The freight market is famously cyclical. Rates soar one moment, collapse the next; carrier capacity swings wildly; shipping demand changes at the drop of a hat. In 2024, the U.S. freight brokerage market was valued at $17.5 billion, projected to reach $35.1 billion by 2033 with an annual growth rate of 8.6% (Market Data Forecast, 2024). As a freight broker, you can’t simply react, you must anticipate, adapt and strategize. This article discusses how to forecast trends, secure capacity, optimize pricing, leverage data and build resilience when the market goes off track. Let’s gear up so you’re not just surviving volatility, you’re thriving in it.

Why Freight Markets Fluctuate, and What It Means for Brokers

Understanding the root causes of rate swings gives you a strategic edge.

- The classic supply-vs-demand cycle: when freight volumes fall and capacity is plentiful, rates drop; when carriers are scarce relative to cargo, rates climb.

- Fuel costs, global events, tariffs, weather and regional disruptions all change the cost base and routing dynamics for carriers.

- Seasonal shifts and regional anomalies create timing- and lane-specific volatility, not just national averages.

What It Means for Brokers

- Pricing Becomes a Moving Target: Brokers can’t rely on static rate sheets; they must use dynamic pricing tools and market intelligence platforms like DAT or Truckstop to adjust quotes in real time.

- Carrier Relationships Gain or Lose Value Fast: When capacity is tight, loyal carriers become your lifeline. In soft markets, you may need to rebalance your network to maintain utilization and fair pricing.

- Margin Pressure Is Constant: Every shift in the market either compresses your margin (when shippers push rates down) or tests your value proposition (when carriers demand more).

- Forecasting Becomes a Strategic Imperative: Brokers who monitor indicators like GDP, manufacturing output, and fuel prices can prepare earlier, locking in rates or repositioning carriers before market shifts hit full swing.

- Communication Defines Credibility: Transparent, data-backed explanations of rate changes strengthen trust with both shippers and carriers, especially when volatility is high.

“Visibility into regional and lane-specific trends beats relying solely on national averages.”

How often do you review lane-specific data in your brokerage operations, versus national industry averages?

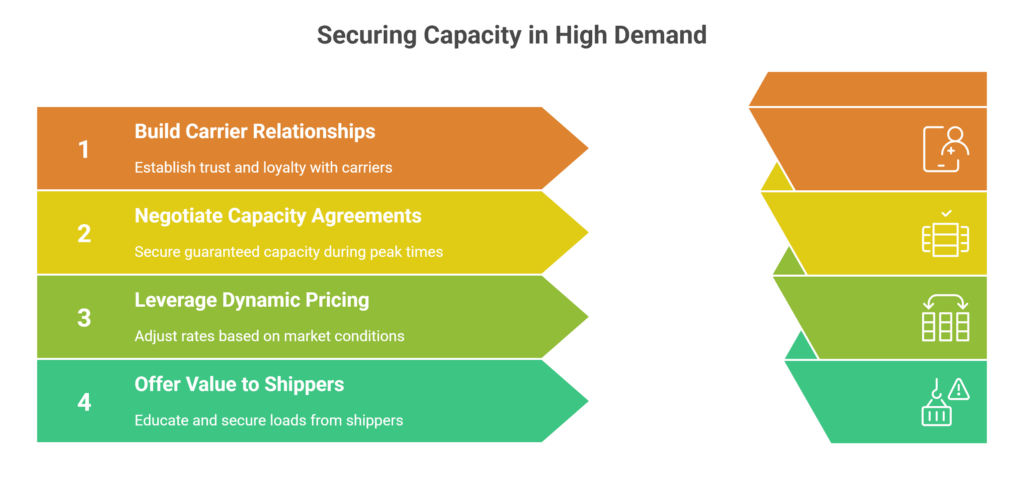

Strategies to Navigate Tight Carrier Capacity When Demand Outstrips Supply

When capacity is tight and demand is high, you need to position your brokerage to secure the best loads, rate premiums, and carrier relationships. Use these tactics proactively rather than waiting for the squeeze.

-

Build trusted carrier relationships

- Pay carriers promptly and consistently.

- Provide tools (e.g., load tracking, streamlined documentation) to make their work easier and keep them loyal.

- Cultivate smaller carriers too. Local/regional capacity can often be more flexible in tight times.

-

Negotiate flexible but reliable capacity agreements

- Use contract frameworks that guarantee a minimum load or capacity commitment during peaks.

-

Leverage dynamic pricing and lane-specific intelligence

- Monitor real-time market indices and benchmarks.

- Adjust rates upward timely when capacity tightens in a lane.

-

Offer value to shippers to lock loads

- Educate shippers about tight capacity conditions. Articulate why you may need to charge higher rates or adjust terms.

- Position yourself as the broker who secures capacity when others can’t.

“When carriers know your brokerage reliably delivers, especially in tight markets, they’ll prioritise your loads, giving you a competitive edge.”

What mechanisms do you currently use to ensure carriers prefer working with you when capacity is scarce?

Strategies for Excess Capacity and Downward Pressure on Rates

Conversely, when carrier supply outpaces demand, margins get squeezed. In soft markets, efficiency, niche focus and innovation become your allies (FreightWaves, 2025). Here’s how to maintain profitability.

-

Segment and prioritise profitable lanes / niches

- Identify lanes where you hold strength (carrier pool, knowledge, relationships) and double down.

- Consider shifting away from highly commoditized lanes where everyone bids rates down.

-

Use contract volume or committed-load models

- Secure shippers who are willing to commit to volume, giving you greater leverage than spot loads.

-

Improve operational efficiency to reduce costs

- Leverage technology for quoting, tracking, documentation and carrier management.

- Use carrier networks and pooling strategies to optimize utilization.

-

Offer differentiated services

- Value-added insights, premium carrier options, expedited lanes, specialized handling, shift away from purely cost-based bidding.

Truck capacity is now falling faster than demand, creating new opportunities for brokers with reliable carrier networks (FreightWaves, 2025)

“Soft markets force brokers to shift from rate-chasing to value-creation.”

Struggling to protect your margins when rates drop? Discover actionable strategies for freight broker compliance and risk management.

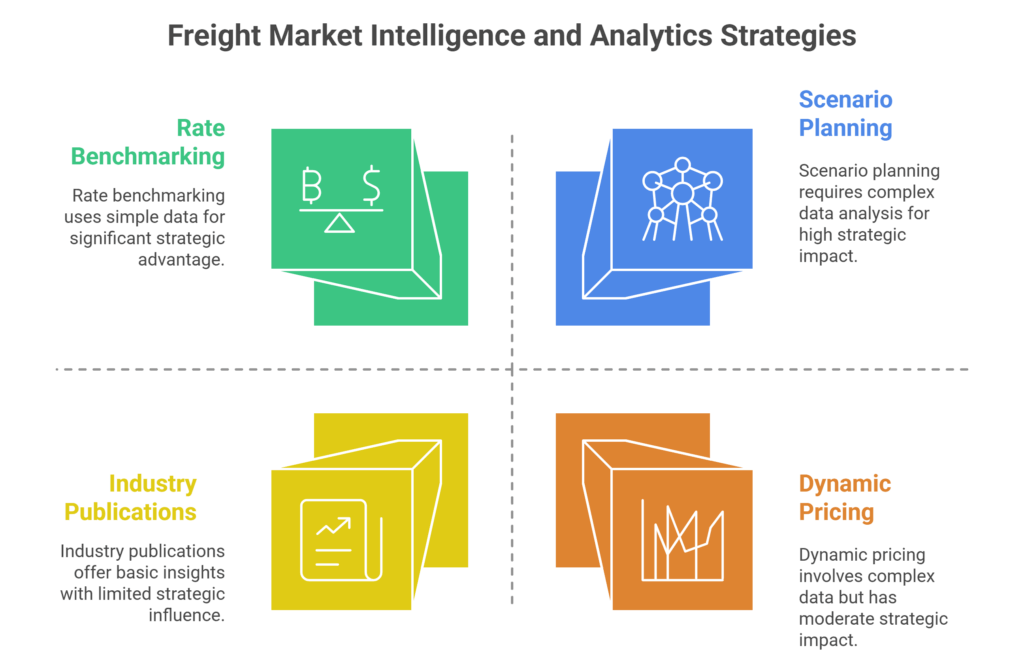

Real-Time Market Intelligence & Data Analytics

Knowledge is power, and in freight markets, real-time intelligence and analytics make the difference between guessing and guiding.

-

Top sources for freight market intelligence

- Platforms such as DAT iQ, Truckstop RateView analytics, for rate benchmarking, spot/contract trends.

- Industry publications and reports (e.g., FreightWaves, Cass Freight Index).

- Historical & regional data: national numbers mask local variations.

-

Use data analytics to forecast freight demand and trends

- Identify leading economic indicators (GDP growth, manufacturing output, consumer spending, fuel prices, tariffs) and correlate them with rate/volume changes (FMCSA, 2024).

- Create internal dashboards: e.g., truck-capacity supply vs tender-acceptance rates, spot vs contract spread, seasonal depth vs upcoming peaks.

- Scenario planning: e.g., what if fuel rises 10 %, or a major import surge hits a region? Build responses.

-

Deploy dynamic pricing strategies based on data

- Use benchmarks to set minimum rates, spot market triggers, lane risk premiums.

- Segment pricing by lane, carrier class, service level and urgency.

- Consider hedging tools or contractual minimums when applicable.

Truckload spot rates are expected to rise only 2% YoY in 2025, showing a stable but low-margin market (C.H. Robinson, 2025).

“Modern brokers need more than intuition, they need analytical firepower and real-time tools to stay ahead in volatile markets.”

Which KPI or dashboard metric would you add tomorrow to better anticipate a market shift in your brokerage operations?

Seasonal Demand, Economic Indicators & Niches

External factors and structural insights can guide where you focus efforts and resources.

-

Seasonal demand swings

- Holiday peaks, produce seasons, weather-driven shifts all create capacity strain and rate swings.

- Plan ahead: map your calendar, lock in carriers and shippers early for peak periods; avoid being reactive.

-

Economic indicators and macro-factors

- GDP growth, consumer spending, manufacturing PMI, fuel price trends, trade tariffs all impact overall freight volume and capacity balance (FMCSA, 2024).

- When these indicators signal downturn (e.g., manufacturing slump, tariff uncertainty), shift to cost containment, niche focus, contract rather than spot.

-

Resilient niches or freight types

- Some freight segments are less impacted by general market swings: e.g., medical equipment, critical parts, dedicated/regional lanes, high-value expedited freight.

- Position your brokerage to specialise in or retain strength in those niches as a hedge.

“Consistent profitability in volatile markets often comes from focusing on resilient niches, not trying to win everything.”

What niche or freight-type could your brokerage target more aggressively to reduce exposure to broad market swings?

Communication, Contracts & Long-Term Relationships

Strategy isn’t just internal, how you communicate, structure contracts and build long-term relationships matters.

-

Effectively communicating market volatility to shippers

- Be transparent: explain why rates may vary, capacity may be constrained, and what you’re doing to protect service levels.

- Educate: lead shippers through what conditions drive rates and capacity so they trust your pricing.

-

Contracts versus spot-market engagement

- Use long-term contracts where possible to lock in volume and rates, reduce exposure to spot volatility.

- But maintain spot market engagement to capture upside when conditions favor brokers.

-

Building resilient carrier networks and loyal partner relationships

- Cultivate carriers with whom you share information, trust, and collaborate. These partners stay with you in tight markets.

- Organise regular carrier-meetings, share forecast info, and provide value beyond just loads (digital tools, reliable volumes).

The FMCSA reported an 8.6% decline in active freight brokerages over the past year, showing how volatility weeds out weak networks (Cogistics Transportation, 2024).

“Contracts and communication, not just pricing, are what make brokers indispensable partners during turbulent markets.”

Want to strengthen your shipper and carrier relationships while mitigating risk? Explore comprehensive freight broker solutions.

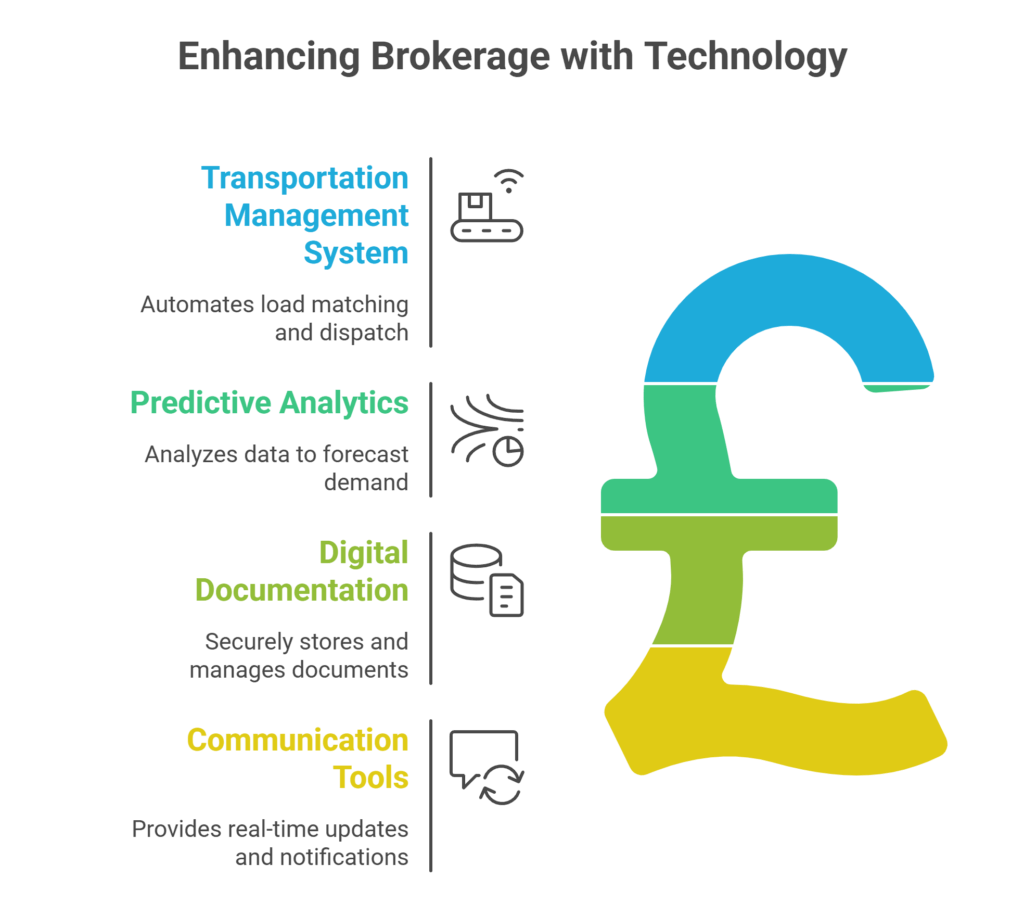

Leveraging Technology and Automation to Navigate Market Volatility

Technology is no longer optional for modern freight brokers, it’s a competitive advantage. Automation tools, TMS platforms, and predictive analytics help brokers react faster, reduce manual errors, and maintain margins even in volatile markets.

How Brokers Can Use Technology

-

Implement a Transportation Management System (TMS):

- Automate load matching, dispatching, and carrier communication.

- Reduce administrative overhead so brokers can focus on revenue-generating activities.

-

Use predictive analytics for demand forecasting:

- Analyze historical lane data, seasonal trends, and economic indicators.

- Anticipate market swings and adjust pricing or carrier assignments proactively.

-

Digitize documentation and compliance tracking:

- Store contracts, insurance certificates, and broker-carrier agreements in one secure platform.

- Minimize delays and reduce risk of non-compliance fines.

-

Adopt communication tools for real-time updates:

- Keep shippers and carriers informed with automated notifications and dashboards.

- Improves transparency, trust, and service reliability.

“Automation doesn’t replace brokers, it amplifies their decision-making. The smartest brokers leverage tech to make faster, data-backed choices, leaving competitors behind.”

Looking for ways to streamline your brokerage with the latest technology? Explore our advanced freight broker tech solutions.

Frequently Asked Questions (FAQs)

1: How can brokers forecast freight market trends accurately?

Use tools like DAT iQ, Truckstop, and FreightWaves SONAR alongside economic data (GDP, manufacturing PMI, fuel prices). Build dashboards that track both national and lane-specific trends for early insight.

2: What are the best strategies to handle excess capacity?

Focus on high-margin lanes, automate operations, build dedicated shipper contracts, and diversify into recession-resistant freight sectors.

Q3: How do I communicate market volatility to shippers effectively?

Back every rate change with credible data. Share trend charts or FreightWaves reports to show it’s a market-driven shift, not arbitrary pricing.

Stay Profitable Through Every Market Cycle

Volatility in the freight market is less an anomaly and more the norm. For brokers who treat it as a given, opportunity exists in the fringes of chaos. By combining market intelligence, robust carrier networks, strategic niche focus, dynamic pricing, and clear communication, you can not only survive turbulent times, you can turn them into competitive advantage. Let the market cycle drive others out of business; you stay focused, informed and ready.

Ready to outlast the market and grow through every cycle? Contact us to learn how SPI Logistics helps brokers turn volatility into opportunity.

References

- Market Data Forecast (2024). United States Freight Brokerage Market Report (2024–2033). https://www.marketdataforecast.com/

- Cogistics Transportation (2024). Freight Market Outlook: Building Stability in a Volatile Brokerage Landscape. https://www.cogisticstransportation.com/

- FreightWaves (2025). Truckload Capacity Is Falling Faster Than Demand. https://www.freightwaves.com

- C.H. Robinson (2025). North America Freight Insights – August 2025 Truckload Market Update. https://www.chrobinson.com

- FMCSA (2024). Motor Carrier Management Information System (MCMIS) Snapshot. https://ai.fmcsa.dot.gov/mcmis.asp