Shipping goods isn’t just about getting from point A to B, it’s about doing it safely and profitably. That’s where cargo insurance comes in. Whether you’re a seasoned freight broker or a first-time shipper, understanding insurance rates can make or break your margins.

In this guide, we’ll explore how cargo insurance is calculated, how much it really costs, and how to find the best value for your freight.

Why Cargo Insurance Matters

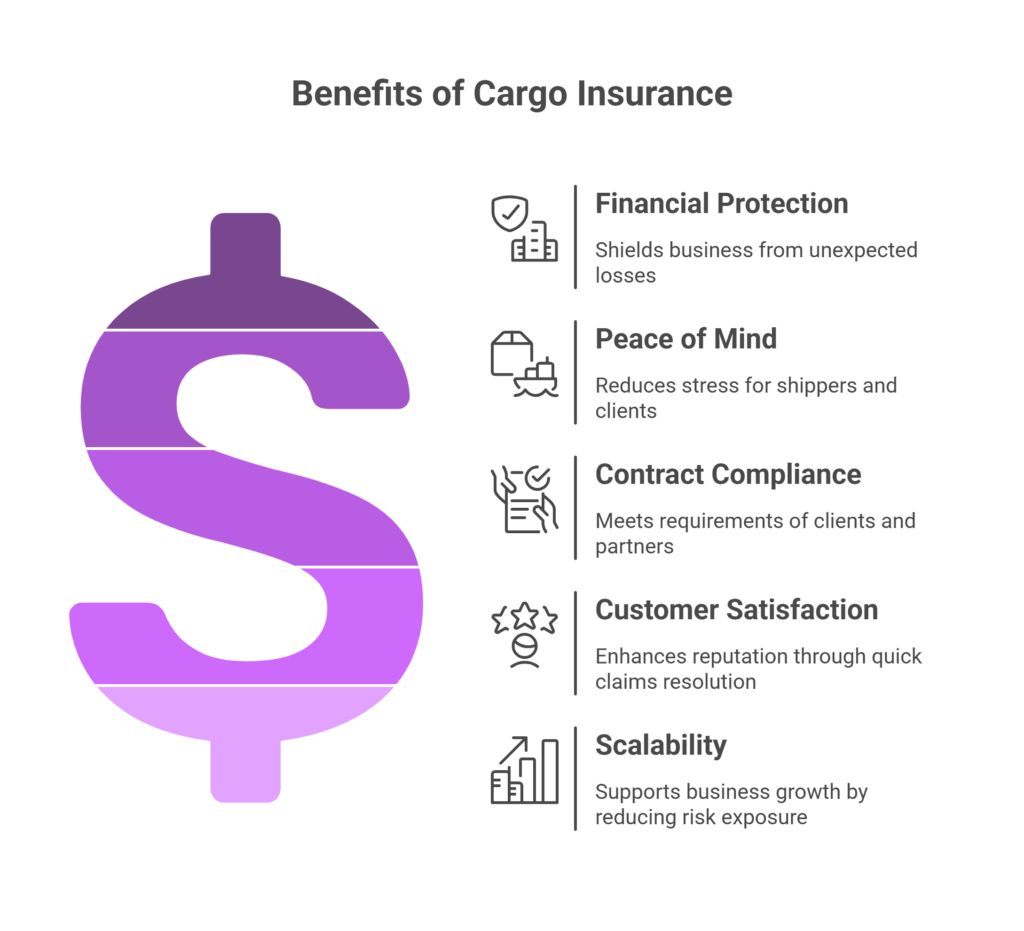

Without proper insurance, a single accident, theft, or loss can wipe out your shipment value, and your business reputation. Having a Cargo Insurance gives you:

- Financial protection: Shields your business from unexpected losses due to damage, theft, or accidents.

- Peace of mind: Reduces stress for shippers and clients knowing freight is covered.

- Contract compliance: Many clients and partners require proof of cargo coverage.

- Customer satisfaction: Quickly resolving claims can enhance your reputation.

- Scalability: Helps support business growth by reducing risk exposure on large or frequent shipments.

“Cargo insurance not only protects assets but enhances client trust, which is crucial for long-term partnerships.”

How has cargo insurance improved your business resilience during unforeseen disruptions?

How Is Cargo Insurance Calculated?

This is one of the most common, and most critical, questions in freight. So, how is cargo insurance calculated?

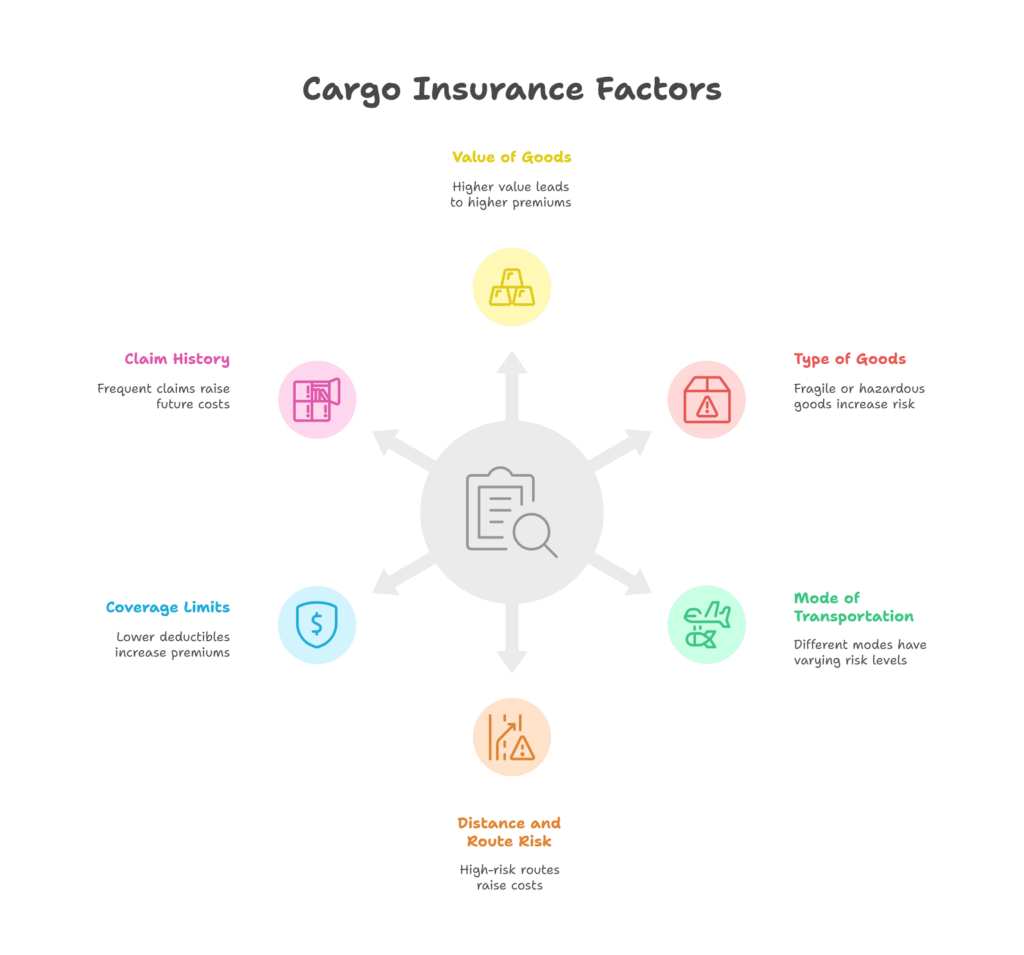

Here are the key factors most insurers consider:

- Value of the goods: Higher-value items mean higher premiums.

For example, insuring a shipment of luxury electronics will cost more than insuring a batch of t-shirts due to the higher replacement value (Freightos, n.d.).

- Type of goods: Fragile, perishable, or hazardous goods can increase risk.

For instance, Shipping fresh seafood requires fast delivery and temperature control, making it riskier and more expensive to insure than durable goods like steel rods.

- Mode of transportation: Ocean, air, rail, and truck have different risk levels.

Air freight may be faster but is often costly to insure due to the higher cargo value it typically carries, whereas truck shipments may face more accident-related risks.

- Distance and route risk: High-risk areas or long distances = higher cost.

For example, shipping through piracy-prone waters or areas with political instability, like certain regions in West Africa, can raise premiums significantly.

- Coverage limits and deductibles: Lower deductibles raise premiums.

A policy with a $500 deductible will have a higher monthly cost than one with a $5,000 deductible, but it also reduces out-of-pocket expenses during a claim (Freightos, n.d.).

- Claim history: Frequent claims may drive up future costs. If a company has a track record of damaged or lost shipments, insurers may charge more due to the higher perceived risk.

If you’re shipping internationally, you’ll also need to look at marine cargo insurance cost variables.

Pro Tip: Always ask for a breakdown so you’re not overpaying.

“Calculating cargo insurance accurately requires a deep understanding of cargo value, transport risks, and market conditions. Leveraging technology like AI-driven risk assessment is becoming industry standard.”

What factors have you found most challenging when estimating cargo insurance costs?

Common Types of Cargo Insurance and Rates

There’s no one-size-fits-all insurance plan. Here’s a breakdown of common types and what to expect in terms of rates:

| Type of Coverage | Typical Use Case | Average Rate Estimate |

| All-risk cargo insurance | Comprehensive coverage | 0.5% – 2% of cargo value |

| Named perils insurance | Basic protection for specific risks | 0.1% – 0.5% of cargo value |

| Marine cargo insurance | International sea or air freight | Varies widely |

Understanding marine cargo insurance rates helps you make informed decisions on cross-border shipments.

“All-risk policies offer the most comprehensive protection but come at a higher price. Shippers should balance coverage needs with cost-effectiveness based on cargo type and route.”

Have you found all-risk or named perils insurance more effective for your shipments, and why?

How much does Cargo Insurance Cost?

So, how much does cargo insurance cost in real life?

Let’s break down some averages:

- Average cost of cargo insurance: Between $100–$500 per shipment, depending on size, risk, and coverage limits (Freightos, n.d.).

- Cargo insurance price for standard goods (e.g., apparel or home goods) typically hovers around 0.6% of the shipment’s declared value (International Trade Administration, n.d.).

- Freight insurance cost can spike for electronics or pharmaceutical shipments due to increased theft or spoilage risk (TT Club, 2023).

- Cargo liability insurance cost in the U.S. averages around $0.50–$1.50 per $100 of insured value, depending on the deductible and exclusions (Roanoke Insurance Group, n.d.).

- How much is cargo insurance a month? If you’re insuring high volumes or using an annual plan, monthly premiums can range between $75–$300 (Loadsure, n.d.).

For example, insuring a $100,000 shipment of laptops going via ocean freight from Shenzhen to Los Angeles might cost around $750–$1,200 for all-risk coverage, while the same coverage for furniture could fall under $600.

Use a cargo insurance cost calculator to estimate exact numbers for your load. While most are labeled “shipping insurance calculator” or “transport insurance cost estimator,” many brokers offer free tools.

“Tech shipments incur up to 30% higher premiums due to theft risk, while bulk commodities like grains attract the lowest rates. Understanding your cargo category is critical.”

What trends have you noticed in your cargo insurance premiums over the past year?

How to choose the right Insurance Policy

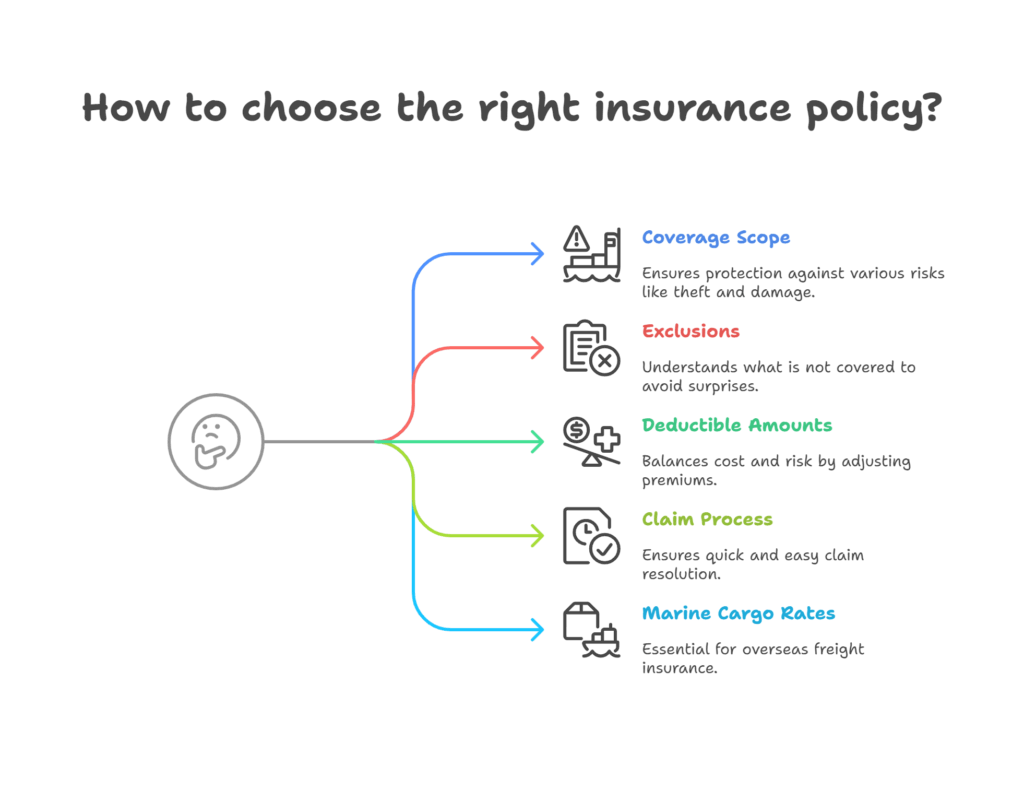

Not all insurance is equal. Here’s how to compare and choose wisely:

Key Metrics to Check:

- Coverage scope – Does it cover theft, damage, delay?

- Exclusions – Know what isn’t covered.

- Deductible amounts – Higher deductibles can reduce premiums.

- Claim process – Fast, simple claims matter.

- Marine cargo insurance rates – For overseas freight.

If you’re shipping high-value loads, make sure to understand the 100k cargo insurance cost — this refers to policies covering up to $100,000 in loss or damage.

“Look beyond price, evaluate claim responsiveness, exclusions, and insurer reputation to avoid surprises during claims.”

Want to find the best shipping insurance for your business? Explore comprehensive shipping insurance solutions tailored for your business at our Shipping Services.

Freight Insurance Tools That Make It Easy

Manual quoting is outdated. Use digital tools to streamline your insurance planning:

Top Tools:

- Cargo insurance cost calculator – Estimate your total protection cost.

- Shipping insurance calculator – Compare premiums by carrier.

- Transport insurance cost estimator – Analyze multi-modal options.

These tools often let you toggle coverage limits, value, and cargo type to get real-time pricing.

“Digital insurance calculators and AI-based quoting tools are revolutionizing freight insurance by enabling instant, accurate pricing and better risk management.”

Have you integrated any digital insurance tools into your workflow? What benefits or challenges have you experienced?

How Much Cargo Insurance Do I Need?

The amount of Cargo insurance you need depends on:

- Your shipment’s total value – This is the foundation of your insurance coverage.

For example, insuring a shipment worth $250,000 will require a policy that reflects that full value or more to ensure you’re adequately protected in case of total loss.

- Risk of loss or theft – If your cargo is high-risk (e.g., electronics, pharmaceuticals), you’ll need more comprehensive insurance.

A shipment traveling through high-crime zones or with multiple transfer points will also raise the risk and affect the premium.

- Existing carrier liability limits – Most carriers have limits on what they’ll reimburse if cargo is damaged or lost.

For instance, a trucking company may only cover up to $0.50 per pound, which may be far below the value of your goods. Insurance bridges that gap.

- Client requirements or regulations – Some clients may mandate a specific coverage level as part of their contract. Similarly, international shipments might be subject to government or port regulations requiring specific insurance minimums.

Generally, it’s wise to cover at least 110% of your cargo’s commercial invoice value. For high-ticket loads, the cargo insurance rate may justify the peace of mind.

“Covering at least 110% of invoice value is a good rule, but businesses should tailor coverage based on risk appetite and client requirements.”

Not sure how much cargo insurance coverage is right for you? Discover tailored solutions at SPI3PL Freight Broker Solutions.

Frequently Asked Questions (FAQs)

1. How is cargo insurance calculated?

Cargo insurance is calculated based on factors like the value of the goods, type of cargo, mode of transport, route risk, and coverage limits. For example, fragile or high-value shipments typically have higher premiums. Tools like a cargo insurance cost calculator or shipping insurance calculator can help estimate exact rates based on your shipment details.

2. What affects the transport insurance cost the most?

The biggest factors influencing transport insurance cost include the cargo’s value, shipment route risk, type of goods, and coverage limits. Additionally, claims history and deductible amounts also impact your final premium. Understanding these helps you manage your cargo insurance price effectively.

3. How much is cargo insurance a month for frequent shippers?

Monthly cargo insurance costs vary based on shipment volume, coverage limits, and cargo value. Frequent shippers may pay between $50 and $200 per month. Using a shipping insurance calculator can provide tailored estimates to optimize your cargo insurance rate.

4. What is the 100k cargo insurance cost for high-value shipments?

A policy covering up to $100,000 in cargo typically costs between 0.5% and 2% of the shipment’s value, depending on risk factors and transport mode. For high-value items, understanding marine cargo insurance rates or other specialized policies is essential to get the best price and protection.

Make Smart Insurance Decisions

Navigating freight insurance rates can feel overwhelming, but the cost of being underinsured is far worse. With smart tools like a shipping insurance calculator, you can compare multiple rates, find hidden savings, ensure your load and profits are protected. Don’t just ask how much cargo insurance is, ask if you’re getting the best value for what you’re paying.

Ready to secure the best coverage for your freight? Contact us to get expert guidance and optimize your insurance strategy.

References

Roanoke Insurance Group. (n.d.). Marine cargo insurance overview. Retrieved from https://www.roanokegroup.com

Freightos. (n.d.). Cargo insurance pricing guide. Retrieved from https://www.freightos.com

Loadsure. (n.d.). Instant cargo insurance pricing. Retrieved from https://www.loadsure.net

TT Club. (2023). Cargo theft trends and prevention. Retrieved from https://www.ttclub.com

International Trade Administration. (n.d.). Exporter’s guide to cargo insurance. Retrieved from https://www.trade.gov