The freight brokerage industry is growing rapidly, but with growth comes opportunity for fraudsters. Understanding common freight fraud types is essential for brokers, shippers, and carriers to protect their operations and bottom line. From double brokering fraud to phantom shipments fraud, being aware of red flags and implementing preventive strategies can save your business from costly mistakes.

Double Brokering Fraud

Double brokering fraud happens when a carrier accepts a load from a broker and then secretly re-brokers it to another carrier without the original broker’s consent (U.S. Department of Transportation [DOT], n.d.). This not only puts the shipment at risk but can lead to missed payments, damaged goods, and liability disputes.

Example: A broker books a shipment of electronics with Carrier A. Instead of hauling it, Carrier A contracts Carrier B, who then delivers the goods. When the broker tries to pay Carrier A, they discover that Carrier A already collected funds, leaving Carrier B unpaid. This kind of freight brokerage scam can cost thousands in lost revenue and damage your reputation (FreightWaves, n.d.).

Red flags to watch for:

- Unverified carriers: Carriers unwilling or unable to provide proper insurance, DOT numbers, or MC numbers (FMCSA, n.d.).

- Unusual payment requests: Requests for expedited payments or unusual payment methods like wire transfers for “fuel advances.”

- Load board inconsistencies: Frequent cancellations, multiple reassignments of the same load, or duplicate postings of the same shipment on load boards.

- Communication gaps: Carriers avoiding direct calls or using only email/instant messaging to communicate.

Prevention Tips:

- Verify carrier identity: Always confirm credentials with FMCSA and third-party verification services. Check DOT numbers, MC numbers, and insurance coverage.

- Strengthen contracts and confirmations: Include clauses that prevent re-brokering and clearly outline liability if the carrier subcontracts without authorization.

- Track shipments in real-time: Use GPS-enabled devices or TMS platforms to monitor the load from pickup to delivery, ensuring carriers do not pass the freight along without your knowledge.

- Monitor payment flow: Use escrow or verified payment platforms to prevent carriers from collecting multiple payments for the same load.

- Educate your team: Train staff on how to avoid freight fraud, recognizing the warning signs of double brokering and other scams.

Example of successful prevention: A brokerage firm noticed that Carrier X repeatedly requested same-day pickups and unusual fuel advance payments. By verifying Carrier X’s credentials and using real-time shipment tracking, the firm discovered Carrier X was re-brokering freight. The broker terminated the contract and avoided a potential $15,000 loss.

“Double brokering often occurs because brokers and shippers skip verification steps in a rush to secure loads. Using automated carrier vetting systems alongside manual checks significantly reduces risk.”

Worried your loads might be double brokered? Learn how to spot red flags and protect your shipments by watching this video.

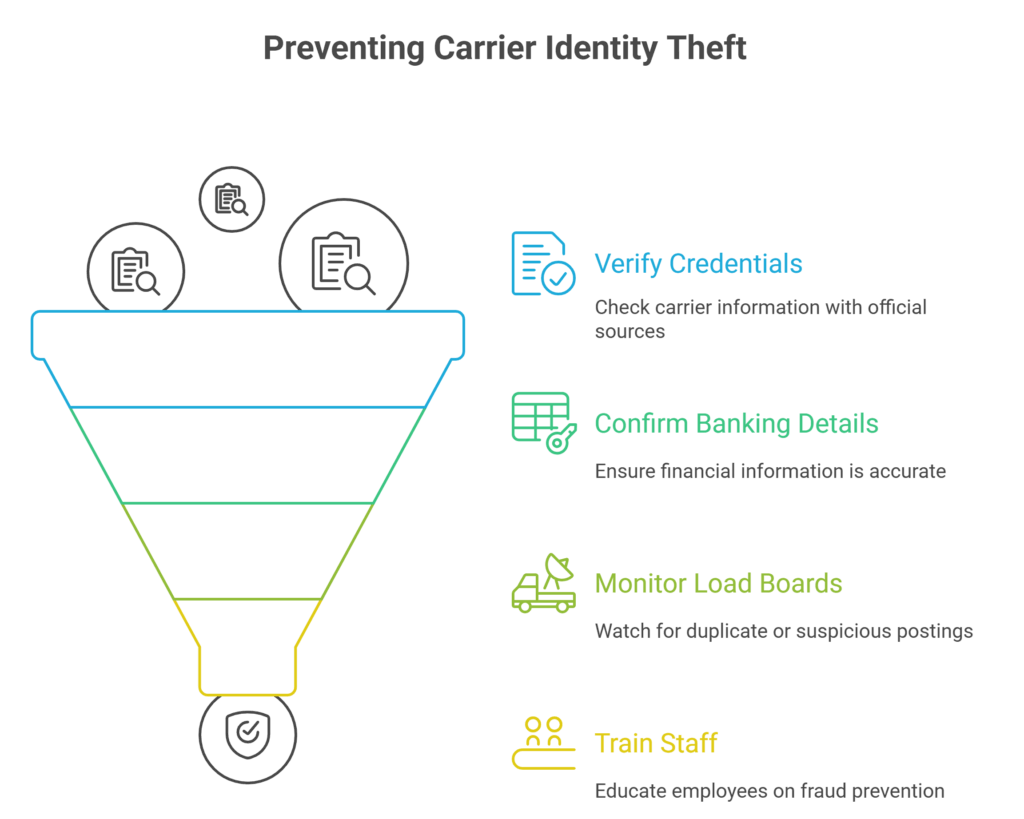

Carrier Identity Theft Freight

Carrier identity theft freight occurs when fraudsters impersonate legitimate carriers to commit scams, such as phantom shipments fraud or fuel advance scams. They often create accounts that mirror real carriers, using stolen credentials to appear legitimate(Transport Topics, n.d.).

Example: A broker booked a load which was verified by the FMCSA database. Later, a fraudulent account with the same name requested a shipment and an upfront fuel payment. The broker realized the email and bank details were different, classic carrier identity theft freight (FreightWaves, n.d.).

Red flags to watch for:

- Slight variations in carrier names, addresses, or email domains.

- Requests for upfront payments, fuel advances, or unusual rate changes.

- New accounts with valid DOT or MC numbers that don’t match known carrier details.

Prevention Tips:

- Verify credentials directly with FMCSA and other official sources (FMCSA, n.d.).

- Confirm banking details and communicate via verified phone numbers.

- Monitor load board activity to spot duplicate postings or suspicious accounts.

- Train staff on how to avoid freight fraud, especially when onboarding new carriers.

Example of successful prevention: A broker noticed a suspicious fuel advance request from a carrier that had previously been verified. By calling the carrier directly, the broker discovered it was an impersonator attempting a freight brokerage scam, saving thousands in potential losses.

“Identity theft in the freight industry is growing. Automated verification tools paired with staff vigilance are essential for spotting discrepancies before financial loss occurs.”

What strategies does your company use to detect carrier identity theft, and how do you ensure new accounts are legitimate before processing shipments?

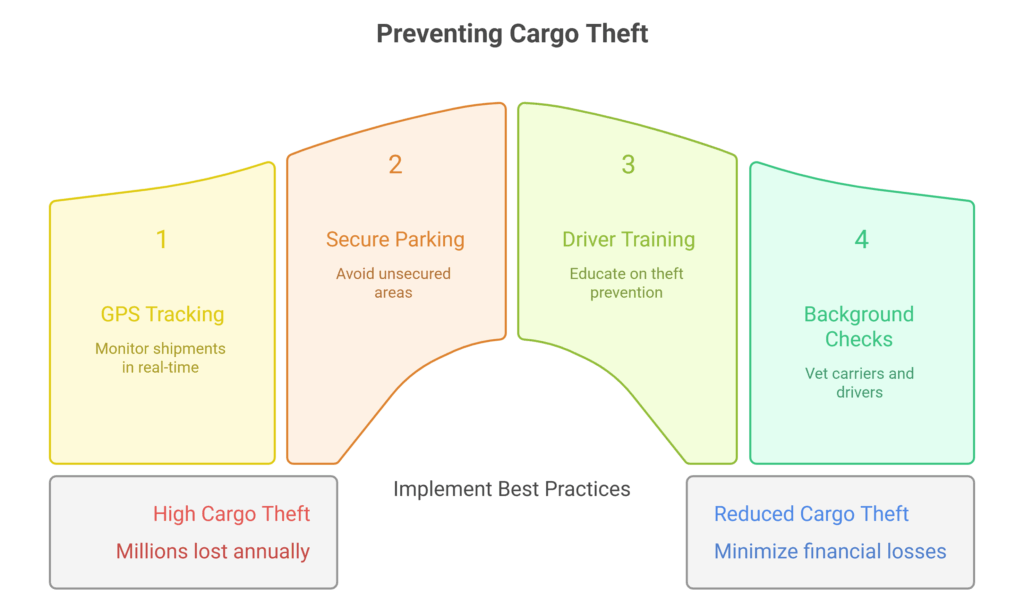

Cargo Theft Prevention

Cargo theft prevention is essential, as stolen freight can cost millions annually. Cargo theft can happen anywhere, from parking lots to warehouses, and often targets high-value goods like electronics, pharmaceuticals, or luxury items (ATRI, n.d.).

Common scenarios:

- Hijacking trucks on highways.

- Diversion to unauthorized locations.

- Theft during temporary stops at rest areas or warehouses.

Best practices:

- GPS-enabled tracking: Monitor shipments in real-time to detect diversions (ATRI, n.d.).

- Secure parking and access control: Avoid leaving high-value shipments unattended in unsecured areas.

- Driver training: Educate drivers on safe handling procedures, route planning, and theft prevention techniques.

- Background checks: Vet carriers and drivers thoroughly to reduce insider threats.

Example: A pharmaceutical shipment was scheduled for overnight delivery. By using GPS tracking, the broker noticed the truck deviating from the route. The driver was contacted immediately, preventing a potential cargo theft incident.

“Cargo theft isn’t just about locks and security cameras; it’s about proactive monitoring and route intelligence. Educating drivers on safe practices significantly lowers risk.”

How does your company incorporate technology and driver training into cargo theft prevention strategies, and what challenges have you encountered?

Fictitious Pick-Ups Fraud

Fictitious pick-ups fraud happens when fraudsters pose as brokers or shippers and create fake pick-up requests to steal freight or money. Often, these scams target new brokers or carriers unfamiliar with verification protocols (U.S. DOT, n.d.).

Red flags:

- Sudden, last-minute pick-ups with minimal details.

- Requests for wire transfers, prepaid fees, or unusual payment methods.

- Emails or documents with inconsistencies or unofficial branding.

Prevention Tips:

- Confirm pick-ups through trusted channels before dispatching carriers.

- Avoid sharing sensitive documentation until verification is complete (FMCSA, n.d.).

- Report suspicious activity immediately to law enforcement or industry authorities.

- Use freight fraud detection tools to monitor load boards and verify shipments.

Example: A broker received a pick-up request for a high-value electronics shipment. The contact email looked legitimate but differed slightly from the company’s verified email domain. The broker confirmed the request with the shipper directly and discovered the request was fake, preventing a costly fictitious pick-ups fraud (FreightWaves, n.d.).

“Fictitious pick-ups often target inexperienced brokers. Verification and standard operating procedures are the most reliable defenses against this type of fraud.”

What steps does your team take to verify new pick-up requests, and how do you train staff to spot suspicious signs?

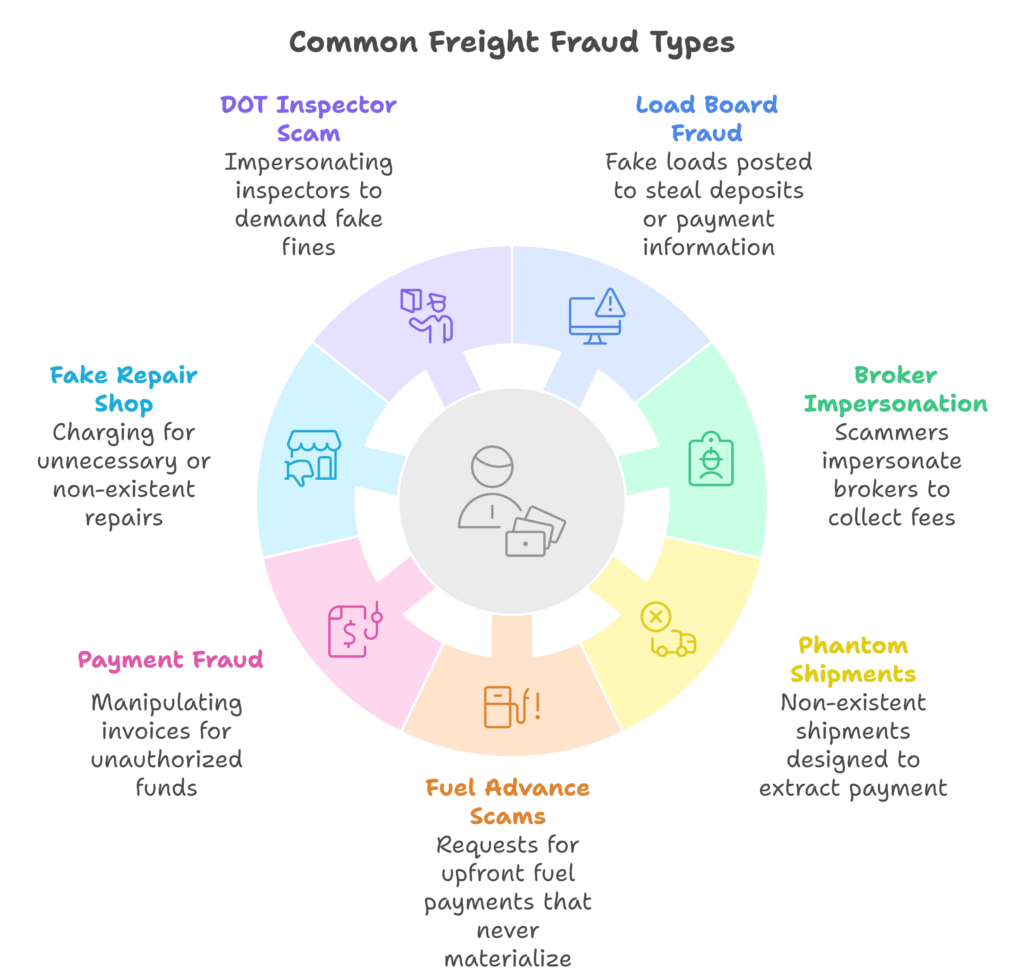

Other Common Freight Fraud Types

In addition to double brokering fraud, carrier identity theft freight, and fictitious pick-ups fraud, the freight industry faces a variety of other scams. Awareness and vigilance are key to mitigating these risks.

1. Load Board Fraud

Fraudsters post fake loads on public or private load boards to trick carriers into paying deposits or providing sensitive information.

Example: A carrier saw a high-paying shipment listed on a popular load board and was asked to wire a deposit to secure the load. After payment, the load disappeared. The posting was fake, representing a classic load board fraud scenario.

Prevention Tips:

- Only work with verified brokers and carriers.

- Avoid upfront deposits for new or unverified clients.

- Cross-check load details with official shipper contacts.

2. Broker Impersonation Scams

Scammers pretend to be legitimate brokers to collect fees or sensitive banking information.

Example: A shipper received an email that looked identical to a trusted brokerage, requesting payment for an upcoming shipment. The email came from a slightly altered domain. The shipper almost transferred the funds before noticing the discrepancy.

Prevention Tips:

- Always verify email domains and contact numbers.

- Confirm payment requests directly via known contacts.

- Educate teams about how to avoid freight fraud and recognize impersonation attempts.

3. Phantom Shipments Fraud

Non-existent shipments are created to trick brokers, carriers, or shippers into paying for freight that doesn’t exist.

Example: A broker received a request for a high-value shipment of electronics. The carrier picked up the freight, but the shipper later claimed the shipment never existed. The broker had to cover the loss.

Prevention Tips:

- Verify shipment details with the shipper before dispatch.

- Use tracking systems to confirm load pick-ups and deliveries.

- Maintain clear documentation for every shipment.

4. Fuel Advance Scams

Fraudsters request upfront payment for fuel, promising reimbursement later. Once the payment is made, the scammer disappears.

Example: A carrier was asked for a $1,500 fuel advance for a long-haul shipment. After payment, all communication from the “broker” stopped. This is a common fuel advance scam in the freight industry.

Prevention Tips:

- Avoid sending fuel advances without verification.

- Use trusted payment platforms or escrow services.

- Confirm requests with verified contacts before payment.

5. Payment Fraud in the Freight Industry

Fraud involving manipulation of invoices, altered payment instructions, or unauthorized changes to banking information.

Example: A shipper received an invoice from a familiar carrier but with new banking information. Payments were made to the wrong account before the discrepancy was discovered.

Prevention Tips:

- Verify any changes in banking details directly with the known contact.

- Implement multi-step approval processes for payments.

- Train staff to detect unusual patterns in invoices and payment requests.

6. Fake Repair Shop Scam

Scammers pose as legitimate repair shops, charging brokers or carriers for unnecessary or non-existent repairs.

Example: A carrier’s truck was “repaired” at a shop recommended by a third party. Later, they realized no work had been done, and payment had been diverted to a fraudulent account.

Prevention Tips:

- Verify repair shops independently.

- Request detailed work orders and receipts.

- Confirm shop licensing and reputation before agreeing to services.

7. DOT Inspector Scam

Fraudsters impersonate DOT inspectors, threatening fines or penalties to extract payments from carriers or brokers.

Example: A driver received a call from someone claiming to be a DOT inspector and demanding payment for violations during a “random inspection.” Payment was requested via wire transfer to avoid real traceability.

Prevention Tips:

- DOT inspectors never request payment directly.

- Verify any inspection notices via official DOT channels.

- Educate drivers and brokers on recognizing impersonation attempts.

“The diversity of freight fraud schemes means that brokers and carriers must be vigilant at every stage, from load posting to payment processing. Combining technology with human oversight is critical.”

Which types of freight fraud does your organization encounter most frequently, and what preventive measures have proven effective?

Freight Fraud Detection Strategies

Effective freight fraud detection combines human diligence and technology.

Key strategies include:

- Carrier vetting: Verify DOT, MC, and insurance credentials.

- Real-time shipment tracking: Detects diversions and unauthorized re-brokering.

- Monitor suspicious activity on load boards: Track duplicate postings, unusual payment requests, and last-minute changes.

- Staff training: Educate teams on how to avoid freight fraud and recognize scam tactics.

- Clear contract and payment policies: Limit upfront payments and require documentation before processing.

- Use freight technology platforms: Fraud-detection software can flag anomalies before financial loss occurs.

“Fraudsters are increasingly sophisticated, leveraging stolen identities and technology to exploit brokers and shippers. Combining thorough verification, real-time tracking, and staff training is the most effective defense.”

Curious how technology can prevent freight fraud in your operations? Discover the top tools and strategies to safeguard your brokerage

Frequently Asked Questions (FAQs)

1. What is the most common freight fraud type?

Double brokering fraud and carrier identity theft freight are most prevalent, often targeting brokers via load boards and impersonation scams.

2. How can I avoid freight fraud?

Verify carriers, monitor load boards, require proper documentation, and use GPS tracking to reduce risk.

3. What steps help with cargo theft prevention?

Implement secure parking, educate drivers, track shipments in real-time, and enforce strict chain-of-custody protocols.

Combat Common Fraud Risks

The freight brokerage industry faces a wide range of fraud risks, from double brokering and fictitious pick-ups to fuel advance scams and fake repair shop schemes. Understanding common freight fraud types, implementing fraud detection measures, and training staff on prevention are critical for protecting shipments, financials, and your business reputation. Vigilance, technology, and structured processes are your strongest defenses against costly scams.

Ready to safeguard your shipments and profits? Contact us to implement robust freight fraud prevention strategies.

References

Federal Motor Carrier Safety Administration (FMCSA). (n.d.). Carrier safety and registration information. Retrieved from https://www.fmcsa.dot.gov

Transport Topics. (n.d.). Cargo theft prevention and freight fraud. Retrieved from https://www.ttnews.com

FreightWaves. (n.d.). Freight brokerage scams and industry fraud trends. Retrieved from https://www.freightwaves.com

American Transportation Research Institute (ATRI). (n.d.). Security and cargo theft insights. Retrieved from https://truckingresearch.org

U.S. Department of Transportation (DOT). (n.d.). Tips for preventing payment fraud and double brokering. Retrieved from https://www.transportation.gov