Effective freight broker risk management is no longer optional, it’s a competitive advantage. With increasing fraud cases, double brokering attempts, carrier disputes, and rising litigation risks, brokers must apply strong carrier vetting best practices, airtight contracts, and clear insurance frameworks to protect their operations (FreightWaves, n.d.).

This guide breaks down the logistics risk management framework for brokers, covering carrier verification processes, indemnity clauses, insurance requirements, liability reduction tools, and more, all designed to build a safer and more resilient brokerage.

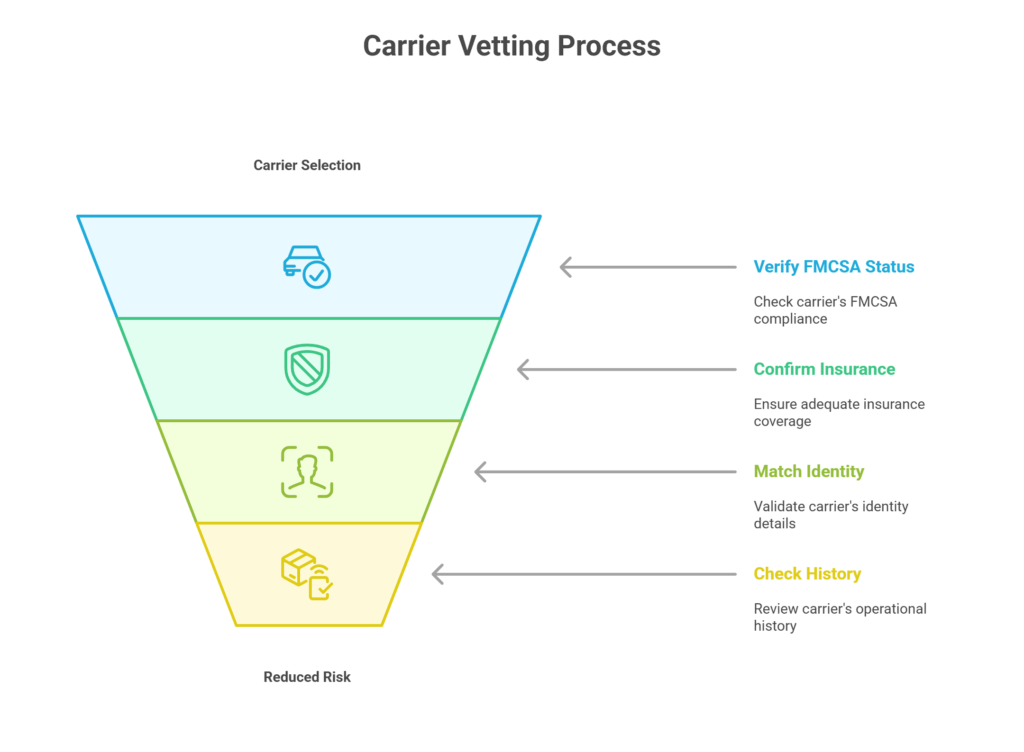

Build Strong Risk Foundations Through Effective Carrier Vetting

Your first line of defense is a disciplined and documented carrier verification process. Proper due diligence in carrier selection significantly reduces fraud exposure and operational risk (Federal Motor Carrier Safety Administration [FMCSA], n.d.).

Best Practices for Carrier Vetting

-

Verify MC, DOT, and Safety Scores

- Check FMCSA status

- Confirm operating authority

- Evaluate BASIC scores

-

Confirm Insurance Levels

- Review cargo insurance and liability coverage

- Validate active policies with agents directly

-

Match Identity Information

- Phone numbers

- Emails

- Business addresses

- Banking info

-

Check Carrier History

- Look for drastic changes (recent MC activation, sudden insurance updates, etc.)

- Screen for double-brokering red flags

How to Minimize Carrier Liability

- Only use carriers meeting broker–carrier agreement insurance requirements (Transport Topics, n.d.)

- Document all compliance checks

- Avoid assigning loads outside a carrier’s normal lanes

- Require written confirmations of subcontracting policies

“Ninety percent of fraud cases involve carriers who bypass one or more vetting steps. A broker with a strict, repeatable vetting process, documented every single time, is statistically one of the hardest targets for bad actors.”

Which carrier vetting step do you find most difficult to enforce consistently, and why?

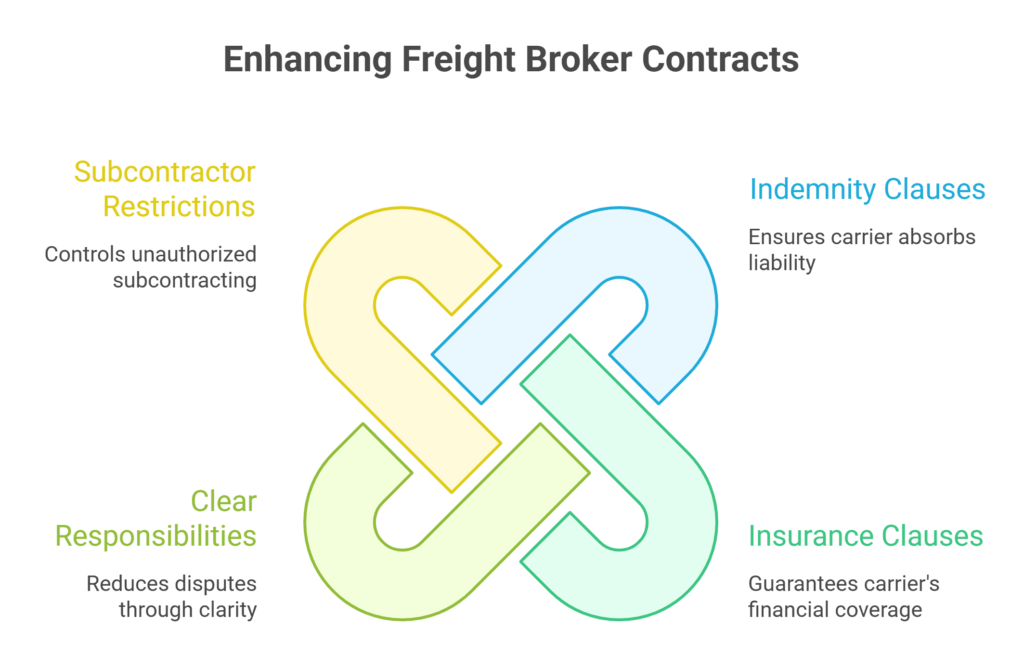

Strengthen Contracts With Clear Indemnity & Risk Transfer Provisions

Contracts are your second major shield, especially when navigating freight broker contracts risk transfer and contract risk management for logistics (Transport Topics, n.d.). Below is a deeper, more comprehensive breakdown of the core terms every broker should strengthen.

1. Transportation Contract Indemnity Clauses

Indemnity provisions determine who pays when something goes wrong. For freight brokers, tightening these clauses ensures the carrier absorbs liability arising from their operations.

What Strong Indemnity Clauses Should Include

-

Defense and indemnification: The carrier must defend, indemnify, and hold harmless the broker from claims arising from:

- Cargo damage

- Accidents and bodily injury

- Property damage

- Driver negligence

- Regulatory violations

- Clear scope of responsibility: State that carrier indemnifies brokers for all acts and omissions of its drivers, employees, contractors, and subcontractors.

- No reciprocal indemnity: Avoid language that forces the broker to indemnify the carrier unless required by law.

- State-specific compliance: Some states restrict indemnity clauses; your contract should include “to the fullest extent permitted by law.”

Why This Matters

A vague clause can shift cargo or accident liability back to the broker. Clear indemnity strengthens freight broker contracts risk transfer and significantly reduces exposure.

2. Insurance Clauses in Transportation Contracts

Insurance clauses make sure the carrier is financially capable of covering the risks assigned to them. Weak insurance language leads to coverage gaps and expensive claims.

What to Include

-

Specific coverage requirements, such as:

- Auto liability: Minimum $1M per occurrence

- Cargo insurance and liability coverage: Match commodity type and value

- General liability: $1M

- Workers’ compensation (where required)

- Proof of insurance before dispatch

- Broker listed as certificate holder

- Direct verification with insurer, not just COIs (certificate of insurance)

-

Notification requirements:

- Carrier must notify broker of cancellations, reductions, or changes

-

No exclusions that impact freight, such as:

- Reefer breakdown

- Theft

- High-value commodities

These requirements enforce clarity, prevent uninsured losses, and support consistent freight broker risk management across all operations.

3. Clear Definitions of Responsibilities and Liabilities

A good contract leaves no room for interpretation. Clarity reduces disputes and ensures all parties know their obligations.

Define Responsibilities Such as

- Who is responsible for loading/unloading

- Who handles securement

- Who files cargo claims

- When carriers must report delays or incidents

- Documentation timelines

- Driver qualification requirements

Define Liabilities Such as

- Carrier responsibility for cargo loss while in possession

- Broker liability limitations

- Consequences for unauthorized subcontracting

- Limits on broker’s role to avoid vicarious liability in trucking (Journal of Commerce, n.d.)

Why This Matters

Clear responsibilities help brokers avoid claims by proving operational control remained with the carrier, not the broker.

4. Subcontractor Restrictions

Unauthorized subcontracting is a major cause of:

- Double brokering

- Cargo theft

- Insurance denial

- Disputes over liability

Your contract must strictly control it.

What to Include

- Carrier may not subcontract loads without written broker approval

-

If subcontracting is allowed:

- Subcontractor must meet the same carrier vetting best practices (FreightWaves, n.d.)

- Provide their own insurance meeting the agreement requirements

- Must operate under their own authority (no leased authority layered situations)

- Unauthorized subcontracting = automatic breach with full liability on the carrier

- Broker may withhold payment until investigation is complete

Why It’s Critical

Subcontracting without controls destroys risk visibility and eliminates the broker’s ability to perform a proper carrier verification process leading to massive exposure and potential legal battles.

“Most broker liabilities originate from ambiguous contract wording. The more precise the definitions in your indemnity and insurance clauses, the easier it becomes to shift risk properly and defend yourself in disputes.”

Want to see how top brokers strengthen their contracts and reduce liability? Check out our full guide on Freight Broker Compliance & Risk Management to learn how to enforce proper insurance requirements, and protect your brokerage from avoidable risk.

Use Indemnity and Hold Harmless Clauses Correctly

Legal wording matters. A weak clause can shift unintended liability to you.

Hold Harmless and Indemnity Clause Examples

Good Example:

“Carrier shall defend, indemnify, and hold Broker harmless from all claims arising from Carrier’s performance, including cargo loss, personal injury, property damage, or regulatory violations.”

Bad Example:

“Each party agrees to indemnify the other as needed.” (Too vague. Transfers risk back to the broker.)

Why Indemnity Clauses Protect Brokers

They ensure:

- Proper assignment of operational liability

- Defense against lawsuits

- Clear risk transfer away from the broker

“The biggest mistake brokers make is copying generic hold-harmless clauses from templates. Indemnity must be tailored to the realities of transportation risk, otherwise carriers will use loopholes to escape liability.”

Have you reviewed your indemnity clauses recently? If not, what prevents you from updating them?

Leverage Insurance as a Core Risk Management Tool

Insurance policies provide financial backstops for incidents that contracts and vetting cannot fully prevent (Insurance Journal, n.d.). Insurance is central to any freight broker risk management strategy.

Key Insurance Policies for Brokers

- Contingent Cargo Insurance

- Contingent Auto Liability

- General Liability

- E&O (Errors and Omissions)

- Freight Liability Policies

Cargo Insurance and Liability Coverage Essentials

- Verify policy limits match commodity values

- Require cargo exclusions list

- Monitor expired or canceled policies

- Avoid loads insurers do not cover (e.g., electronics, alcohol, hazmat, depending on policy)

“Insurance is the safety net of the logistics world, but a net filled with holes is useless. Many brokers rely solely on COIs, not realizing that policy exclusions quietly eliminate coverage on common loads.”

Curious how insurance actually protects your freight brokerage in real-world situations? Watch this breakdown to understand the policies brokers rely on, how claims are handled, and the biggest insurance mistakes to avoid.

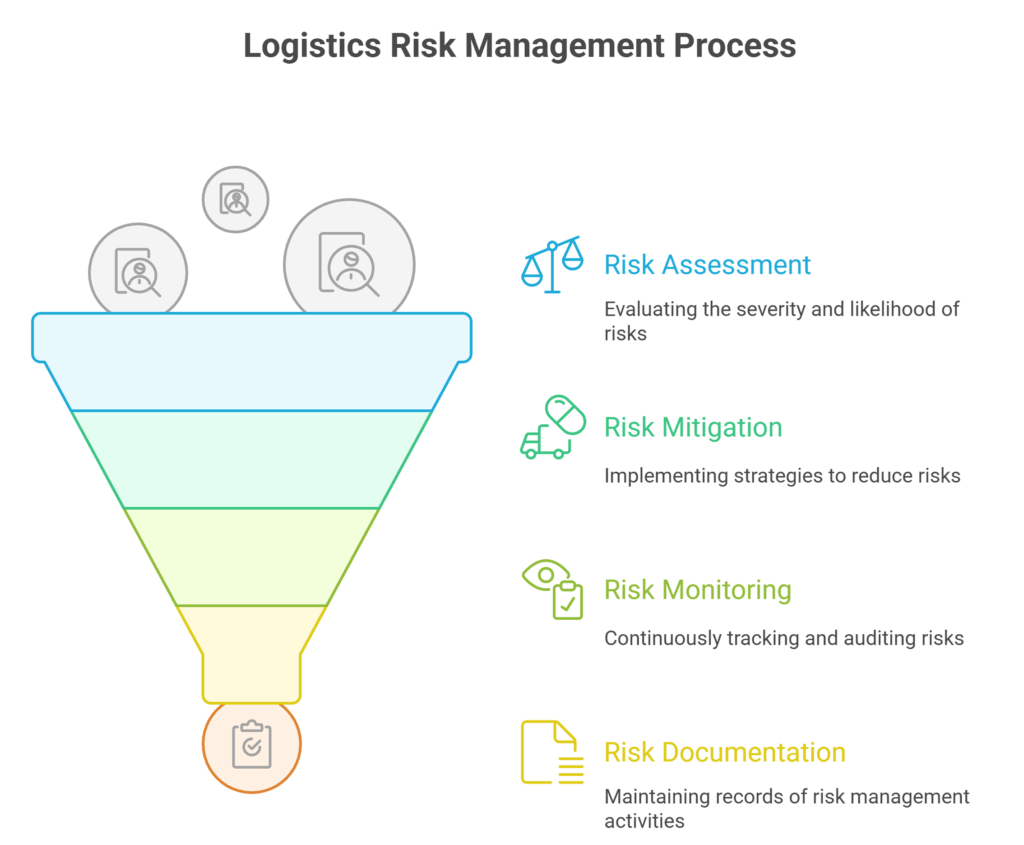

Apply a Complete Logistics Risk Management Framework

A structured logistics risk management framework for brokers keeps risk prevention consistent, repeatable, and measurable (Transport Topics, n.d.). A strong logistics risk management framework for brokers includes:

A. Risk Identification

- Fraud attempts

- Cargo theft

- Contract loopholes

- Insurance gaps

- Unfit carriers

B. Risk Assessment

- Severity vs. likelihood scoring

- High-value loads prioritized differently

C. Risk Mitigation

- Strong carrier vetting

- Clear contracts

- Insurance verification

- Driver and equipment checks

D. Risk Monitoring

- Quarterly audits

- Ongoing insurance tracking

- Monitoring carrier safety trends

E. Risk Documentation

- Digital logs of vetting procedures

- Contract version control

- Email communication archives

“Brokers who build procedures around every step dramatically reduce their exposure and improve carrier performance over time.”

Which part of the risk framework (identify, assess, mitigate, monitor, document) does your brokerage struggle with most?

Frequently Asked Questions (FAQs)

1. How does a freight broker reduce vicarious liability?

By drafting clear indemnity clauses, enforcing strong broker–carrier agreement insurance requirements, and avoiding any control over the driver’s operations.

2. How often should brokers re-verify carrier insurance?

At minimum every load, but ideally with automated tools that track renewals and real-time status changes.

3. What is the most important part of the carrier vetting process?

Confirming identity, insurance, and safety history, these form the backbone of carrier vetting best practices and help prevent double brokering and fraud.

Master Risk Management and Minimize Exposure

Mastering risk management requires more than basic carrier checks. Modern brokers must combine carrier verification processes, smart contract drafting, strong insurance requirements, and a full-fledged logistics risk management framework to stay compliant, competitive, and protected.

By applying the best practices above you minimize carrier liability, strengthen your contracts, and protect your brokerage from costly legal and financial exposure.

Ready to safeguard your brokerage and reduce risk? Contact us to implement expert-backed risk management strategies and protect your business.

References

Federal Motor Carrier Safety Administration (FMCSA). (n.d.). Carrier Safety and Compliance. Retrieved from https://www.fmcsa.dot.gov

Transport Topics. (n.d.). Minimizing Carrier Liability in Freight Brokerage. Retrieved from https://www.ttnews.com

FreightWaves. (n.d.). Best Practices in Carrier Vetting. Retrieved from https://www.freightwaves.com

Insurance Journal. (n.d.). Cargo Insurance and Liability Coverage Essentials. Retrieved from https://www.insurancejournal.com

Journal of Commerce. (n.d.). Avoiding Vicarious Liability in Trucking. Retrieved from https://www.joc.com