Double brokering is one of the fastest-growing threats in transportation, costing brokers, carriers, and shippers millions every year. Understanding what double brokering is, why it happens, and how to prevent double brokering is essential for protecting your freight, your reputation, and your bottom line.

Below is a comprehensive guide to help you recognize signs of double brokering, avoid double brokering scams, improve double brokering fraud detection, and maintain control over every load you move.

What Is Double Brokering?

Double brokering occurs when a carrier or broker accepts a load and then re-brokers, transfers, or dispatches it to another carrier without your knowledge or consent (Carrier411, n.d.).

To clarify what is double brokering in simple terms:

You tender a load → A carrier accepts it → That carrier secretly gives it to a different carrier → You lose visibility, control, and protection.

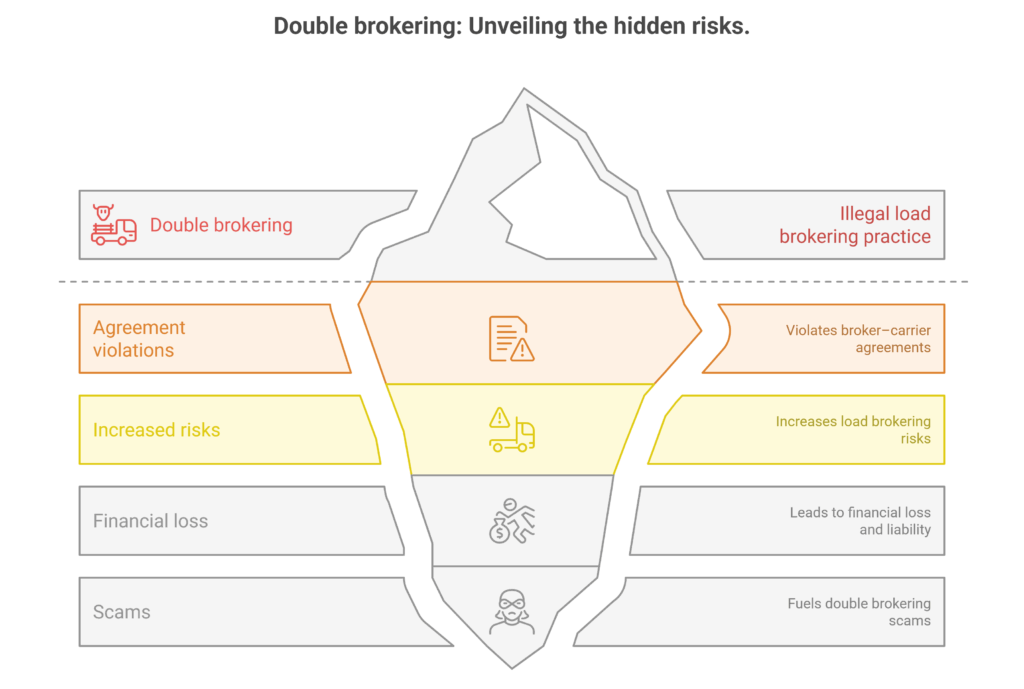

Double brokering:

- It violates broker–carrier agreements (FMCSA, n.d.)

- It increases load brokering risks

- It leads to financial loss and liability

- It fuels double brokering scams across the industry

“Double brokering isn’t just a compliance issue, it’s a visibility issue. When you lose visibility, you lose control, and that’s where financial and legal risks escalate quickly.”

What was the first time you learned what double brokering was? Did you find out after an incident, or did someone teach you early on?

Why Double Brokering Is So Dangerous

Understanding the consequences of double brokering helps explain why fraudsters increasingly exploit this loophole.

Major risks include:

1. Zero visibility

When a load is double brokered, you lose control over who actually picked up your freight, making tracking impossible.

Examples:

- You tender a load to Carrier A. Suddenly, the driver information changed three times, because Carrier A secretly passed it to Carrier B and then Carrier C.

- The driver stops answering calls and texts because they don’t work for the carrier you hired.

- GPS tracking fails because the real truck is not connected to your tracking system.

This visibility loss can lead to missed appointments, detention fees, and unhappy shippers (FreightWaves, n.d.).

2. Insurance gaps

Most cargo insurance policies do not cover loads moved by unauthorized subcontractors.

Examples:

- Carrier A has a valid insurance certificate, but the real driver works for Carrier B, and Carrier B’s insurance excludes the commodity.

- A refrigerated load spoils because the real carrier had faulty equipment, and neither insurance company accepts the claim.

- Your shipper files a cargo claim, but insurance denies it because the carrier listed on the rate confirmation wasn’t the one moving the freight.

This is one of the most financially devastating consequences of double brokering.

3. Payment disputes

Multiple parties end up demanding payment for the same load (Carrier411, n.d.).

Examples:

- Carrier A accepted the load but re-brokered it to Carrier B. Carrier B delivers the freight and requests payment, but Carrier A disappears.

- Carrier A sends an invoice for the full amount even though they didn’t touch the load.

- Carrier B files on your bond for non-payment because they performed the work, even though you already paid Carrier A.

This makes you vulnerable to legal claims, bond hits, and cash flow issues.

4. Cargo theft

Many double brokering scams are intentionally designed to steal freight quickly and cleanly (FreightWaves, n.d.).

Examples:

- A high-value electronics load is picked up by a driver with fake credentials provided by a sham carrier, the freight is never seen again.

- A double brokered load is redirected to an unauthorized warehouse and unloaded before anyone realizes the driver wasn’t legit.

- A scammer uses a stolen MC number to accept the load, then hands it off to another carrier, collects payment, and disappears.

Double brokering is now one of the top methods used in organized cargo theft.

5. Legal exposure

Because double brokering violates your rate confirmations and carrier agreements, you are pulled into disputes, even if you acted in good faith.

Examples:

- The shipper holds you responsible for lost freight because you tendered the load to the wrong carrier (even if you didn’t know).

- A carrier sues you for non-payment because they moved the load, even though you never hired them.

- Law enforcement gets involved in cargo theft cases and requests documentation, contracts, and communication logs.

Legal exposure adds stress, labor hours, lost shippers, and thousands in attorney fees (FMCSA, n.d.).

“Most brokers underestimate the downstream fallout. A single double-brokered load can trigger chargebacks, lawsuits, and permanent damage to shipper relationships.”

Which risk concerns you the most, visibility loss, insurance issues, or cargo theft? Why?

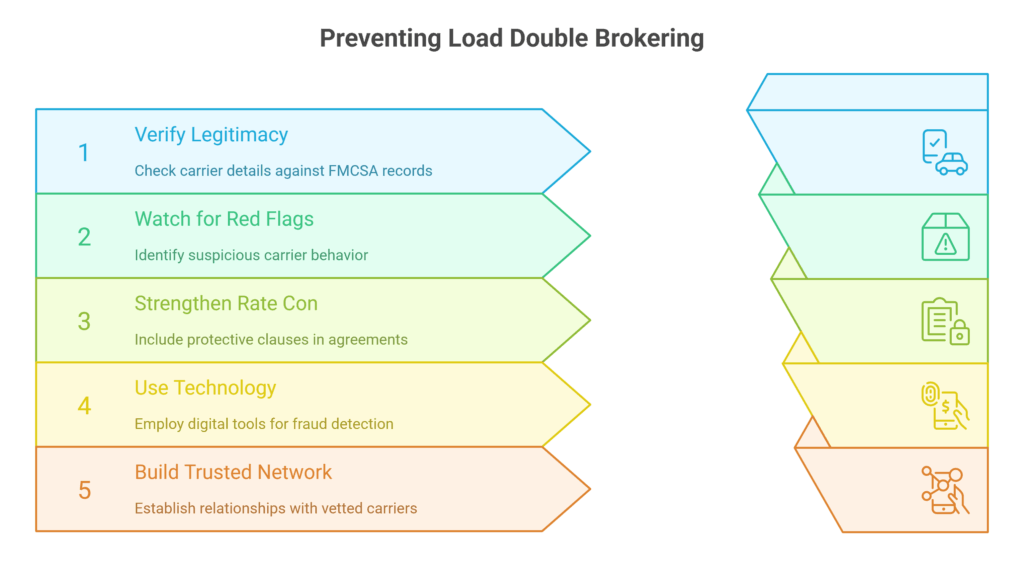

How to Prevent Double Brokering

Preventing load double brokering starts with strong carrier onboarding and continuous verification (FMCSA, n.d.).

Verify Broker Legitimacy & Carrier Identity

Before tendering any load:

- Check MC, DOT, safety ratings, and operating authority

- Compare booking details (phone number, email domain, address) to FMCSA records(Carrier411, n.d.)

- Look for mismatched emails like free Gmail accounts instead of company domains

- Confirm the dispatcher and driver work for the carrier you booked

This one step alone dramatically improves double brokering fraud detection.

Watch for Early Warning Signs

You must actively look for signs of double brokering. Red flags include:

- Carrier refuses to use their own truck or wants to “send a partner”

- Constantly changing driver and truck information (Carrier411, n.d.)

- Carrier pressures you to release the rate con quickly

- MC number too new with no safety score

- Mismatch between phone number area code and company headquarters

Spotting these signs of double brokering early is key to avoiding fraud.

Strengthen Your Rate Con Confirmation

Include clauses that protect you:

- No re-brokering or subcontracting without written consent (TIA, n.d.)

- Require driver name, truck number, trailer number before pickup

- Require photo ID and insurance verification

- Document communication through email, not only phone

This helps you avoid double brokering even if scammers attempt to hide their behavior.

Use Technology for Fraud Detection

Digital tools help prevent load double brokering by validating identities and monitoring risk signals (DAT, n.d.).

Platforms can:

- Detect mismatched carrier data

- Alert you of stolen or fake MC numbers

- Track driver assignments and equipment

- Flag FMCSA inactive or revoked authorities (TIA, n.d.)

Tech isn’t perfect, but it enhances your double brokering fraud detection capacity.

Build a Trusted Carrier Network

The safest loads are the ones moved by vetted, known carriers.

- Create a private, repeat-carrier pool

- Score carriers based on performance

- Reduce spot-market dependency

- Prevent desperation bookings

- Encourage loyalty and consistency

A smaller, safer network reduces load brokering risks significantly.

“Fraud usually starts with identity manipulation. If the contact information doesn’t match FMCSA records, assume risk is present.”

Worried about your loads being double brokered? Discover how to strengthen your broker compliance and manage freight risk effectively

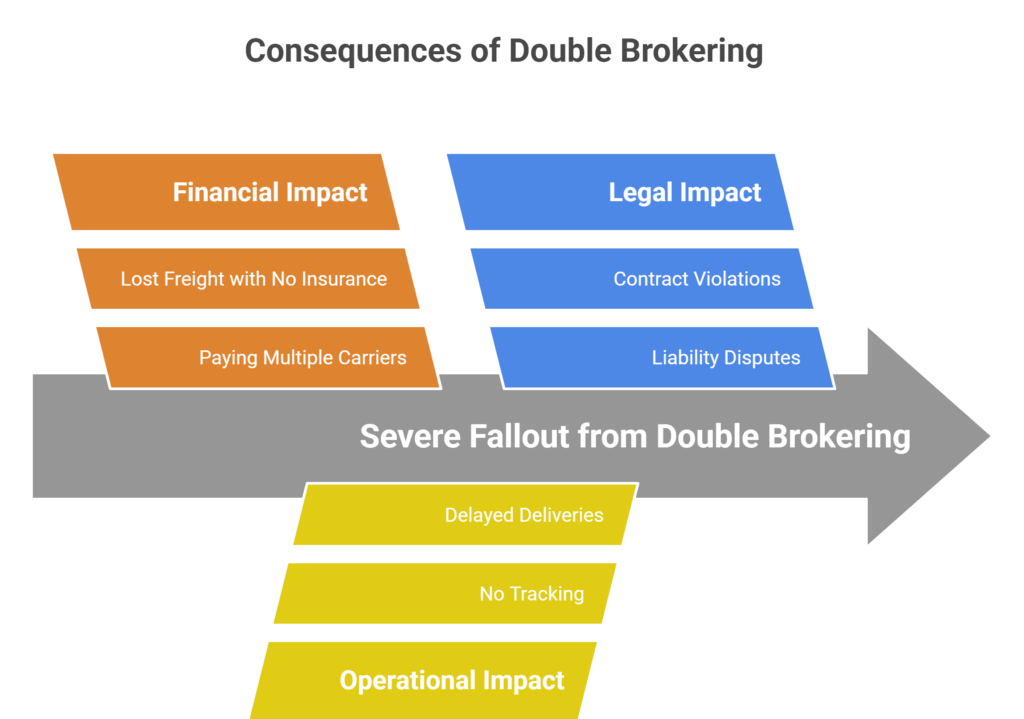

Consequences of Double Brokering You Must Take Seriously

If your load is re-brokered without permission, the fallout can be severe.

Financial Impact

- Paying multiple carriers

- Lost freight with no insurance coverage

- Chargebacks from shippers

Operational Impact

- No tracking

- Delayed deliveries

- Customer dissatisfaction

Legal Impact

- Contract violations

- Liability disputes

- Investigation risk

These consequences of double brokering highlight why prevention matters more than recovery.

“Even if you recover the load, the operational and reputational loss can outlast the financial loss.”

Which consequence would harm your business the most long term?

How to Report a Double Brokering Scam

If you suspect that your load has been re-brokered without permission, you must take action immediately. Double brokering scams move quickly. The longer you wait, the lower the chance of recovering freight, preventing financial loss, or stopping repeat offenders.

Here’s how you can report a double brokering scam and protect your brokerage.

1. Collect All Evidence Before Reporting

Before filing any complaint, gather documentation to support your case.

What to collect:

-

Rate confirmation

Example: Your agreement shows you hired “ABC Logistics LLC,” but the proof of delivery shows “Red Star Trucking LLC.” -

Driver ID, truck number, and plate

Example: Driver picked up with truck #7890, but dispatch initially sent you truck #2345, a common sign the load was doubled out. -

Recorded calls or emails

Example: Carrier denies re-brokering, but your email shows they sent a new driver at the last minute. -

BOL and POD copies

Example: BOL lists a different carrier name than the one on your rate con. -

MC and DOT mismatches

Example: The MC number on the carrier’s email signature belongs to a revoked authority

Document everything. It strengthens your claim and speeds up the investigation.

2. Immediately Notify the Shipper and Your Internal Team

Transparency protects your relationships and reputational trust.

Why this matters:

- Shippers may reroute loads still in transit to prevent freight loss.

- Your dispatcher may identify new clues, such as suspicious phone numbers or hidden contacts (DAT, n.d.).

- Your legal or compliance team may begin preparing protective documentation.

3. Contact the Carrier You Initially Tendered the Load To

Sometimes double brokering is intentional; other times, it’s internal miscommunication.

Check for:

- Inconsistent stories

- Claims that a “partner carrier” helped

- Fake documents or forged insurance

- Sudden phone number disconnects

This confirms the scam and strengthens your case before reporting.

Where to report double brokering scam cases:

- FMCSA National Consumer Complaint Database

- DAT Fraud Reporting Tool (DAT, n.d.)

- Carrier411

- Local law enforcement (in cases of theft)

- Your insurance provider

Reporting protects your business and strengthens the industry against double brokering scams.

“Reporting fraud isn’t optional, it’s part of protecting the entire industry. The more cases reported, the better databases become at identifying repeat offenders.”

Not sure how to handle a double brokering incident? Watch this guide to reporting double brokering scams and protect your freight

Frequently Asked Questions (FAQs)

1. What is double brokering in freight?

Double brokering happens when a carrier or broker accepts a load and gives it to another carrier without permission, creating serious financial, legal, and visibility risks.

2. What are common signs of double brokering?

Red flags include suddenly changing driver information, mismatched carrier contact details, pressure to rush paperwork, and newly activated MC numbers.

3. How can I prevent double brokering?

Verify carrier identity, implement strong rate confirmation policies, monitor red flags, use technology for fraud detection, and build relationships with trusted carriers.

Take Control of Your Freight Security

Double brokering is a growing threat in the freight industry, making it critical for brokers and shippers to understand what double brokering is, recognize early warning signs, and implement strong prevention strategies. By verifying carrier identity, watching for red flags, strengthening rate confirmations, using fraud-detection technology, and building a trusted carrier network, you can significantly reduce the risk of unauthorized re-brokering.

Ready to protect your freight and revenue? Contact us to implement proven strategies against double brokering and secure your operations.

References

Carrier411. (n.d.). Carrier monitoring and fraud prevention tools. Retrieved from https://www.carrier411.com

DAT. (n.d.). Carrier onboarding, identity verification, and fraud insights. Retrieved from https://www.dat.com

FMCSA. (n.d.). Safety and compliance regulations for carriers and brokers. Retrieved from https://www.fmcsa.dot.gov

FreightWaves. (n.d.). Cargo theft trends and trucking fraud reports. Retrieved from https://www.freightwaves.com

TIA. (n.d.). Broker best practices and fraud prevention resources. Retrieved from https://www.tianet.org