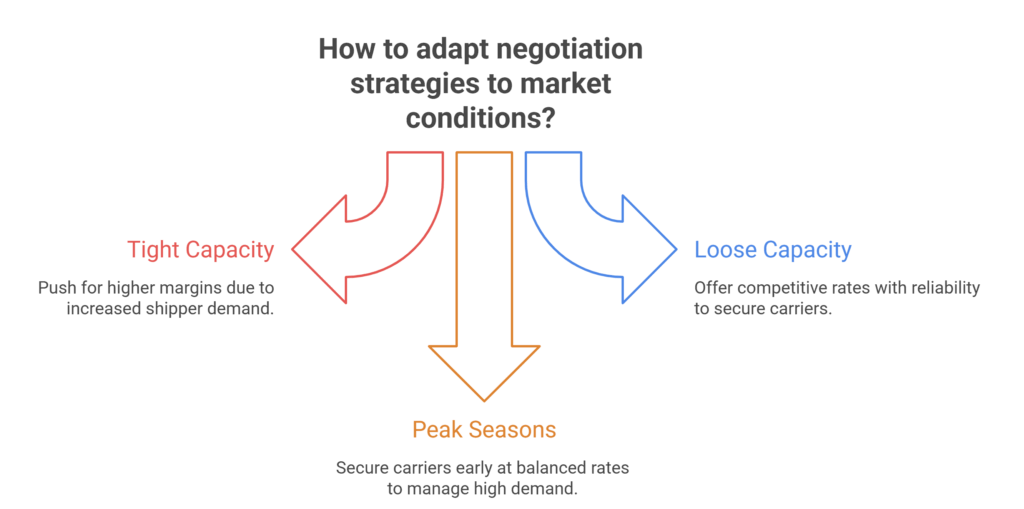

Adapting Negotiation Strategies to Market Conditions

Market swings demand flexible strategies.

Scenarios:

- Tight Capacity → Shippers need you more. Push for higher margins.

- Loose Capacity → Carriers compete more. Offer fair but competitive rates by demonstrating reliability and timely payments.

Example: In a slow season, multiple carriers bid for a lane; offer a slightly higher than market rate plus quick pay to secure the best option.

- Peak Seasons → Secure reliable carriers early at balanced rates, factoring in higher demand.

Example: During the holiday surge, book trusted carriers weeks in advance and negotiate a rate that balances peak demand with sustainable margins.

“Brokers who adjust strategies quickly during capacity shifts maintain consistent profit margins.”

How do you change your negotiation style during peak holiday seasons?

Building Leverage in Negotiations Without Burning Bridges

Leverage comes from trust, not just pricing power.

Ways to Build Leverage:

- Consistency:Prove reliability with repeat loads by showing a track record of handling the same lanes successfully.

Example: Demonstrate that you’ve managed a weekly Chicago–Dallas lane for six months without delays.

- Transparency: Share why rates are set the way they are, including all cost components.

Example: Explain to the shipper that your rate includes base linehaul, fuel surcharge, and accessorial charges for clarity.

- Specialization: Offer niche solutions competitors can’t, like handling temperature-controlled or hazardous materials.

Example: You provide certified carriers for pharma shipments, giving you an edge over general brokers.

“Long-term leverage is built on being a broker who consistently delivers, not one who undercuts.”

Looking to strengthen your brokerage with proven solutions? Discover our freight broker solutions.

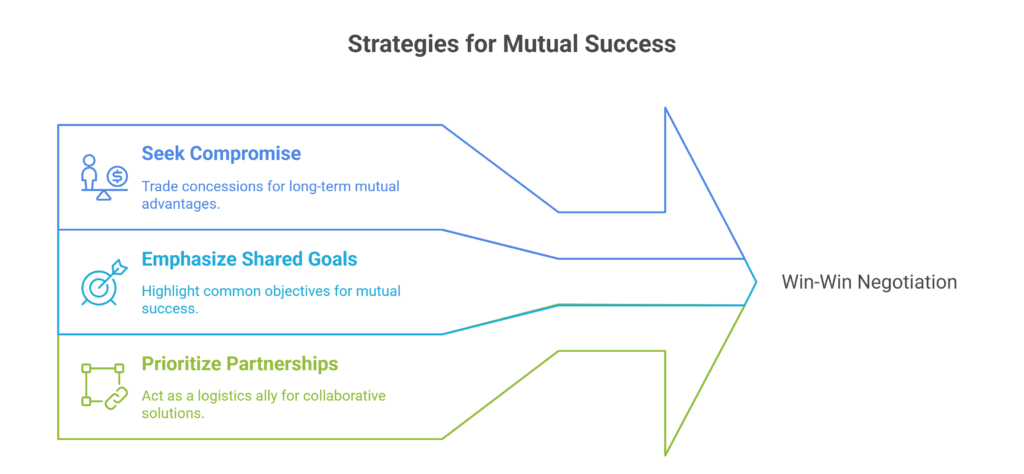

Win-Win Negotiation Techniques for Brokers, Shippers, and Carriers

The best negotiations leave everyone satisfied.

Techniques:

1. Seek Compromise: Trade small concessions for long-term benefits.

Example: Agree to a slightly lower rate for a load if the shipper commits to weekly shipments, ensuring steady volume for both parties.

2. Emphasize Shared Goals: On-time delivery, cost savings, reliability.

Example: Highlight that a slight rate increase guarantees faster delivery and fewer delays, benefiting both the shipper and the carrier.

3. Prioritize Partnerships: Position yourself as a logistics ally, not just a middleman.

Example: Offer proactive problem-solving like rerouting carriers during delays to prevent customer complaints.

“Win-win deals create repeat business, better margins, and long-term loyalty.”

Want to leverage technology to streamline win-win negotiations? Explore our freight broker technology.

All-In vs. Linehaul Rates

Understanding rate structures prevents confusion.

- Linehaul Rate – Covers base cost of moving freight.

Example: $1,000 covers 500 miles at $2.00/mile.

- All-In Rate – Includes linehaul + fuel + accessorials.

Example: $1,000 linehaul + $150 fuel surcharge + $50 detention = $1,200 all-in.

Always clarify whether you’re quoting all-in or linehaul to avoid disputes.

“Misunderstandings on rate structures often cause distrust. Clarity prevents conflicts.”

Do you prefer quoting all-in or linehaul, and why?

Fuel Prices and Freight Rates

Fuel is one of the biggest variables in freight pricing.

Management Strategies:

- Tie surcharges to DOE fuel index.

- Negotiate flexible fuel surcharge agreements.

- Monitor and adjust weekly to stay competitive.

“Transparent fuel surcharge policies protect margins and reassure carriers and shippers.”

How do you explain fuel surcharge adjustments to clients without pushback?

Frequently Asked Questions (FAQs)

1. What’s the average freight broker margin in the industry?

Most brokers aim for 10–15%, though margins vary depending on lanes, market conditions, and services offered.

2. How do I convince shippers to accept higher rates?

By highlighting value: reliability, specialized services, and real-time data support rather than competing on price alone.

3. What tools can help me with freight rate negotiations?

DAT RateView, Truckstop Rate Insights, and SONAR are widely used to benchmark rates and justify quotes.

Maximize Profit and Build Trust

Negotiating freight rates is both an art and a science. Success comes from balancing profitability, fairness, and trust with shippers and carriers. By leveraging market data, demonstrating value beyond price, and maintaining transparent communication, brokers can secure profitable agreements without compromising relationships. Applying strategies like handling objections, managing accessorials, and adapting to market conditions ensures both short-term gains and long-term partnerships. Ultimately, the brokers who master these skills position themselves as trusted logistics partners, fostering repeat business and sustainable growth.

Ready to elevate your freight negotiations and secure better deals? Contact us to get expert guidance and tools to optimize your rate strategy.

References

- DAT. (n.d.). RateView freight data. Retrieved from https://www.dat.com

- FreightWaves. (n.d.). Freight market intelligence. Retrieved from https://www.freightwaves.com

- Truckstop.com. (n.d.). Rate insights and benchmarking. Retrieved from https://www.truckstop.com

- FMCSA. (n.d.). Federal Motor Carrier Safety Administration regulations. Retrieved from https://www.fmcsa.dot.gov