Freight broker insurance is one of the most important pillars of a successful and legally compliant brokerage. Whether you’re working with small shippers or large national accounts, the right insurance policies protect your business from lawsuits, financial losses, and operational disruptions (Transport Risk Management, n.d.). Understanding the essential freight broker insurance coverage options, and how each type supports your risk strategy is crucial for long-term growth.

Below is a complete breakdown of the freight broker insurance types every brokerage must know, including costs, liabilities, and real-world use cases.

Why Freight Broker Insurance Matters

Freight brokers sit at the center of one of the most unpredictable and high-pressure ecosystems: the global supply chain. Although you never physically touch the freight, you are still legally and financially tied to every load you arrange. Every shipment involves multiple parties, shippers, carriers, consignees, warehouses, and sometimes third-party subcontractors, and any mistake among those parties can fall back on the broker (FMCSA, n.d.).

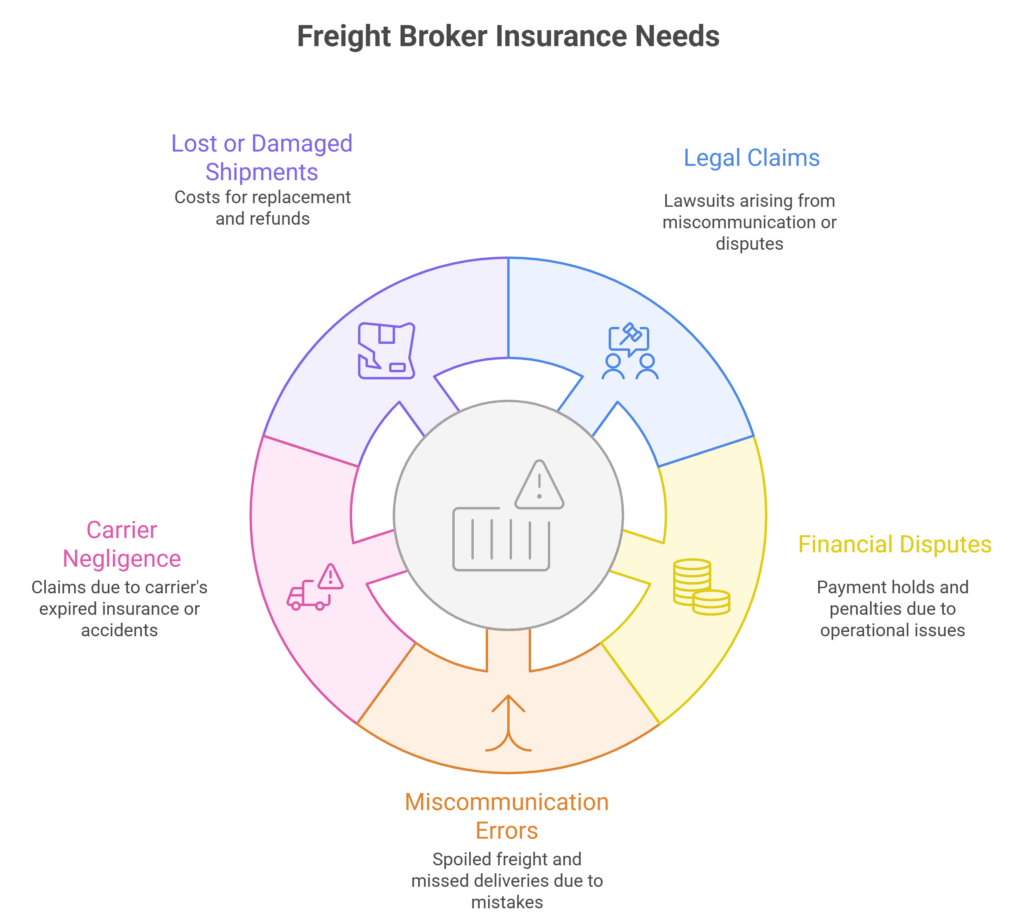

This is why freight broker insurance is essential. It shields your business from expensive risks that can occur even when you’ve done everything right. Even with strong procedures and vetted carriers, brokers remain exposed to:

1. Legal Claims

Freight-related lawsuits can arise from:

- Miscommunication about pickup/delivery times

- Disputes over routing instructions

- Damages that occur during transit

- Contract disagreements

- Claims that the broker “misrepresented” a carrier’s capabilities

In many cases, even if the broker is not at fault, they may still need legal defense, which can cost thousands without the right broker liability insurance or freight broker general liability insurance.

2. Financial Disputes

Operational breakdowns create financial disputes between shippers, carriers, and brokers. Common triggers include:

- Freight delays

- Rate misunderstandings

- Extra accessorial charges

- Damaged or lost cargo

- Double brokering situations

Without proper business liability insurance for freight brokers, these disputes can quickly escalate into payment holds, contract penalties, or litigation.

3. Miscommunication Errors

Even a small administrative mistake, a wrong address, incorrect temperature requirement, or missing special instruction can cause:

- Spoiled freight

- Rejected loads

- Missed delivery windows

- Production shutdowns for the shipper

This is exactly why freight broker errors and omissions insurance (E&O) is now considered essential. It protects brokers when the loss is tied to your oversight rather than a carrier failure.

4. Carrier Negligence

Brokers rely heavily on carriers, and even the most carefully vetted driver can:

- Have expired insurance

- Carry fraudulent or invalid documentation

- Fail to secure cargo correctly

- Be involved in an accident

- Commit theft or misrepresentation

If a carrier’s motor truck cargo policy denies a claim, which happens often, the shipper will turn to the broker for compensation. This is where contingent cargo insurance for freight brokers becomes a critical layer of protection.

5. Shipments That Are Lost, Damaged, or Delayed

Brokers routinely get blamed when something goes wrong in transit, even if the carrier is responsible. Without strong freight broker insurance types, especially E&O and contingent cargo coverage, the broker may be forced to cover:

- Replacement costs

- Repair costs

- Customer refunds

- Expedited re-shipments

- Business interruption costs claimed by the shipper

These losses can cripple a brokerage that isn’t properly insured.

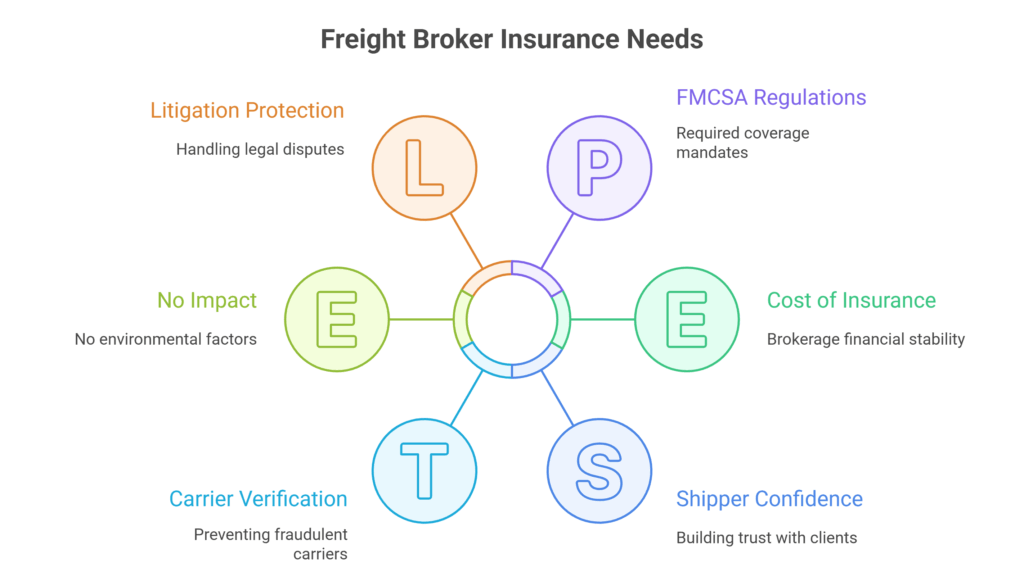

Why Freight Broker Insurance Must Go Beyond Basic Requirements

Obtaining your FMCSA authority is only step one. The required insurance for freight brokers is minimal, but the actual risk exposure in real operations is massive.

A strong freight broker insurance portfolio protects your brokerage from:

1. Litigation

Legal defense alone can cost $10,000–$50,000 per case.

Policies like E&O and general liability prevent legal costs from wiping out your profit margin.

2. Contract Violations

Large shippers require specific insurance limits to:

- Reduce their own risk

- Ensure brokers can absorb losses

- Prevent disputes

Without proper coverage, you lose opportunities and face penalties.

3. Financial Responsibility for Cargo Mishaps

Most disputes involve damaged or lost freight. Even when the carrier is at fault, brokers get pulled into the claim.

Contingent cargo helps absorb this risk.

4. Client Claims & Reputation Damage

When a claim isn’t handled well, brokers lose credibility. Insurance gives brokers a structured, defensible process for responding to issues professionally and quickly (Logistics Management, n.d.).

5. Operational Shutdowns

Severe claims without proper insurance can:

- Freeze cash flow

- Trigger FMCSA compliance reviews

- Cause shipper contract cancellations

- Force small brokers out of business

Insurance is not just protection, it’s business continuity.

“Most brokers underestimate their exposure because they don’t physically handle freight. In reality, over 60% of freight-related disputes begin with administrative or communication issues, areas where brokers carry the most responsibility

Are you confident your brokerage has the right protections in place? Strengthen your compliance, reduce risk, and safeguard every load by exploring our guide on Freight Broker Compliance & Risk Management.

The Essential Freight Broker Insurance Coverage You Need

Below are the core policies every freight brokerage should evaluate.

1. Freight Broker General Liability Insurance

Freight broker general liability insurance covers bodily injury, property damage, and personal injury claims that occur in non-cargo situations (Logistics Management, n.d.).

It protects you from risks like:

- Client slipping in your office

- Damage caused by your employees

- Lawsuits tied to advertising or reputational claims

This is a foundational business liability insurance for freight brokers and often required to sign contracts with enterprise shippers.

“General liability isn’t just office coverage, it’s the baseline protection large shippers look for before agreeing to work with a brokerage. It signals professionalism and operational maturity.”

Do you think general liability should remain optional for brokers, or should the FMCSA make it a required coverage?

2. Broker Liability Insurance

Broker liability insurance helps protect your brokerage from claims related to your advisory role, service errors, or professional oversight issues (Transport Risk Management, n.d.).

Examples include:

- Incorrect documentation

- Miscommunication between carrier and shipper

- Faulty routing instructions

This core coverage reduces exposure when disputes escalate.

“Broker liability insurance closes the gap between a broker’s contractual duties and real-world shipment outcomes. Without it, simple misunderstandings can quickly escalate into expensive legal battles.”

Have you ever experienced a situation where miscommunication between broker, carrier, and shipper created unnecessary conflict?

3. Freight Broker Errors and Omissions Insurance (E&O)

This is one of the best insurance policies for freight brokers looking to reduce operational risk.

Freight broker E&O coverage, also called freight broker errors and omissions insurance, protects you from financial losses caused by mistakes such as:

- Wrong pickup instructions

- Misquoted delivery times

- Incorrect freight classification

- Failure to verify carrier credentials (DAT Freight & Analytics, n.d.)

The cost of freight broker E&O insurance typically depends on:

- Your brokerage size

- Annual revenue

- Claims history

- Services offered

- Coverage limits

Most small–mid sized brokers pay $1,200–$4,500 annually.

“E&O claims are rising faster than cargo claims. The biggest losses today often come from paperwork mistakes, not damaged freight. That’s why E&O is now considered essential for every brokerage.”

Which type of administrative error do you think causes more financial damage: documentation mistakes or failure to verify carrier insurance?

4. Contingent Cargo Insurance for Freight Brokers

One of the most misunderstood policies is contingent cargo insurance for freight brokers, but it is essential for building shipper confidence. Contingent cargo coverage acts as a secondary layer of protection (Logistics Management, n.d.). If a carrier’s cargo insurance fails, denies a claim, or is insufficient, your contingent cargo policy may step in to cover the loss.

Freight Broker Contingent Cargo vs Motor Truck Cargo

- Motor Truck Cargo = primary insurance purchased by the carrier

- Freight Broker Contingent Cargo = secondary coverage to protect brokers and shippers when the primary coverage does not respond

This is critical in a market where fraudulent carriers and insurance lapses are increasing.

“Most brokers assume the carrier’s motor truck cargo policy will pay the claim, but nearly half of denied claims are due to exclusions the broker didn’t know existed. Contingent cargo closes this dangerous gap.”

Should brokers be required to carry contingent cargo coverage before they are allowed to operate under FMCSA authority?

5. Freight Broker Insurance for Litigation Protection

Lawsuits in logistics are common, delays, lost freight, and miscommunications often escalate quickly (FreightWaves, n.d.).

Freight broker insurance for litigation protection ensures:

- Access to legal defense

- Coverage for settlements

- Reduced financial exposure

- Compliance with shipper requirements

This allows you to operate confidently, knowing your business is protected from sudden legal threats.

“In freight, lawsuits move quickly. Legal fees alone can exceed the value of the entire shipment.”

Which legal threat is most dangerous to brokers: cargo claims, misrepresentation, or contract disputes?

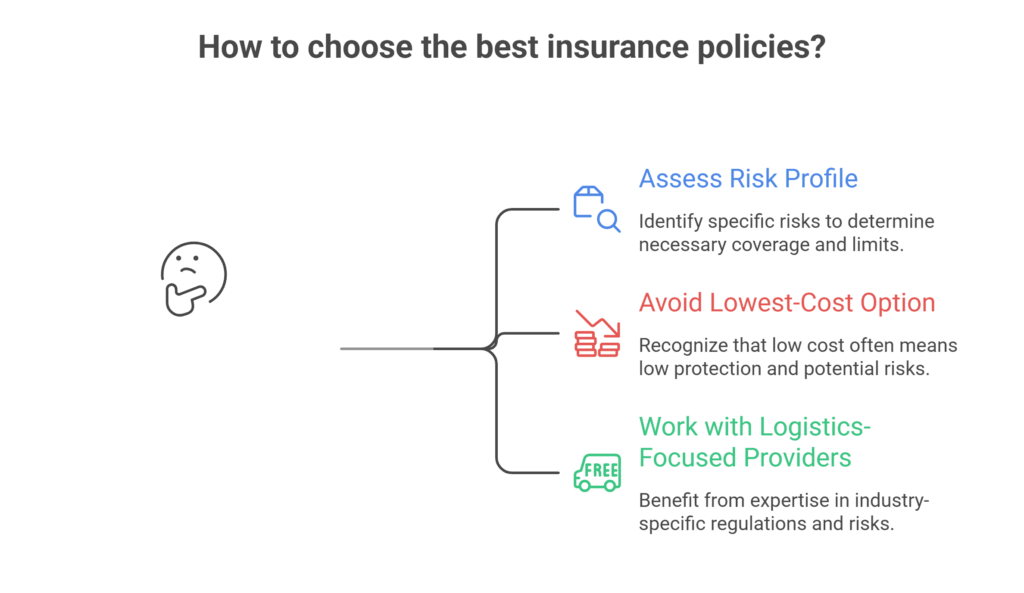

How to Choose the Best Insurance Policies for Freight Brokers

Selecting the right freight broker insurance is not just a compliance step, it’s a strategic, long-term decision that directly impacts your ability to win shippers, absorb risk, and maintain operational stability. Because the freight industry carries unique exposure points (miscommunication errors, carrier negligence, fraudulent carriers, and shipment disputes), brokers must take a structured approach to evaluating insurance.

Below is a more comprehensive decision framework:

1. Assess Your Risk Profile

Every brokerage has a different operational footprint, so the first step is identifying where your risks originate. This assessment helps determine the essential freight broker insurance coverage you need, and how much of it.

Key risk factors to evaluate:

a. Cargo Type & Value

High-value or specialized freight increases exposure.

Examples: Electronics, pharmaceuticals, machinery, Food & perishables

Higher-value freight typically requires stronger broker liability insurance, robust freight broker E&O coverage, and higher-limit contingent cargo insurance.

b. Carrier Pool Size & Quality

The more carriers you use, the greater the chance of:

- Coverage gaps

- Fraudulent insurance certificates

- Safety violations

- Denied cargo claims

If you rely on a large pool of small carriers or owner-operators, increase your E&O limits and strengthen your contingent cargo policy (Transport Risk Management, n.d.).

c. Shipment Volume

More freight = more touchpoints for mistakes.

Higher volume increases exposure to:

- Miscommunication

- Routing errors

- Missed appointments

- Documentation issues

This directly impacts the need for freight broker errors and omissions insurance.

d. Shipper Requirements

Many mid-sized and enterprise shippers require brokers to carry:

- Set minimum liability limits

- Freight broker general liability insurance

- E&O coverage

- Contingent cargo coverage

Understanding their requirements helps you avoid losing contracts.

2. Avoid the Lowest-Cost Option

Many new brokers shop for the cheapest premium, but in insurance, low cost usually means low protection (Transport Risk Management, n.d.).

Risks of choosing the cheapest freight broker insurance policies:

-

Coverage exclusions

(e.g., no coverage for reefer loads, high-value goods, or intermodal freight) -

Slow claims response times

Delays worsen shipper relationships and increase your liability. -

Hidden loopholes

Some policies deny claims based on technical wording. -

Low coverage limits

Not enough to satisfy shippers or cover real losses. -

Minimal litigation protection

Leaving brokers exposed to attorney fees and settlement costs.

Insurance should be viewed as an investment in your operational stability, not a monthly bill.

3. Work With Logistics-Focused Insurance Providers

General commercial insurers often do not understand the complexity of freight brokerage risk. Logistics-focused insurers and brokers, however, understand:

- FMCSA regulations

- Carrier vetting requirements

- Contingent cargo triggers

- Double brokering fraud trends

- Shipper contract language

- Freight claims processes

They can help you:

- Select the best insurance policies for freight brokers

- Avoid loopholes that deny claims

- Use accurate coverage limits based on your freight profile

- Stay compliant with industry standards

Specialized insurance partners can also assist during claims, ensuring faster payout and better defense when litigation arises (DAT Freight & Analytics, n.d.).

“The right insurance doesn’t just reduce risk, it becomes a competitive advantage. Shippers prefer working with brokers who can provide documentation, higher limits, and strong compliance standards.”

Need help choosing the right coverage mix for your brokerage? See how our tailored Freight Broker Solutions can support your operations, boost your protection, and help you scale with confidence.

Frequently Asked Questions (FAQs)

1. What required insurance for freight brokers should every brokerage carry?

At minimum:

- General liability

- Errors and omissions (E&O)

- Contingent cargo

- Broker liability insurance

These provide protection from operational, legal, and cargo-related risks.

2. Is contingent cargo insurance for freight brokers the same as cargo insurance?

No. Contingent cargo is secondary coverage and only activates if the carrier’s primary cargo insurance fails or denies the claim.

3. How much does freight broker E&O insurance cost?

Most small to mid-sized brokerages pay $1,200–$4,500 per year, depending on revenue, shipment volume, and claims history.

Build the Right Insurance Foundation for Your Brokerage

Freight broker insurance is more than a compliance requirement, it’s a strategic investment in risk management, credibility, and operational stability. With the right combination of freight broker insurance types, including E&O, general liability, broker liability insurance, and contingent cargo, your brokerage is better protected from lawsuits, financial disasters, and unexpected disputes.

Building a reliable insurance portfolio ensures you’re not only compliant, but positioned for long-term trust and success in a competitive logistics market.

Ready to safeguard your brokerage with the right coverage? Contact us to strengthen your protection, reduce risk, and operate with confidence.

References

Federal Motor Carrier Safety Administration. (n.d.). Broker requirements and compliance guidelines. Retrieved from https://www.fmcsa.dot.gov

Transport Risk Management. (n.d.). Freight broker liability and insurance best practices. Retrieved from https://www.transportsecurity.com

Logistics Management. (n.d.). Understanding contingent cargo and broker risk exposure. Retrieved from https://www.logisticsmgmt.com

DAT Freight & Analytics. (n.d.). Freight broker compliance and carrier vetting standards. Retrieved from https://www.dat.com

FreightWaves. (n.d.). Insurance trends and risk challenges in freight brokerage. Retrieved from https://www.freightwaves.com