Strong revenue alone isn’t enough to scale a freight brokerage, profitability depends on smart freight broker financial management. With tight margins, inconsistent shipper payment terms, and rising operating costs, brokers must adopt efficient cash flow management for freight brokers to stay competitive, accelerate growth, and safeguard liquidity.

This guide covers proven freight broker cash flow solutions, commission split models, factoring options, and freight broker accounting best practices to keep your brokerage financially healthy.

Why Financial Planning Matters in Freight Brokerage

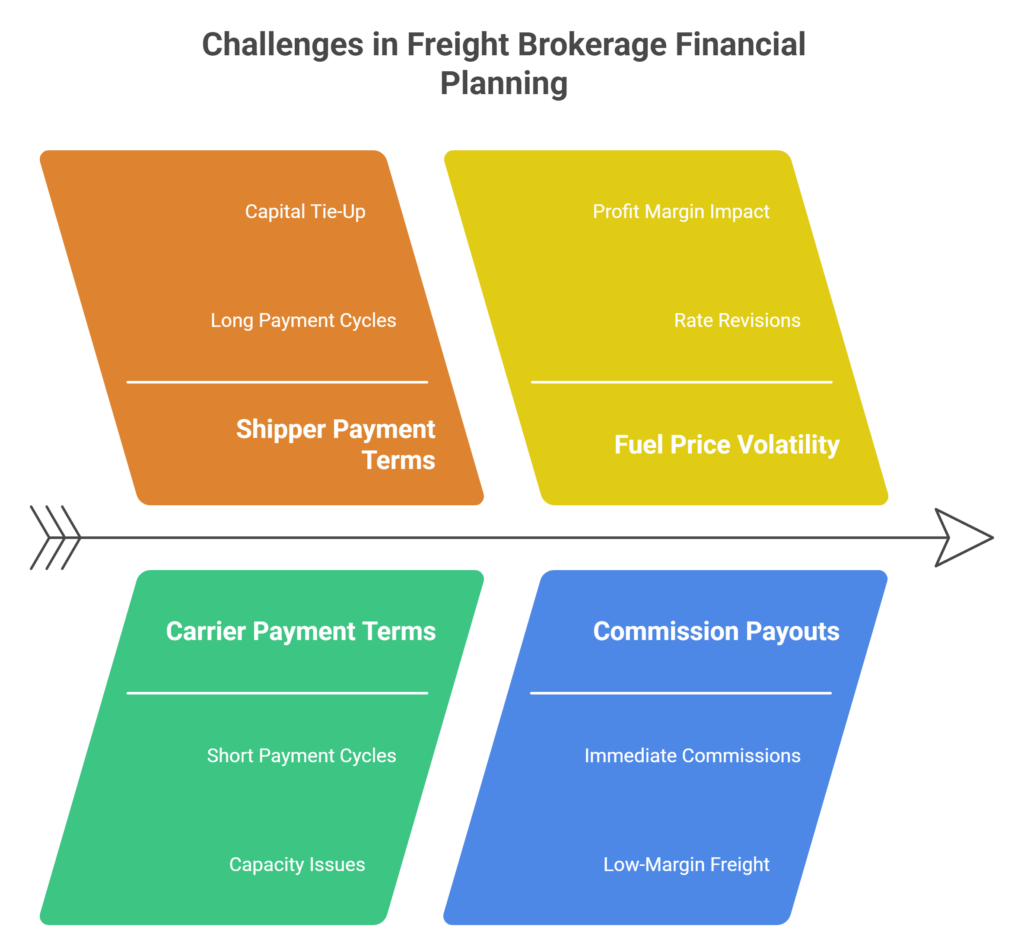

The cash flow dynamics of a freight brokerage are inherently imbalanced, making freight brokerage financial planning critical for survival and growth(FreightWaves, 2025). Here’s a deeper look at the core challenges:

1. Long Shipper Payment Terms Create Cash Gaps

Most shippers pay 30–90 days after delivery, meaning:

- Brokers complete the service weeks before they receive revenue

- Operating expenses pile up while waiting for payments

- Growth slows because capital is tied up in A/R

If not managed proactively, slow receivables delay business scaling and weaken a brokerage’s ability to secure more freight (Denim, 2024).

2. Carrier Invoices Are Due Fast, Often Within 7–14 Days

Carriers expect prompt payments because their cost of operation is immediate:

- Fuel, maintenance, payroll, and insurance run weekly

- Paying late damages carrier relationships and reliability

- Carriers may demand higher rates from slow-paying brokers

Timely payment secures capacity in tight markets and strengthens loyalty, a competitive advantage (Denim, 2024).

3. Fuel Price Volatility Directly Affects Brokerage Payouts

Fuel surcharges change weekly and influence:

- Carrier demands for revised rates

- Operating cost assumptions used when quoting shippers

- Profit margins when volatility isn’t priced correctly

Financial systems must track cost changes in real-time to prevent accidental underpricing.

4. Commission Payouts Must Align With Revenue Cycles

Sales agents typically receive immediate commissions, but:

- The brokerage may not get paid for months

- Payroll and bonuses must be funded consistently

- Agents may push low-margin freight to earn fast commissions.

Commission models need structure so payouts are aligned with collections, not only revenue booked (Denim, 2024).

Why This All Matters

Without proactive freight broker financial management:

- Brokers appear profitable on paper but run out of cash

- Payment delays create operational instability

- Growth becomes risky instead of strategic

With the right cash flow management for freight brokers, companies can:

- Pay carriers faster → secure better rates and service

- Reinforce trust with shippers → increase load volume

- Invest in tech and staff → improve efficiency and scalability

“Financial planning ensures that operational growth is backed by sufficient liquidity and capital structure. Without disciplined cash forecasting, revenue expansion can actually accelerate failure instead of profitability.”

How well does your brokerage’s current financial planning model anticipate seasonal fluctuations, fuel volatility, and extended shipper payment terms?

Optimizing Commission Structures for Profitability

A freight brokerage’s commission splits are more than just compensation, they are a strategic financial tool. The wrong structure creates weak margins, inflated payroll expenses, and high turnover. The right one drives sales growth and sustainable profitability.

Below is a full breakdown for freight broker commission structures using real brokerage operations logic:

A) Traditional Split Plans

A common structure for freight agents who manage both sales + operations:

| Split Type | Common Percent | Best For | Challenges |

| 50/50 | Entry-level agents | Quick hiring, simple | Low incentive for top performers |

| 60/40 (agent higher) | Experienced, independent agents | Strong motivation | Broker must ensure margin discipline |

| 70/30+ (agent highest) | High volume remote agents | Broker overhead is low | Thin margins if pricing is weak |

Why it works:

- Motivates agents to build accounts and negotiate profitably

- Clear revenue sharing

Why it fails without oversight:

- Agents may chase volume over margin → profitability declines

B) Tiered Performance Commission Plans

Motivation increases as margins improve.

Example progression:

- 50% for first $10K gross profit/month

- 60% for $10K–$30K GP

- 70%+ above $30K GP

Performance-based pricing can drive sustained performance across a freight brokerage, but it also requires strong freight broker accounting best practices to ensure accurate margin tracking and operational profitability (C.H. Robinson, 2025).

C) Salary + Commission Hybrid

Ideal when brokers need control over service quality and predictable payroll.

Good fit for:

- In-house employees handling customer service + operations

- New brokerages training beginners

- Teams supporting large enterprise shippers

Link bonuses to gross margin, not load count → This supports freight broker profitability strategies.

D) Gross Margin Commission Structures

Agents earn commission based only on the profit, not revenue.

Example:

- $2,500 shipper rate

- $2,200 carrier cost

- $300 margin

- Commission = 50% of margin = $150 payout

This structure is transparent, scalable and protects brokerage cash flow. This model is industry-preferred because it aligns incentives perfectly (C.H. Robinson, 2025).

“Commission plans must align with margin protection and financial sustainability. Compensation structures that reward only volume inevitably erode profitability and increase working-capital stress.”

Do your commission rules reinforce pricing discipline and profitable account selection, or do they encourage revenue growth at the expense of margin?

How Freight Factoring Improves Operational Stability

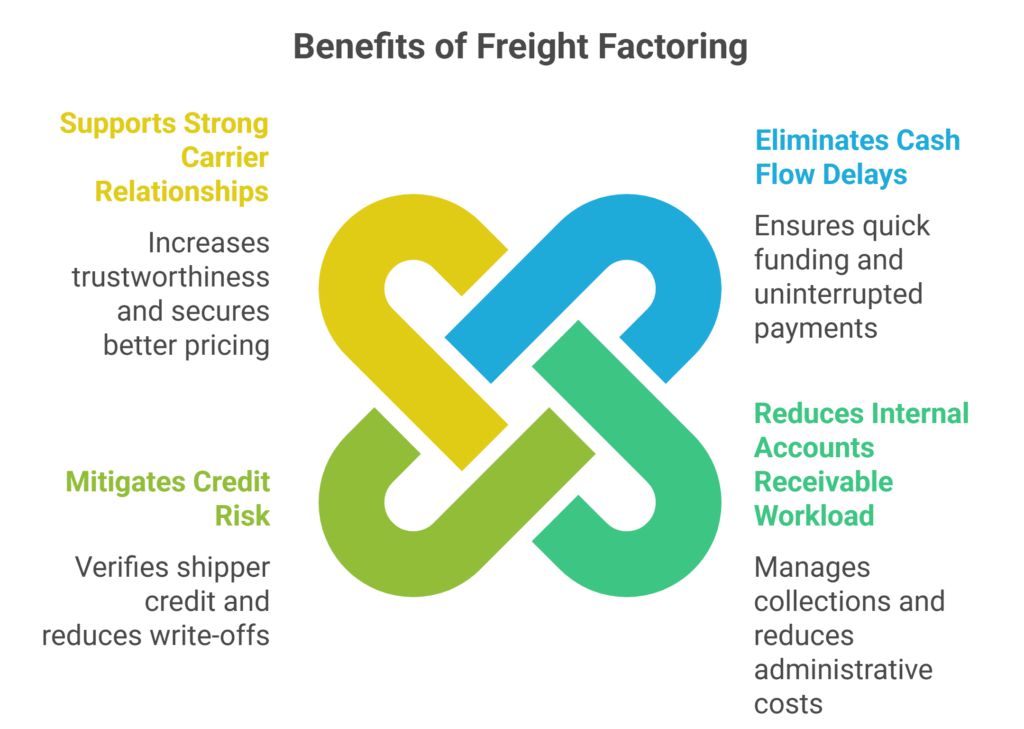

Freight factoring is one of the most widely adopted freight broker payment solutions due to long shipper payment cycles. It allows a brokerage to sell its invoices to a factoring provider and receive immediate capital instead of waiting 30–90 days for payment. This strengthens liquidity, reduces risk, and supports scaling (C.H. Robinson, 2025).

Factoring solutions are especially critical for newer brokerages that do not yet carry strong credit reputations or sufficient retained earnings for growth (Gaviti, 2023). Below is a breakdown of the core benefits of freight broker invoice factoring and how they directly improve operational systems:

1. Eliminates Cash Flow Delays

- Brokers are funded within 24–48 hours

- Ensures uninterrupted payments to carriers

- Supports financial predictability for load volume growth

2. Reduces Internal Accounts Receivable Workload

- Factoring companies manage collections and payment follow-up (Gaviti, 2023).

- Less administrative cost and fewer manual interventions

- Improves freight broker accounting best practices through accuracy and organization

3. Mitigates Credit Risk

- The factor verifies shipper credit before loads move

- Brokers avoid freight for customers with poor payment reliability

- Risk of write-offs is reduced significantly

4. Supports Strong Carrier Relationships

- On-time payment increases brokerage trustworthiness

- Helps secure preferred lanes and better pricing during tight markets (Gaviti, 2023).

“Factoring transforms future revenue into working capital, allowing brokerages to scale without relying on retained earnings or bank credit limits. The result is operational continuity and accelerated growth.”

Looking for a smarter way to stabilize cash flow and fund growth without taking on debt? Explore proven financial strategies and commission insights here.

Types of Factoring for Freight Brokers

Understanding factoring structure is essential before engaging an agreement:

| Factoring Type | Description | Risk Handling | Ideal Use Case |

| Recourse Factoring | Broker must repay unpaid invoices | Broker carries the credit risk | Experienced brokers with strong shipper portfolios |

| Non-Recourse Factoring | Factor absorbs non-payment | Higher fees, but risk shifts to provider | New brokers or high-risk shipper bases |

| Spot Factoring | Selective invoice factoring | Flexibility, but often higher cost | Brokers testing factoring or with inconsistent volumes |

| Full-Service Managed Factoring | End-to-end billing + collections | Comprehensive back-office support | Brokers seeking reduced overhead |

Ensuring clarity on risk transfer is central to freight broker finance management.

“Choosing between recourse and non-recourse factoring is ultimately a risk-allocation decision. The correct model depends on shipper credit quality, claims exposure, and the brokerage’s working-capital tolerance.”

Which risk profile is more acceptable for your organization: higher fees and protection or lower cost with retained responsibility for unpaid invoices?

Typical Pricing and Fee Structures

Factoring fees depend on:

- Invoice volume

- Shipper payment terms

- Risk class of the shipper

- Amount of forward funding required

Common cost structure:

- Advance rates: 80–95%

- Fees: 1.5–5% of invoice value per 30 days

Misaligned contracts can erode profit if not monitored properly. This requires accurate freight broker financial planning to assess impact before signing long-term agreements (Gaviti, 2023).

“Evaluating factoring costs requires analyzing their impact on net margins and working capital velocity. Lower headline fees may not provide the best overall economics if service levels fail to accelerate the cash conversion cycle.”

Managing Cash Flow

Cash flow is the most critical financial stability measure for freight brokers. Even profitable brokerages collapse when cash is tied up in accounts receivable. Effective cash flow management for freight brokers requires precise planning, strong credit governance, and the right financial tools to ensure that revenue collected keeps pace with operating expenses.

The objective is straightforward: maintain enough liquid capital to pay carriers, staff, and vendors on time while scaling operations responsibly.

Core Cash Flow Challenges in Freight Brokerage

-

Payment Term Mismatch

- Shippers frequently pay in 30–90 days

- Carriers typically require payment in 7–21 days

- Brokers often cover the time gap from working capital (Gaviti, 2023)

-

Unpredictable Market Dynamics

- Spot rate changes impact margin stability

- Sudden volume shifts can create short-term capital strain

-

Operational Cost Volatility

- Fuel surcharge fluctuations influence payout timing

- Technology and staffing costs rise as volume increases

The solution is implementing structured freight broker cash flow solutions that improve timing, predictability, and margin protection (Gaviti, 2023).

“Brokerages that integrate real-time cash flow visibility into daily decision-making maintain stronger carrier relationships, avoid credit constraints, and improve overall financial resilience.”

How consistently does your team review cash positions and aging receivables when planning pricing, hiring, or weekly load commitments?

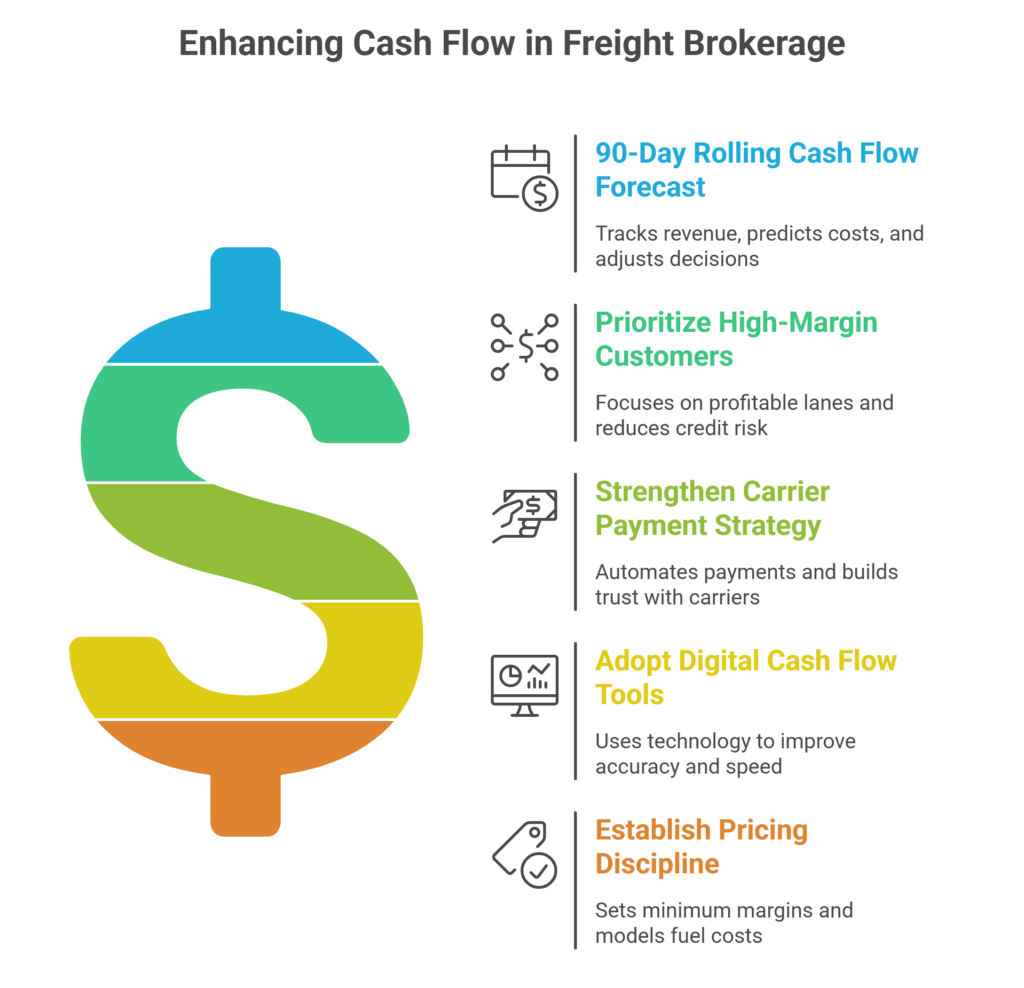

Cash Flow Optimization Strategies

Below are essential techniques for managing cash flow in freight brokerage effectively:

A) Deploy a 90-Day Rolling Cash Flow Forecast

- Track incoming revenue by customer aging

- Predict carrier costs based on booked loads

- Adjust pricing and operational decisions proactively

Key performance indicators include:

- Days sales outstanding (DSO)

- Gross margin per load

- Average weekly cash burn rate

B) Prioritize High-Margin and Fast-Pay Customers

- Focus on lanes and clients that support rapid capital recovery

- Reduce exposure to shippers with poor credit or long payment cycles

This improves profitability and reduces A/R-driven risk.

C) Strengthen Carrier Payment Strategy

Options include:

- Payment automation via digital systems

- Deferred structured terms for reliable carriers

- Quick pay programs with fee offsets

Maintaining trust with carriers is foundational to operational continuity.

D) Adopt Digital Cash Flow Tools for Brokers

Examples:

- TMS with integrated accounting modules

- Automated AP and AR invoicing workflows

- Real-time margin monitoring dashboards

Such tools eliminate manual error, increasing accuracy and decision speed.

E) Establish Pricing Discipline

- Refuse freight that does not meet minimum margin thresholds

- Apply accessorial charges rigorously

- Quote with fuel volatility modeled into costs

Without pricing controls, revenue growth may reduce net profit instead of increasing it.

“A strategic cash flow framework balances aggressive growth with liquidity safeguards. Forecasting, expense controls, and payment-timing policies must operate as a unified system.”

Are your current cash flow strategies proactive, anticipating challenges, or reactive, addressing shortages only after they materialize?

Credit and Billing Best Practices

Strong freight payment best practices mitigate collection delays and disputes:

- Conduct credit checks before onboarding shippers

- Require signed rate confirmations and POD accuracy

- Adopt electronic documentation to accelerate submissions

- Monitor aging reports weekly and escalate overdue invoices

The combination of credit control and operational clarity is critical to maintain healthy working capital.

“Credit governance and billing accuracy directly determine a brokerage’s cash conversion cycle. Reducing disputes and accelerating invoice cycles strengthens both profitability and financial stability.”

Curious how top-performing freight agents reduce payment delays and improve financial discipline? Learn what sets successful agents apart here.

Frequently Asked Questions (FAQs)

1: What is freight factoring?

Freight factoring is the process of selling invoices to a third-party company to receive immediate cash, allowing brokers to pay carriers and manage operations without waiting for shipper payments.

2: How should I choose a commission structure for my agents?

Select a model aligned with margin protection, revenue goals, and operational needs. Tiered or gross-margin-based structures often improve profitability while motivating agents

3: Which cash flow management tools are most effective for brokers?

Digital TMS systems with integrated accounting modules, automated AP/AR workflows, and real-time margin dashboards provide actionable insights for liquidity management.

Strengthen Your Financial Foundation for Sustainable Brokerage Growth

Profitability in freight brokerage doesn’t depend on load volume alone, it depends on how effectively a brokerage manages its revenue lifecycle. By implementing strategic financial planning, optimizing commission structures, leveraging freight factoring, enforcing disciplined credit and billing practices, and adopting technology-enabled cash flow solutions, brokers can maintain liquidity, protect margins, and unlock long-term scalability. Freight brokerage financial management is not just an accounting function, it is a competitive advantage that directly influences carrier relationships, service performance, and the ability to reinvest in growth.

Want to strengthen your brokerage’s financial stability and scale with confidence? Contact us to learn how SPI Logistics supports brokers with the tools and cash-flow solutions needed to stay profitable.

References

C.H. Robinson. (2025). Freight factoring for the trucking industry. Retrieved from https://www.chrobinson.com/en-us/resources/blog/freight-factoring/

Denim. (2024). Financial planning for freight brokers: A quickstart guide. Retrieved from https://www.denim.com/blog/financial-planning-for-freight-brokers-a-quickstart-guide

FreightWaves. (2025). Managing cash to keep the wheels turning. Retrieved from https://www.freightwaves.com/news/managing-cash-to-keep-the-wheels-turning

Gaviti. (2023). Cash flow optimization in the transportation and logistics industry. Retrieved from https://gaviti.com/cash-flow-optimization-in-the-transportation-and-logistics-industry/