Freight claims for lost, damaged, short, or delayed cargo are a challenging but unavoidable part of the logistics industry. For freight brokers, the ability to manage claims efficiently is not only about protecting themselves from liability but also about serving as a trusted advisor to shippers. This guide explores the process, legal responsibilities, documentation requirements, and insurance considerations every broker should know.

What Are Freight Claims?

Freight claims are formal requests filed by shippers or consignees to recover financial losses when cargo is lost, damaged, delayed, or delivered short (Freightquote, n.d.). They are an unavoidable part of the freight industry, but brokers who understand them can better protect their business and provide valuable guidance to clients.

Here’s what freight claims typically cover:

- Loss claims: When cargo never arrives at the destination.

- Damage claims: When goods arrive broken, wet, crushed, or otherwise unusable.

- Shortage claims: When part of the shipment is missing.

- Delay claims: When late delivery causes financial harm to the shipper.

Freight Claims vs. Service Complaints

Not all issues qualify as freight claims.

- Freight claims: Involve loss, damage, shortage, or delay of cargo.

- Service complaints: Relate to late pickups, poor communication, or billing errors.

“Brokers who clearly explain the claims process upfront reduce misunderstandings with shippers and carriers, leading to faster resolutions.”

Have you ever had a shipment delayed or damaged? How did the claims process affect your trust in the broker or carrier?

Filing Freight Claims

When cargo is lost, damaged, short, or delayed, shippers expect a structured claims process. As a broker, knowing the standard procedure helps you guide clients confidently.

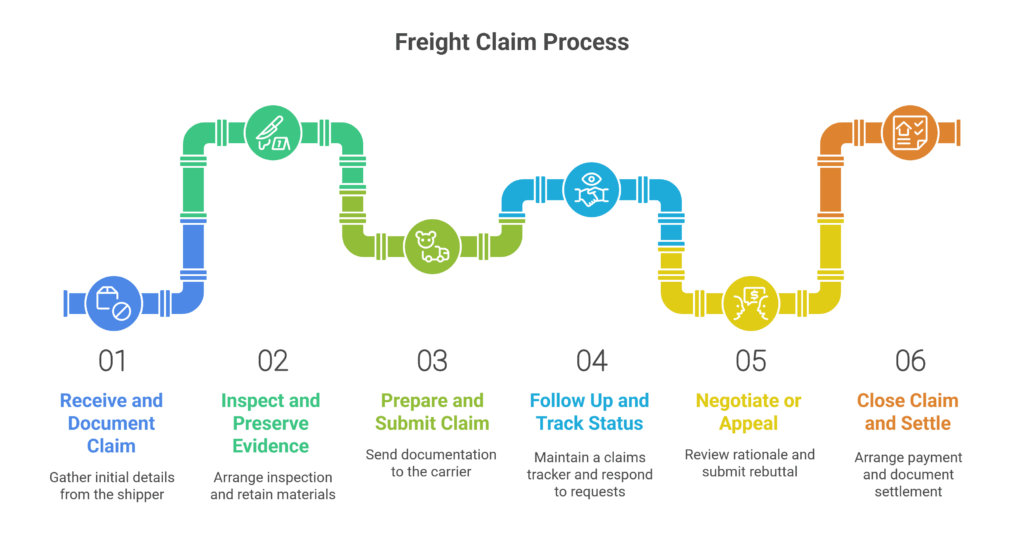

Typical steps in filing a freight claim:

-

Receive and document the claim

- Ask the shipper to notify you immediately upon discovering loss/damage/shortage/delay (Freightquote, n.d.).

- Gather initial details: date of shipment, carrier name, bill of lading number, condition on arrival, photos, etc.

-

Inspect and preserve evidence

- If possible, arrange inspection of the shipment, packaging, and any relevant materials.

- Direct the consignee or driver to retain packaging materials, damaged goods, and container seals for inspection.

- Take high-quality photographs from multiple angles, including packaging and cargo.

-

Prepare and submit the claim to the carrier

- Send all required documentation to the carrier’s claims department.

- Use certified mail, email, or their required method to establish proof of filing (FMCSA, n.d.) .

- Be aware of deadlines.

-

Follow up and track status

- Maintain a claims tracker (spreadsheet or software) with status, follow-up dates, responses.

- Promptly respond to any requests from the carrier or their adjuster for additional information.

-

Negotiate or appeal if needed

- If the carrier issues a partial denial or undervalued settlement, review their rationale.

- Submit rebuttal with documentation or escalation to higher authority.

- If necessary, engage legal counsel or file in court.

-

Close the claim & settle with shipper

- On an approved claim, arrange payment to shipper (or reimburse via your contractual role).

- Document final settlement and close in your records.

- Log key lessons learned for future prevention.

“The success of a freight claim depends more on the quality of supporting documentation than on the severity of the loss.”

How can brokers create a checklist system to ensure shippers always provide the necessary claim documents on time?

The Carmack Amendment

The Carmack Amendment establishes that carriers are responsible for cargo damage or loss in transit, with limited exceptions such as:

Key points on Carmack Amendment:

- The Carmack Amendment is a federal law that governs interstate transportation claims and typically makes the motor carrier liable for cargo loss or damage during transit.

- Under Carmack, a carrier can limit liability only if certain conditions are met and if limits are explicitly stated in the bill of lading.

- Exceptions and defenses include acts of God, public enemies, inherent nature of goods, defects in packaging (if shipper-packed), and neglect by shipper.

- For claims to be valid under Carmack, procedural requirements (notification, deadlines, documentation) must be strictly followed.

Implications for brokers:

- Brokers act as facilitators, your role is to ensure that shippers and carriers understand Carmack’s boundaries.

- Ensure that carrier bills of lading comply with Carmack’s rules (e.g. liability limits, clear disclaimers, and hazard declarations).

- Help shippers understand when a carrier might successfully defend under Carmack’s exceptions.

“The Carmack Amendment is the backbone of cargo liability law,brokers who understand its nuances can better guide their shippers.”

How often should brokers revisit their understanding of liability laws to stay compliant and effective?

Freight Claim Documentation Checklist

Strong documentation is the backbone of a successful claim. Missing paperwork is the #1 reason claims get denied.

Essential documents include:

- Original Bill of Lading (BOL)

- Freight bill or invoice

- Proof of value (invoices or receipts)

- Inspection or survey reports

- Photos of damage

- Claim form with details of the loss

Tips for better documentation:

- Use timestamps and metadata in photos to show when damage was discovered.

- Maintain a claims file per shipment, even if no claim arises, so you’re ready.

- Mark exceptions or damage on BOL at delivery time

“If it’s not written, signed, or photographed, it didn’t happen in the eyes of insurance.”

Should brokers provide shippers with pre-formatted claim packets to make filing smoother?

How Brokers Can Make Freight Claims Easier

Beyond liability, brokers can stand out by making claims less stressful for their clients.

Ways to support shippers:

- Offer a claims guide or checklist.

- Provide templates for documentation.

- Communicate regularly with updates.

- Assist with appeals if claims are denied.

“Proactive communication during claims builds trust, even if the broker isn’t directly liable.”

Want to strengthen your compliance and risk management as a freight broker? Discover practical strategies here.

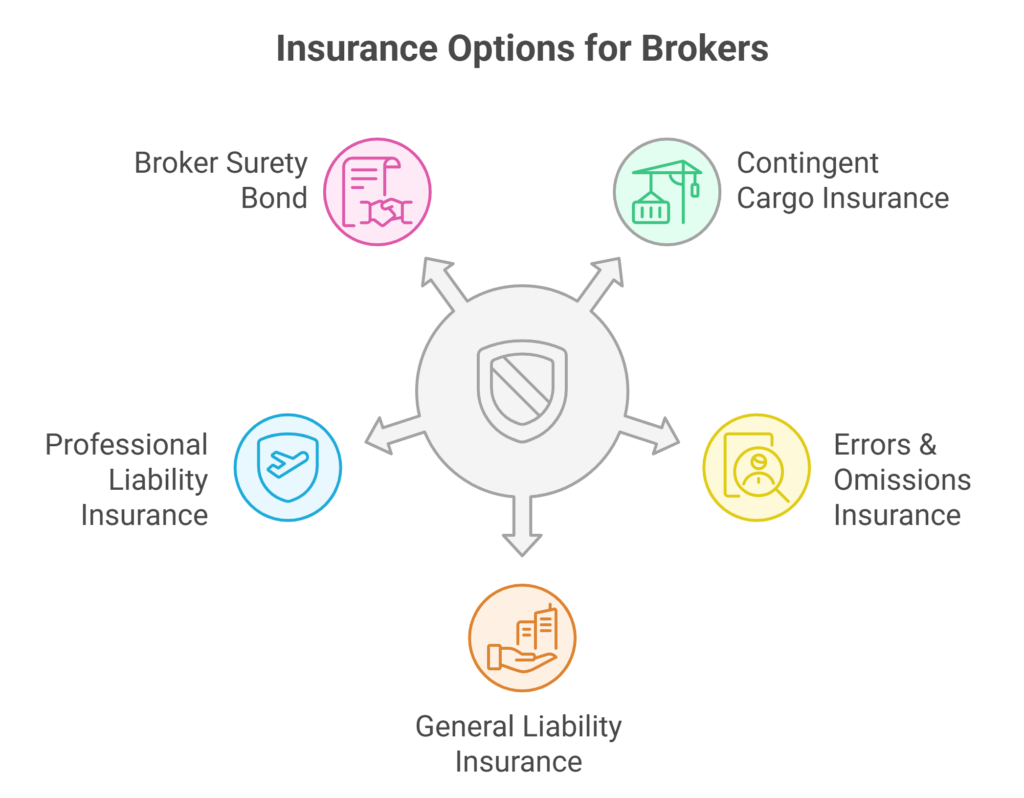

Insurance Types Brokers Need for Potential Claims

Having the right insurance coverage is your safety net, know your options.

Key insurance types for brokers:

- Contingent Cargo Insurance: provides coverage if a carrier’s policy fails to pay a valid claim.

- Errors & Omissions (E&O) Insurance: covers claims arising from negligence, mistakes, omissions in your service or advice.

- General Liability Insurance: protects against third-party bodily injury or property damage claims (less directly tied to cargo).

- Professional Liability Insurance (if distinct from E&O): covers claims regarding professional services.

- Broker Surety Bond / Broker License Bond (required in many jurisdictions): not for cargo claims but for licensing compliance (FreightWaves, 2023).

Best practices:

- Confirm whether contingent cargo insurance includes war, theft, external perils.

- Ensure policy limits are adequate for your largest shipments.

- Review exclusions and deductibles carefully.

- Coordinate with carriers to confirm they carry their own cargo insurance (primary coverage).

- Periodically review your coverage relative to growth and risk profile.

“Contingent cargo insurance isn’t a luxury, it’s a necessity for brokers who want peace of mind.”

How should brokers balance insurance costs against the risk of uncovered claims?

What to do When Carriers Deny Claims

Denied claims can frustrate shippers and damage trust. Brokers can guide them through next steps.

What to do if a claim is denied:

- Review denial letter for reasoning.

- Double-check documentation for completeness.

- File an appeal with additional evidence (FreightWaves, 2023).

- Escalate to insurance providers if necessary.

- Consider legal action if denial seems unjust.

“Persistence pays. Most denials are overturned when shippers submit stronger evidence.”

Should brokers play an active role in appealing denied claims, or should this responsibility rest solely with shippers?

Reducing the Frequency of Freight Claims

Preventing claims is better than managing them. Brokers can reduce risk by:

- Vetting carriers thoroughly.

- Educating shippers on proper packaging.

- Monitoring carrier performance.

- Using tracking tools to detect issues early.

“Preventive carrier vetting is a broker’s first line of defense against claims.”

What preventive measures should brokers prioritize, carrier selection, packaging education, or shipment tracking?

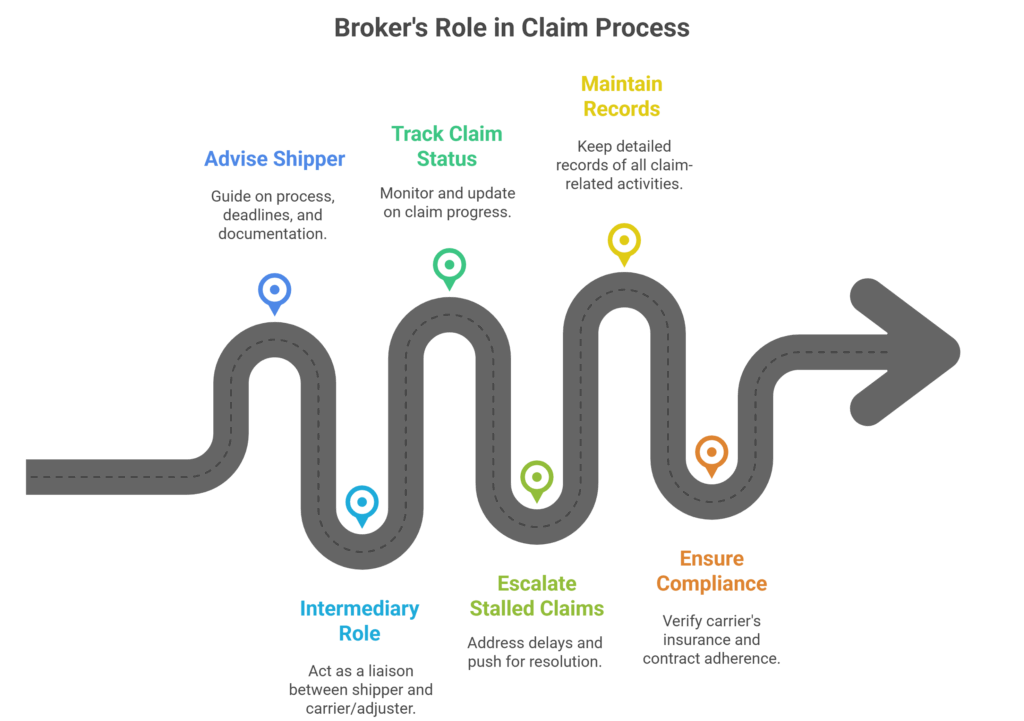

Broker Responsibilities During a Claim

Though the broker is not typically liable, your role is critical to facilitating claims.

Broker responsibilities in the claim process:

- Advising and guiding the shipper on process, deadlines, and documentation

- Acting as an intermediary with carriers or adjusters (if contractually allowed)

- Tracking claim status and alerting shippers to open issues

- Escalating when claims stall

- Maintaining records of correspondence and claims history

- Ensuring carrier compliance (insurance, liability, contract terms) at selection time

Distinction to avoid crossing lines:

- Do not admit liability on behalf of carriers unless contractually specified.

- Don’t act beyond your authority, only submit or share documents with the carrier if permitted by shipper.

- Avoid misrepresenting facts or making claims promises you can’t fulfill.

“A broker’s responsibility is advisory, not financial, unless contractually obligated.”

Looking for ways to simplify claim handling and back-office tasks as a freight broker? Explore our back-office support solutions.

Freight Claim Time Limits

Timeliness can make or break a claim.

Standard U.S. timelines:

- Notice of intent to file: As soon as possible.

- Formal claim submission: Within 9 months of delivery.

- Legal action: Within 2 years of carrier claim denial.

“Missed deadlines are the silent killers of otherwise valid freight claims.”

Should brokers remind shippers of approaching claim deadlines, or should that responsibility remain solely with shippers?

Common Reasons Freight Claims Get Denied

Understanding typical denials helps you prevent them.

Top reasons for claim denial:

- Missing or incomplete documentation

- Late filing or failure to give timely notice

- Disagreement over value of goods

- Failure to inspect or retain damaged goods

- Carrier invoking “acts of God” or “inherent vice” clauses

- Mis-declared commodity or improper packaging

- Discrepancies between BOL and actual shipment

- Lack of causal link ,i.e., carrier contends damage occurred before/after transit

Avoidance strategies:

- Use a claims checklist to ensure no item is omitted (FreightWaves, 2023).

- File notices immediately, ideally at delivery.

- Retain all packaging and damaged goods until inspection.

- Ensure the BOL accurately describes contents, condition, packaging.

- Value goods properly (don’t undervalue).

- Document chain of custody.

“Most denials could have been avoided with better attention to documentation.”

Should brokers train their teams on claim documentation to better assist shippers?

Freight Broker Agents and Claims

Independent agents often worry about personal liability.

- Agents are typically not liable personally.

- Brokerage companies hold responsibility unless contracts state otherwise.

- Exceptions: Agents acting outside their authority could be exposed.

“Agents should always clarify liability in their contracts to avoid surprises.”

Should agents push for explicit clauses in agreements that shield them from personal liability?

Bill of Lading Notations

The Bill of Lading (BOL) plays a vital role in claims. Improper notations can cost shippers their compensation.

Best practices for BOL notations:

- Note visible damages at delivery.

- Record shortages clearly.

- Avoid vague notes like “subject to inspection.”

- Ensure consignee signs acknowledging issues.

“The BOL is your first defense, if it doesn’t reflect damage, your claim may collapse.”

Should brokers train consignees on how to properly inspect and notate deliveries?

Damaged Cargo Handling

When goods arrive damaged, shippers must decide what to do.

- Hold for inspection until the carrier or insurer authorizes disposal.

- Never discard damaged goods prematurely, this may void the claim.

- Photograph and document the condition before any movement.

“Destroying or discarding cargo before inspection is one of the fastest ways to lose a valid claim.”

Should brokers establish standard policies for shippers on handling damaged cargo?

Frequently Asked Questions (FAQs)

1. Can I file a freight claim after the carrier’s stated deadline expired?

It’s possible only in limited circumstances (e.g. mutual agreement, tolling under contract, statute of limitations), but your best chance is to file within the deadline. Late claims are routinely rejected.

2. What’s the difference between a freight claim and a service complaint?

A freight claim deals with physical loss, damage, or delay of cargo, resulting in financial recovery. A service complaint might address poor communication, scheduling mistakes, or service issues but not loss/damage, it typically doesn’t give legal claim rights.

3. Who pays for inspection costs or surveyor fees in a claim?

It depends on the contract or carrier policy. Sometimes the carrier pays; other times costs are shared or must be reimbursed. Always confirm in writing before ordering expensive inspections.

Building Trust Through Effective Claims Management

Freight claims are an unavoidable part of the logistics world, but how brokers handle them can make the difference between frustrated shippers and loyal, long-term customers. By understanding liability, documenting shipments properly, guiding shippers through the process, and carrying the right insurance, brokers protect their business while adding significant value to their clients. The goal isn’t just to resolve claims, it’s to create confidence, transparency, and trust in every shipment.

Ready to strengthen your claims management strategy and build lasting customer trust? Contact us to start building a smarter, more reliable freight operation

References

- FMCSA. (n.d.). What if There Are Problems? Retrieved from https://www.fmcsa.dot.gov

- Freightquote. (n.d.). How to File a Freight Claim. Retrieved from https://www.freightquote.com

- FreightWaves. (2023). How Freight Brokers Can Protect Themselves Against LTL Claims. Retrieved from https://www.freightwaves.com